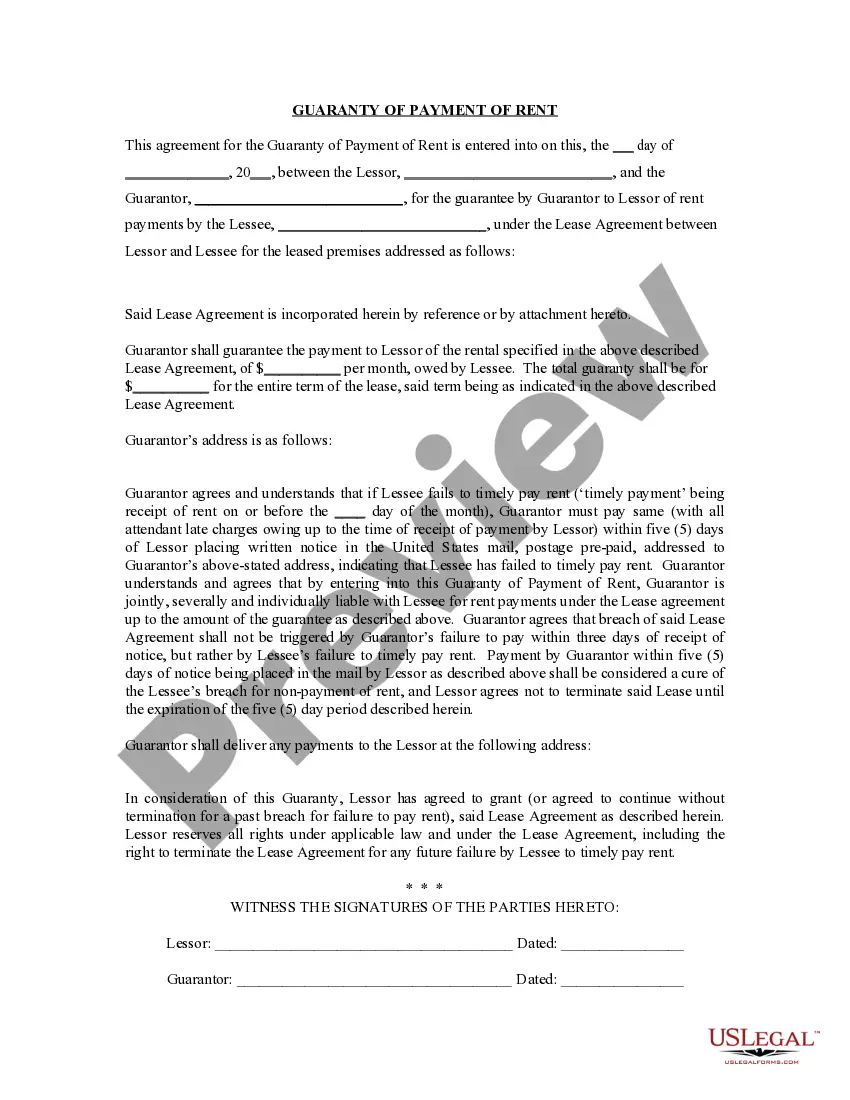

Claim of Exemption: A Claim of Exemption lists certain property, or monies, which one claims are exempt from levying. The Claimant must state statutory reasons as to why the property is exempt. This form is not to be filed with the court, but only with the Levying Officer.

Title: Understanding the West Covina California Claim of Exemption: Types and Detailed Overview Introduction: In West Covina, California, the Claim of Exemption is a legal process that allows individuals or businesses to protect specific assets or income from being seized by creditors or debt collectors. This article aims to provide a detailed description of the Claim of Exemption process in West Covina, highlighting its purpose, eligibility criteria, and different types of exemptions available to residents. 1. Purpose of West Covina California Claim of Exemption: The primary objective of the Claim of Exemption is to safeguard essential assets and income necessary for maintaining a basic standard of living or conducting business operations. By declaring an exemption, individuals can protect certain property from being sold or seized by creditors to recover a debt. This process acts as a crucial lifeline for residents facing financial hardships, allowing them to maintain stability and rebuild their lives. 2. Eligibility for West Covina California Claim of Exemption: To initiate a Claim of Exemption in West Covina, individuals or business owners must meet certain criteria, including being a resident or a lawful business entity operating within the city. Additionally, claimants must demonstrate financial hardship or a substantial threat to their livelihood resulting from a debt collection effort. Eligibility may also hinge on the specific type of exemption being claimed. 3. Types of West Covina California Claim of Exemption: a. Homestead Exemption: The Homestead Exemption pertains to the protection of a claimant's primary residence from being sold to satisfy a debt. By declaring this exemption, individuals may safeguard a portion or the entire value of their home, depending on California's homestead law limits. b. Personal Property Exemption: Under the Personal Property Exemption, certain items and assets crucial for maintaining a basic standard of living are protected from seizure. This may include necessary clothing, household furnishings, appliances, tools of trade, and a vehicle, subject to specific value limits. c. Wage Exemption: The Wage Exemption aims to secure a portion of a person's earned income from garnishment. California's law specifies a percentage of wages that are exempt from seizure, allowing individuals to retain a portion of their earnings to cover essential living expenses. d. Public Benefits Exemption: This exemption safeguards public benefits, such as Social Security, disability, unemployment compensation, or veterans' benefits, from being seized to satisfy a debt. e. Retirement Plan Exemption: West Covina allows claimants to protect retirement funds held in various plans, like IRAs, employer-sponsored 401(k) plans, or pension funds, up to certain limits defined by California law. Conclusion: The West Covina California Claim of Exemption plays a vital role in protecting the rights and financial stability of residents or businesses facing debt collection efforts. By understanding the different types of exemptions available, individuals can navigate the process effectively and ensure that essential assets and income are shielded from seizure. It is advisable to consult a qualified attorney or legal expert to assess eligibility and guide you through the Claim of Exemption process in West Covina, California.