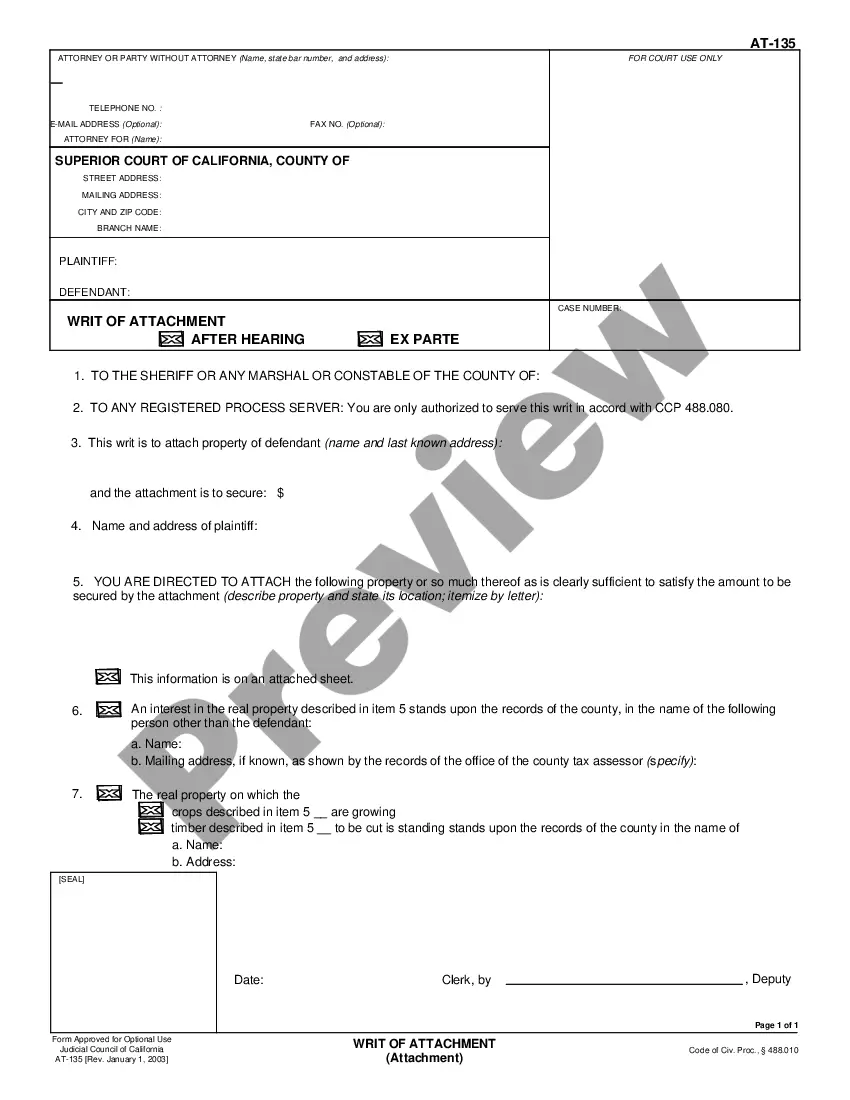

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Orange California Memorandum of Garnishee (same as AT-167) is a legal document used in the state of California to inform the court about a garnishment order and the involved parties' financial obligations. This memorandum outlines the responsibilities of a garnishee, who is a third party holding funds or assets belonging to the debtor, also known as the defendant. When an individual fails to pay a debt, the creditor can obtain a court order to garnish the debtor's wages, bank accounts, or other assets. The Memorandum of Garnishee plays a crucial role in facilitating this process by notifying the garnishee of their obligation to withhold funds owed to the debtor. In Orange County, California, there are various types of Memoranda of Garnishee, including: 1. Wage Garnishment Memorandum: This type of Garnishee Memorandum involves garnishing the defendant's wages. If the debtor is employed, their employer receives this memorandum, which instructs them to deduct a certain percentage from the debtor's wages and remit it to the court or the creditor. 2. Bank Account Garnishment Memorandum: This form of Memorandum of Garnishee applies when the debtor has funds held in a bank account. It informs the bank, as the garnishee, to freeze or withhold a specific sum of money from the account and submit it to the court or creditor. 3. Property Garnishment Memorandum: In cases where the debtor owns property, such as real estate or vehicles, this Memorandum of Garnishee notifies any involved entities or individuals, such as mortgage lenders or the Department of Motor Vehicles, about the garnishment order. The garnishee then becomes responsible for freezing the property's value or proceeds until further instructions from the court. 4. Financial Institution Garnishment Memorandum: This type of garnishment memorandum targets financial institutions other than banks, such as credit unions or investment firms. It requires these institutions to cooperate by freezing the debtor's assets held with them and forwarding the specified amount to the court or creditor. Orange California Memorandum of Garnishee (same as AT-167) is a crucial legal document in facilitating debt collection and enforcing court judgments. It ensures compliance with the proper garnishment procedures, protecting the rights of both the creditor and debtor. By providing detailed information about the garnishment order to the garnishee, it dictates the necessary actions they must take to satisfy the debt.