This is an Official form adopted by the California Judicial Council for use in California Courts.

Inglewood California Exemptions From The Enforcement Of Judgments

Description

How to fill out California Exemptions From The Enforcement Of Judgments?

Finding validated formats tailored to your regional statutes can be difficult unless you utilize the US Legal Forms repository.

It’s an online compilation of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world situations.

All the paperwork is accurately organized by usage area and jurisdiction regions, so finding the Inglewood California Exemptions from the Enforcement of Judgments becomes as straightforward as 1-2-3.

Maintaining documentation orderly and adherent to legal requirements is critically important. Utilize the US Legal Forms library to consistently have essential document templates for any needs readily accessible!

- Review the Preview mode and form description.

- Ensure you’ve selected the appropriate one that satisfies your requirements and entirely aligns with your local jurisdiction criteria.

- Look for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to locate the correct one. If it fits your needs, proceed to the next step.

- Complete the purchase.

Form popularity

FAQ

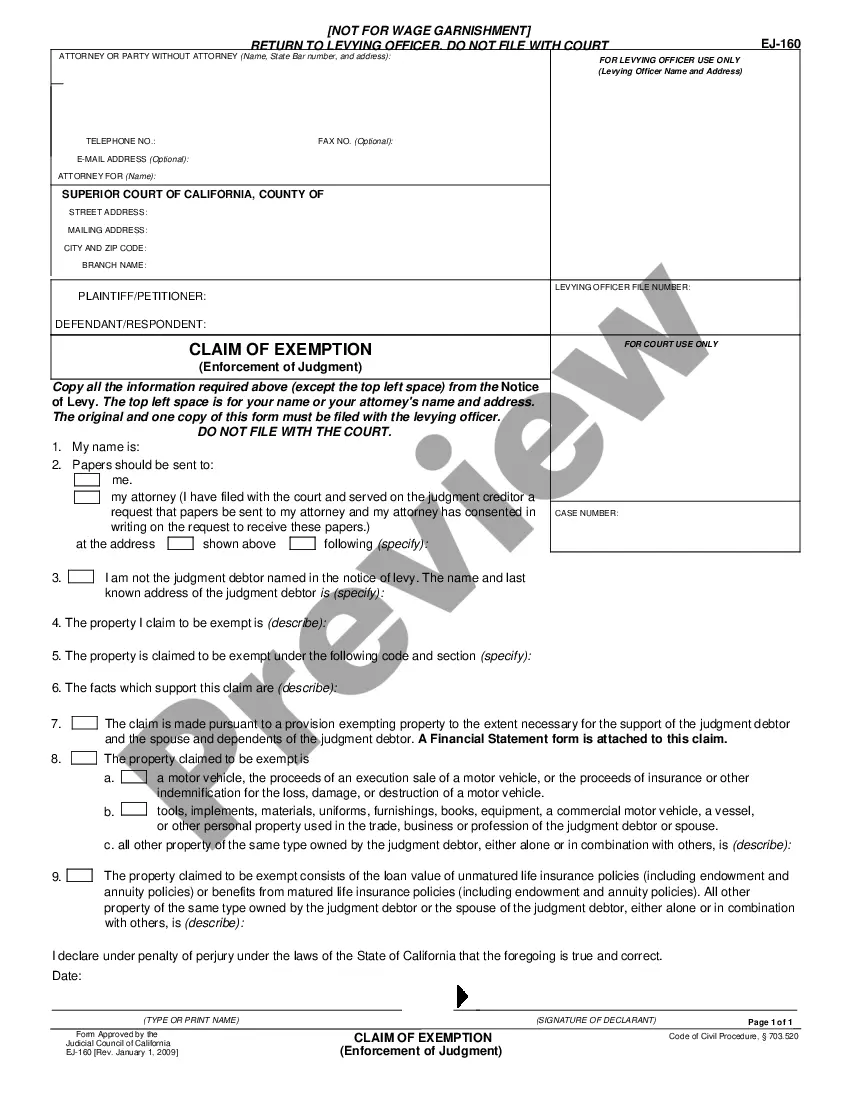

A claim to exemption is similar to a claim for exemption, but it specifically refers to asserting your right to keep certain property out of reach during legal proceedings in Inglewood, California. This claim helps you communicate which assets should not be affected by court judgments, protecting your fundamental needs. It's crucial for anyone facing financial distress to understand this process. You can streamline your filing with resources from US Legal Forms, making it easier to safeguard your valuable assets.

A claim for exemption in Inglewood, California, is a formal request you file to protect your assets from judgment enforcement. By submitting this claim, you assert that certain items or amounts are exempt from being seized due to legal judgments. This process is essential for maintaining your financial stability in tough times. US Legal Forms can guide you through the paperwork to ensure your claim is correctly filed.

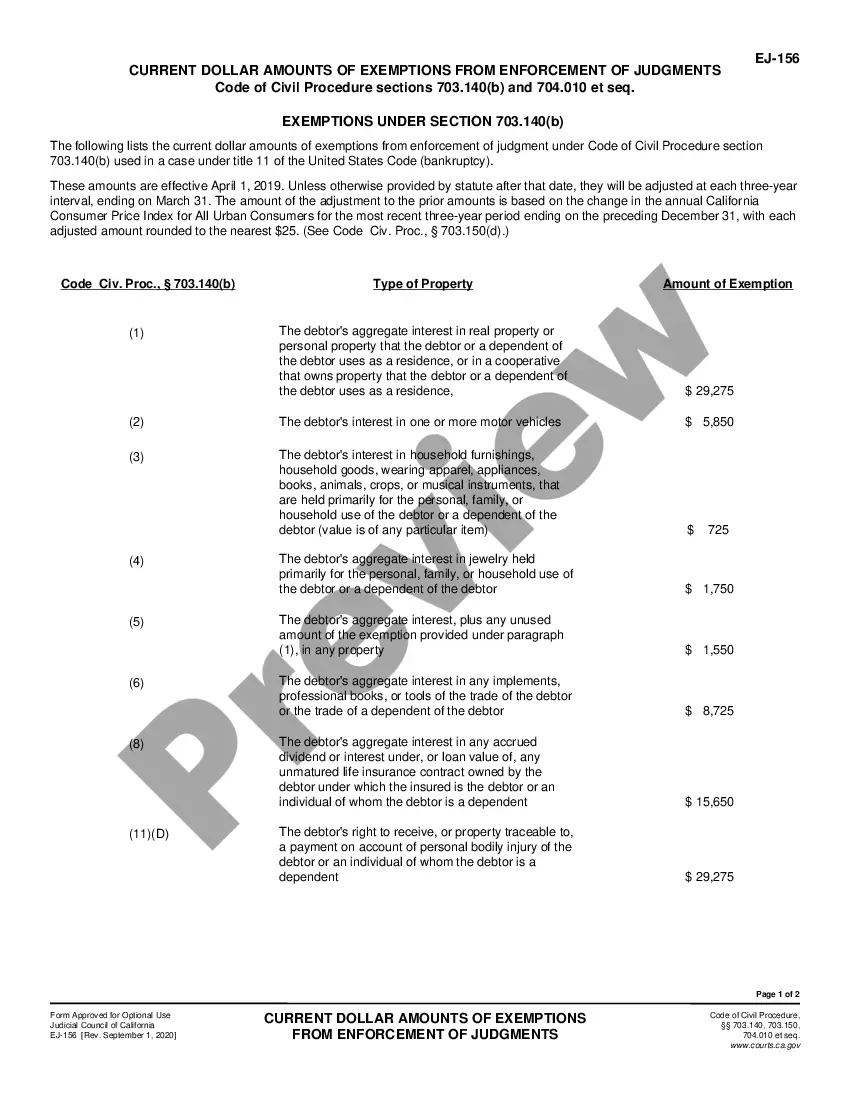

Inglewood California Exemptions From The Enforcement Of Judgments provide you with certain rights that protect specific property from being taken to satisfy a judgment. These rights ensure that basic necessities, like your home and essential personal belongings, remain safe. Knowing your rights of exemption lets you navigate financial challenges with confidence and peace of mind. For further assistance, consider using US Legal Forms, which simplifies the process of understanding and asserting these rights.

In California, several types of funds are exempt from garnishment, including Social Security benefits, unemployment benefits, and certain retirement accounts. Additionally, funds deposited into bank accounts can also be exempt if they originate from these protected sources. Understanding the specifics of Inglewood California Exemptions From The Enforcement Of Judgments allows you to safeguard your income effectively. For further clarification, uslegalforms offers comprehensive resources to assist you.

A claim of exemption in California is a formal request filed with the court to protect certain income or assets from being garnished. This claim asserts that your property meets the criteria for exemption under state law, thereby preventing creditors from seizing it. Familiarity with Inglewood California Exemptions From The Enforcement Of Judgments is crucial in ensuring you file your claim correctly. For personalized assistance, you can utilize uslegalforms to help you navigate the process smoothly.

An exemption hearing is a legal proceeding where an individual can contest garnishment or seek relief from judgment enforcement. During this hearing, you present evidence to show that certain income or assets should be exempt. This process is vital in understanding Inglewood California Exemptions From The Enforcement Of Judgments and can offer a way to protect your financial resources. If you need assistance, uslegalforms can help you prepare for this important step.

Exemption eligibility refers to the criteria you must meet to qualify for protections against garnishment and debt enforcement. In California, you may be eligible based on income level, types of income, or specific legal circumstances. Understanding Inglewood California Exemptions From The Enforcement Of Judgments is essential, as local laws can affect your qualifications. You can find simplified guidance on exemption eligibility through uslegalforms.

A bank exemption protects funds in your bank account from being seized to settle debts. In California, specific accounts can be exempt from garnishment under certain circumstances, particularly if they contain public benefits or specific government assistance. Knowing these details is crucial as they relate to Inglewood California Exemptions From The Enforcement Of Judgments, which can differ from state to federal protections. If you have questions, uslegalforms provides valuable resources to help you understand your rights.

Federal exemptions from garnishment provide individuals with certain protections against having their wages and assets taken to satisfy debts. These exemptions include a portion of your disposable earnings and specific benefits like Social Security or veterans' benefits. It's important to understand that Inglewood California Exemptions From The Enforcement Of Judgments may offer additional protections that differ from federal rules. To navigate these complexities, you can explore resources at uslegalforms for tailored guidance.

To remove a judgment in California, you can file a motion to vacate the judgment or negotiate a settlement with the creditor. Engaging with a professional can clarify the process and improve your chances of a favorable outcome. Understanding the Inglewood California exemptions from the enforcement of judgments helps you navigate this situation more effectively. Utilizing platforms like uslegalforms can provide the necessary resources and guidance.