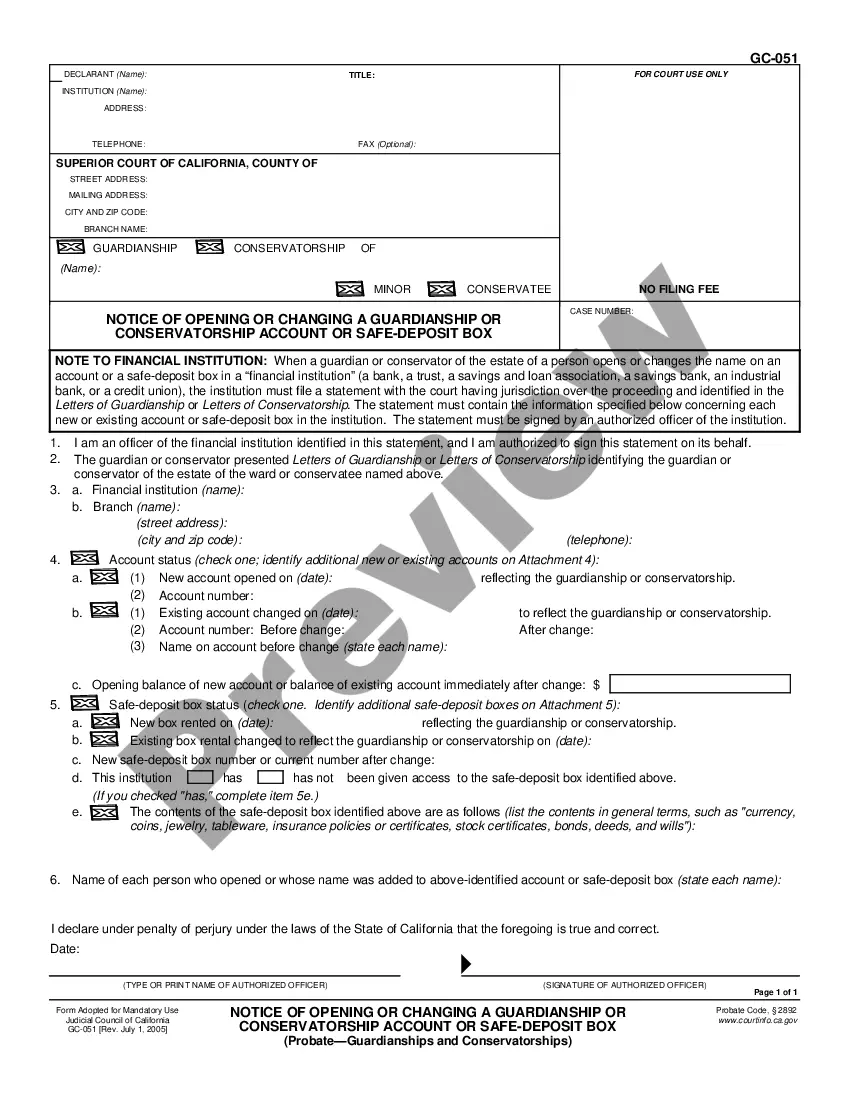

This is an Official form adopted by the California Judicial Council for use in California Courts.

Title: Understanding Irvine, California's Current Dollar Amounts of Exemptions from Enforcement of Judgments Keywords: Irvine California, exemptions, enforcement of judgments, current dollar amounts, types Introduction: In Irvine, California, individuals facing the enforcement of judgments can take advantage of various exemptions that protect specific dollar amounts of their assets. These exemptions help safeguard essential resources needed for maintaining a reasonable quality of life in the face of legal obligations. This article aims to provide a detailed description of the current dollar amounts and types of exemptions available in Irvine, California, ensuring individuals have a comprehensive understanding of their rights and protections. 1. Homestead Exemption: In Irvine, California, homeowners can claim a Homestead Exemption against the enforcement of judgments filed against a primary residence. As of [current year], this exemption allows individuals to protect up to $75,000 of their home's equity if single, $100,000 if married, and $175,000 if elderly, disabled, or a low-income homeowner. 2. Personal Property Exemption: Regarding personal property, individuals in Irvine can claim exemptions to protect their possessions from seizure during the enforcement of judgments. The current dollar amounts are as follows: — $725 for one motovehiclecl— - $8,725 for household furnishings, appliances, and goods — $1,75farewelllr— - $6,875 for tools and equipment necessary for a trade or occupation — $1,550 for any implements, books, or tools of a trade. 3. Wage Exemption: For individuals facing wage garnishment, Irvine, California enforces specific limitations on the amount that can be deducted. As of [current year], the law protects up to 75% of an individual's weekly earnings or up to 30 times the federal minimum hourly wage (currently $15 per hour). 4. Retirement Account Exemptions: Irvine residents can also protect their retirement savings from enforcement of judgments. The exemption pertains to various types of retirement accounts, including: — Individual Retirement Accounts (IRAs— - Roth IRAs — 401(k)s - 403(b)s - Pensions The current dollar amount of exemption is unlimited, meaning that the entirety of these funds is safeguarded against debt collection. Conclusion: Understanding the various dollar amounts and types of exemptions available in Irvine, California is crucial when facing the enforcement of judgments. These exemptions protect homeowners, personal property, wages, and retirement accounts, ensuring individuals can maintain a basic standard of living while addressing their financial obligations. By familiarizing oneself with these exemptions, individuals can navigate the legal system more effectively and secure their essential assets during challenging times.