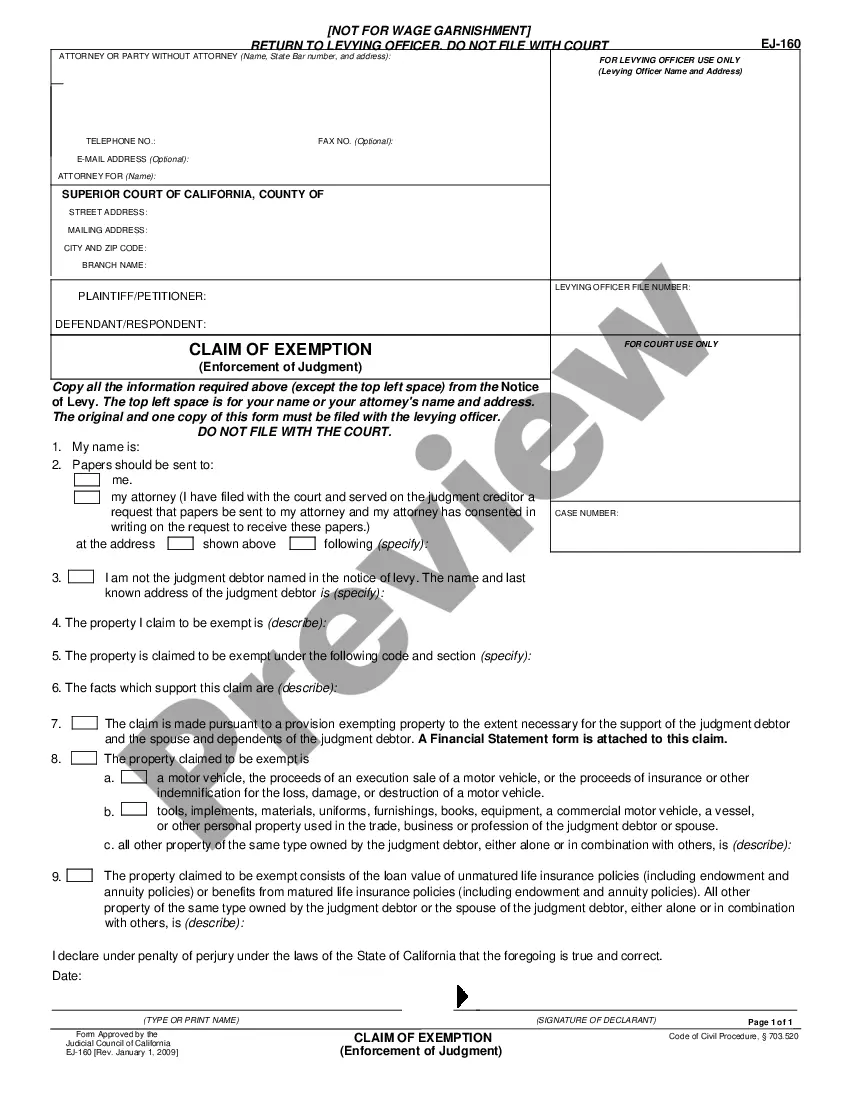

This is an Official form adopted by the California Judicial Council for use in California Courts.

Escondido California Current Dollar Amounts of Exemptions from Enforcement of Judgments refer to the specified monetary limits that protect individuals from having certain assets seized or garnished by creditors. These exemptions allow residents of Escondido, California, to safeguard their property and income to a certain extent. Below are the different types and corresponding dollar amounts of exemptions relevant to Escondido, California: 1. Homestead Exemption: The homestead exemption shields a portion of an individual's primary residence equity from being subjected to debt collection. In Escondido, California, the homestead exemption amount varies based on the homeowner's age, disability, and marital status. The dollar amounts range from $75,000 to $175,000. 2. Vehicle Exemption: This exemption covers the value of one motor vehicle owned by the debtor. In Escondido, California, eligible individuals can protect up to $4,800 in vehicle equity from judgment enforcement. 3. Personal Property Exemption: This exemption safeguards certain personal property items from being seized, such as household goods, furniture, appliances, clothing, and tools of trade. Escondido's residents can protect personal property worth up to $8,000 in value, with specific item categories having separate limits. 4. Wage and Earnings Exemption: This exemption shields a portion of an individual's wages and earnings from wage garnishment. In Escondido, California, the current dollar amount of protection is 75% of disposable earnings or 30 times the federal minimum wage per week, whichever is greater. 5. Retirement Account Exemption: Retirement savings held in qualified accounts, such as IRAs and 401(k)s, are protected from creditors during judgment enforcement. In Escondido, California, these retirement accounts enjoy unlimited exemptions, meaning they are fully safeguarded. 6. Public Benefits Exemption: Certain public benefits, such as Social Security, unemployment benefits, and disability payments, are generally exempt from enforcement of judgments, providing individuals with essential financial support. Understanding the Escondido California Current Dollar Amounts of Exemptions from Enforcement of Judgments is crucial for residents to safeguard their assets and finances in the face of debt collection efforts. By utilizing these exemptions, individuals can maintain a certain level of financial security and protect their well-being.Escondido California Current Dollar Amounts of Exemptions from Enforcement of Judgments refer to the specified monetary limits that protect individuals from having certain assets seized or garnished by creditors. These exemptions allow residents of Escondido, California, to safeguard their property and income to a certain extent. Below are the different types and corresponding dollar amounts of exemptions relevant to Escondido, California: 1. Homestead Exemption: The homestead exemption shields a portion of an individual's primary residence equity from being subjected to debt collection. In Escondido, California, the homestead exemption amount varies based on the homeowner's age, disability, and marital status. The dollar amounts range from $75,000 to $175,000. 2. Vehicle Exemption: This exemption covers the value of one motor vehicle owned by the debtor. In Escondido, California, eligible individuals can protect up to $4,800 in vehicle equity from judgment enforcement. 3. Personal Property Exemption: This exemption safeguards certain personal property items from being seized, such as household goods, furniture, appliances, clothing, and tools of trade. Escondido's residents can protect personal property worth up to $8,000 in value, with specific item categories having separate limits. 4. Wage and Earnings Exemption: This exemption shields a portion of an individual's wages and earnings from wage garnishment. In Escondido, California, the current dollar amount of protection is 75% of disposable earnings or 30 times the federal minimum wage per week, whichever is greater. 5. Retirement Account Exemption: Retirement savings held in qualified accounts, such as IRAs and 401(k)s, are protected from creditors during judgment enforcement. In Escondido, California, these retirement accounts enjoy unlimited exemptions, meaning they are fully safeguarded. 6. Public Benefits Exemption: Certain public benefits, such as Social Security, unemployment benefits, and disability payments, are generally exempt from enforcement of judgments, providing individuals with essential financial support. Understanding the Escondido California Current Dollar Amounts of Exemptions from Enforcement of Judgments is crucial for residents to safeguard their assets and finances in the face of debt collection efforts. By utilizing these exemptions, individuals can maintain a certain level of financial security and protect their well-being.