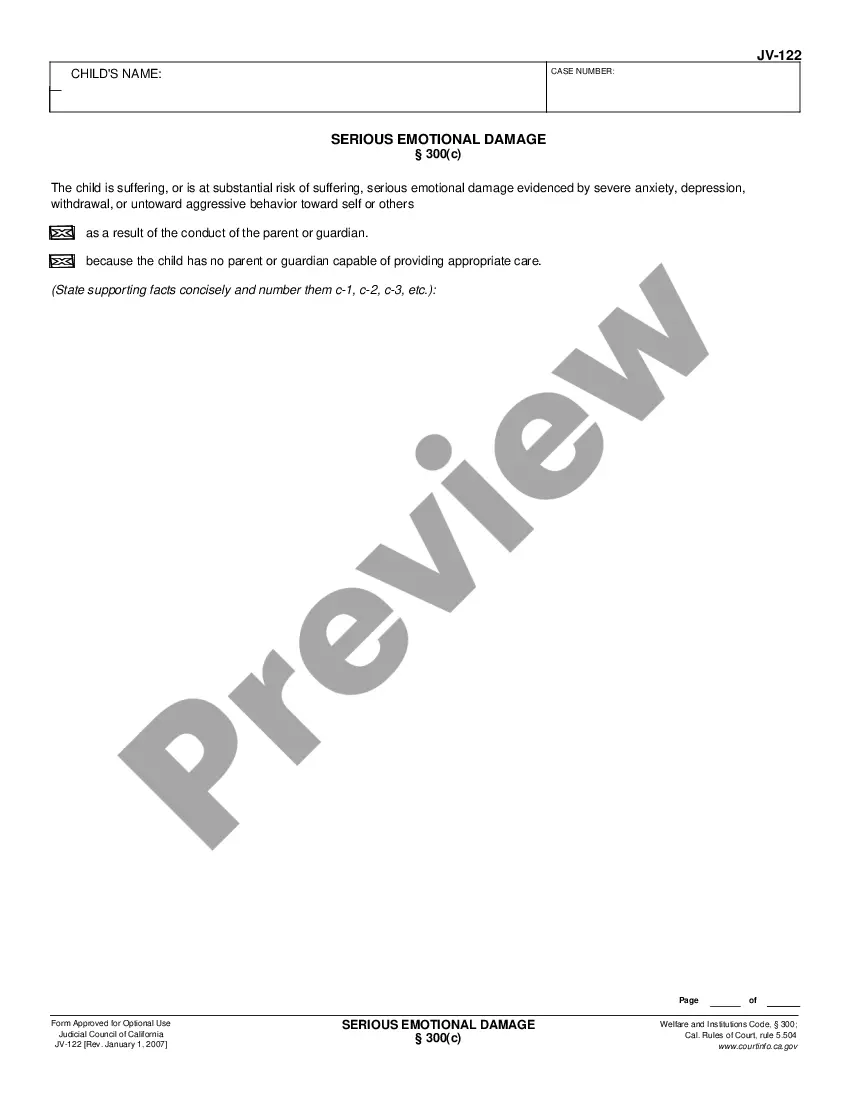

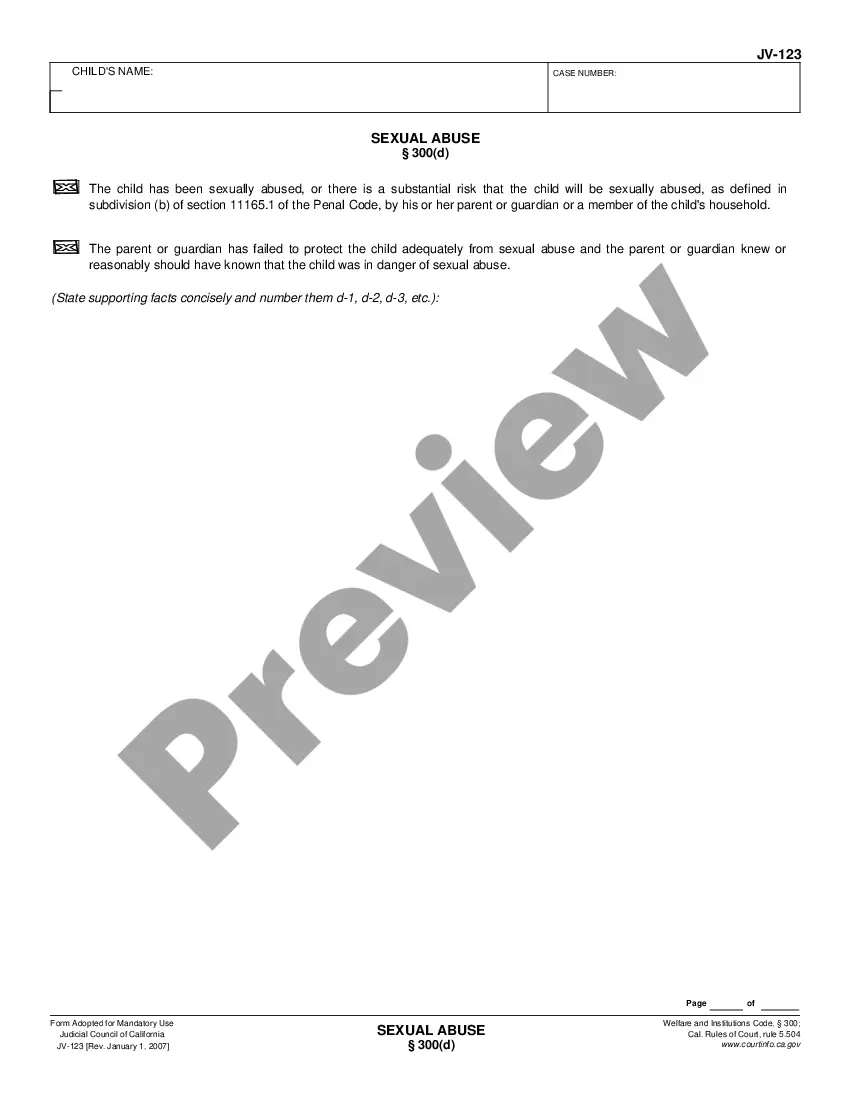

This is an Official form adopted by the California Judicial Council for use in California Courts.

Long Beach, California provides various dollar amounts of exemptions from enforcement of judgments to protect individuals from having their property seized to satisfy a judgment debt. These exemptions aim to ensure a certain level of financial security for residents. Here are the different types of Long Beach California Current Dollar Amounts of Exemptions from Enforcement of Judgments: 1. Homestead Exemption: The homestead exemption allows individuals to protect the equity in their primary residence from being taken to pay off a judgment debt. In Long Beach, California, the current dollar amount for a homestead exemption is $75,000 for single individuals, $100,000 for married individuals, and $175,000 for individuals who are 65 years of age or older, disabled, or are over 55 years old with limited income. 2. Motor Vehicle Exemption: Long Beach, California provides a dollar amount of exemption to protect an individual's motor vehicle from being seized. Currently, the exemption allows for up to $4,800 in equity for one vehicle. 3. Personal Property Exemptions: Certain personal property is also protected under Long Beach California's exemptions. These items include household furnishings, appliances, clothing, jewelry, and other necessary personal items. The current dollar amount for personal property exemptions is $8,000 for individuals or $16,000 for married couples. 4. Tools of Trade Exemption: Long Beach, California recognizes the importance of protecting an individual's tools of trade, such as tools, equipment, machinery, or books used in their business or profession. The current dollar amount for tools of trade exemptions is $8,000. 5. Wages and Bank Account Exemptions: In Long Beach, California, a portion of wages and bank accounts may also be protected from enforcement of judgments. The current dollar amount for wage exemptions is 75% of the individual's disposable earnings, or 30 times the federal minimum hourly wage per week, whichever is greater. Bank account exemptions, including funds directly deposited from government benefits or child support, are exempted up to $1,788. It is important to note that these Long Beach California Current Dollar Amounts of Exemptions from Enforcement of Judgments may change over time due to legislative updates. It is always advisable to consult a legal professional or refer to the latest statutes for accurate information and to ensure the protection of one's assets in the event of a judgment.