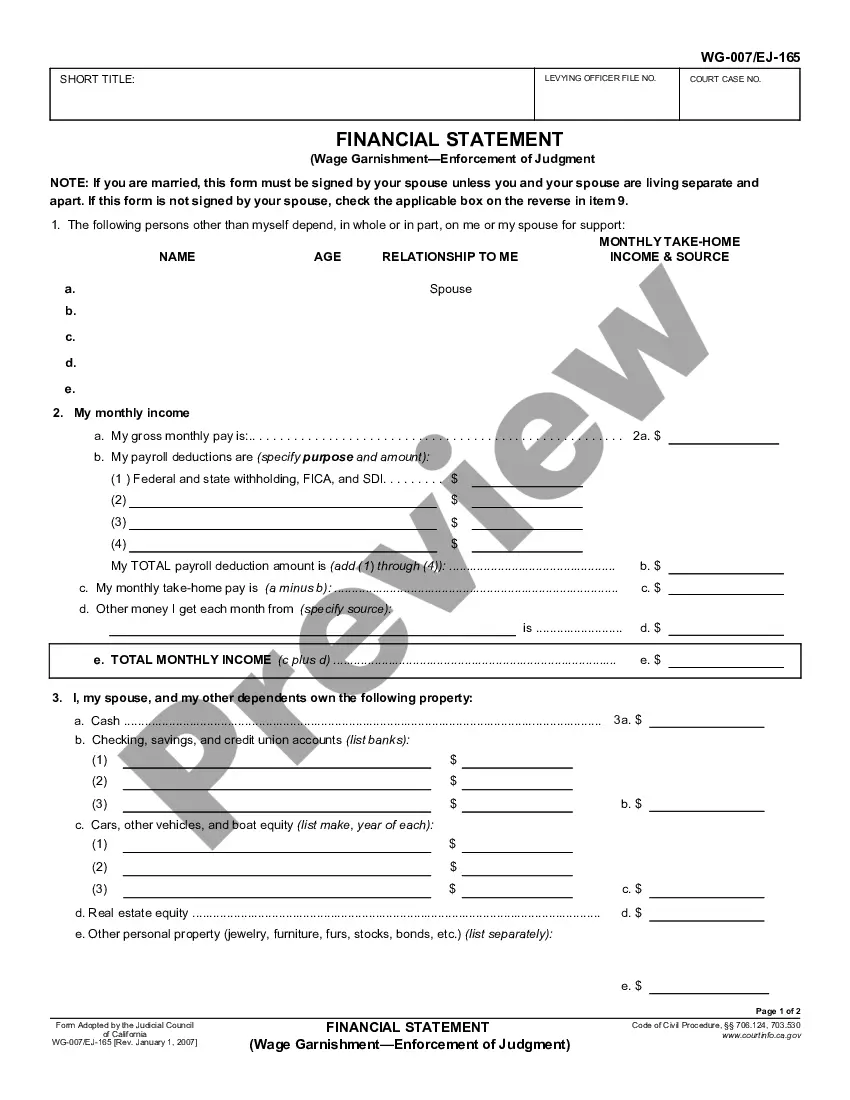

This is an Official form adopted by the California Judicial Council for use in California Courts.

Santa Clara County, located in California, offers several exemptions from the enforcement of judgments for its residents. These exemptions provide protection for certain assets and prevent them from being seized by creditors to satisfy outstanding debts. Let's explore some key exemptions available in Santa Clara California to better understand their significance: 1. Homestead Exemption: The Homestead Exemption in Santa Clara County allows individuals to protect a portion of their primary residence from being taken by creditors. Under the California Code of Civil Procedure, homeowners can claim a homestead exemption up to a specific dollar amount, currently set at $300,000 for individuals or $600,000 for families, depending on their circumstances. 2. Vehicle Exemption: Santa Clara California exemptions from the enforcement of judgments extend to vehicles as well. Residents can protect their personal vehicle up to a certain value to ensure they have a means of transportation. The current vehicle exemption amount is $3,325 for a single vehicle. 3. Personal Property Exemptions: Individuals in Santa Clara County can also claim exemptions for specific personal property items, including household furnishings, clothing, appliances, jewelry, and other necessary items. These exemptions ensure that basic personal belongings are safeguarded against creditors. 4. Retirement Account Exemption: Santa Clara California exempts certain retirement accounts from judgment enforcement. Qualified plans, such as IRAs (Individual Retirement Accounts), Roth IRAs, 401(k)s, and pensions, are generally shielded from creditors to provide individuals with financial security during retirement. 5. Public Benefits Exemptions: Various public benefits received by individuals in Santa Clara County are exempt from enforcement of judgments. These benefits include Social Security, disability benefits, unemployment compensation, and veterans' benefits. 6. Tools of Trade Exemption: Individuals who rely on specific tools or equipment to earn a living are eligible for exemptions on these assets. Santa Clara California recognizes the importance of maintaining one's ability to support themselves and allows protection for tools of trade up to a designated dollar amount. It is essential to note that these exemptions serve as a general guide and may be subject to change. It is advisable to consult with a legal professional to fully understand the exemptions applicable to your specific circumstances. Overall, Santa Clara California exemptions from the enforcement of judgments provide crucial protection of certain assets, ensuring individuals can maintain their livelihoods, protect their homes, and secure their financial futures.Santa Clara County, located in California, offers several exemptions from the enforcement of judgments for its residents. These exemptions provide protection for certain assets and prevent them from being seized by creditors to satisfy outstanding debts. Let's explore some key exemptions available in Santa Clara California to better understand their significance: 1. Homestead Exemption: The Homestead Exemption in Santa Clara County allows individuals to protect a portion of their primary residence from being taken by creditors. Under the California Code of Civil Procedure, homeowners can claim a homestead exemption up to a specific dollar amount, currently set at $300,000 for individuals or $600,000 for families, depending on their circumstances. 2. Vehicle Exemption: Santa Clara California exemptions from the enforcement of judgments extend to vehicles as well. Residents can protect their personal vehicle up to a certain value to ensure they have a means of transportation. The current vehicle exemption amount is $3,325 for a single vehicle. 3. Personal Property Exemptions: Individuals in Santa Clara County can also claim exemptions for specific personal property items, including household furnishings, clothing, appliances, jewelry, and other necessary items. These exemptions ensure that basic personal belongings are safeguarded against creditors. 4. Retirement Account Exemption: Santa Clara California exempts certain retirement accounts from judgment enforcement. Qualified plans, such as IRAs (Individual Retirement Accounts), Roth IRAs, 401(k)s, and pensions, are generally shielded from creditors to provide individuals with financial security during retirement. 5. Public Benefits Exemptions: Various public benefits received by individuals in Santa Clara County are exempt from enforcement of judgments. These benefits include Social Security, disability benefits, unemployment compensation, and veterans' benefits. 6. Tools of Trade Exemption: Individuals who rely on specific tools or equipment to earn a living are eligible for exemptions on these assets. Santa Clara California recognizes the importance of maintaining one's ability to support themselves and allows protection for tools of trade up to a designated dollar amount. It is essential to note that these exemptions serve as a general guide and may be subject to change. It is advisable to consult with a legal professional to fully understand the exemptions applicable to your specific circumstances. Overall, Santa Clara California exemptions from the enforcement of judgments provide crucial protection of certain assets, ensuring individuals can maintain their livelihoods, protect their homes, and secure their financial futures.