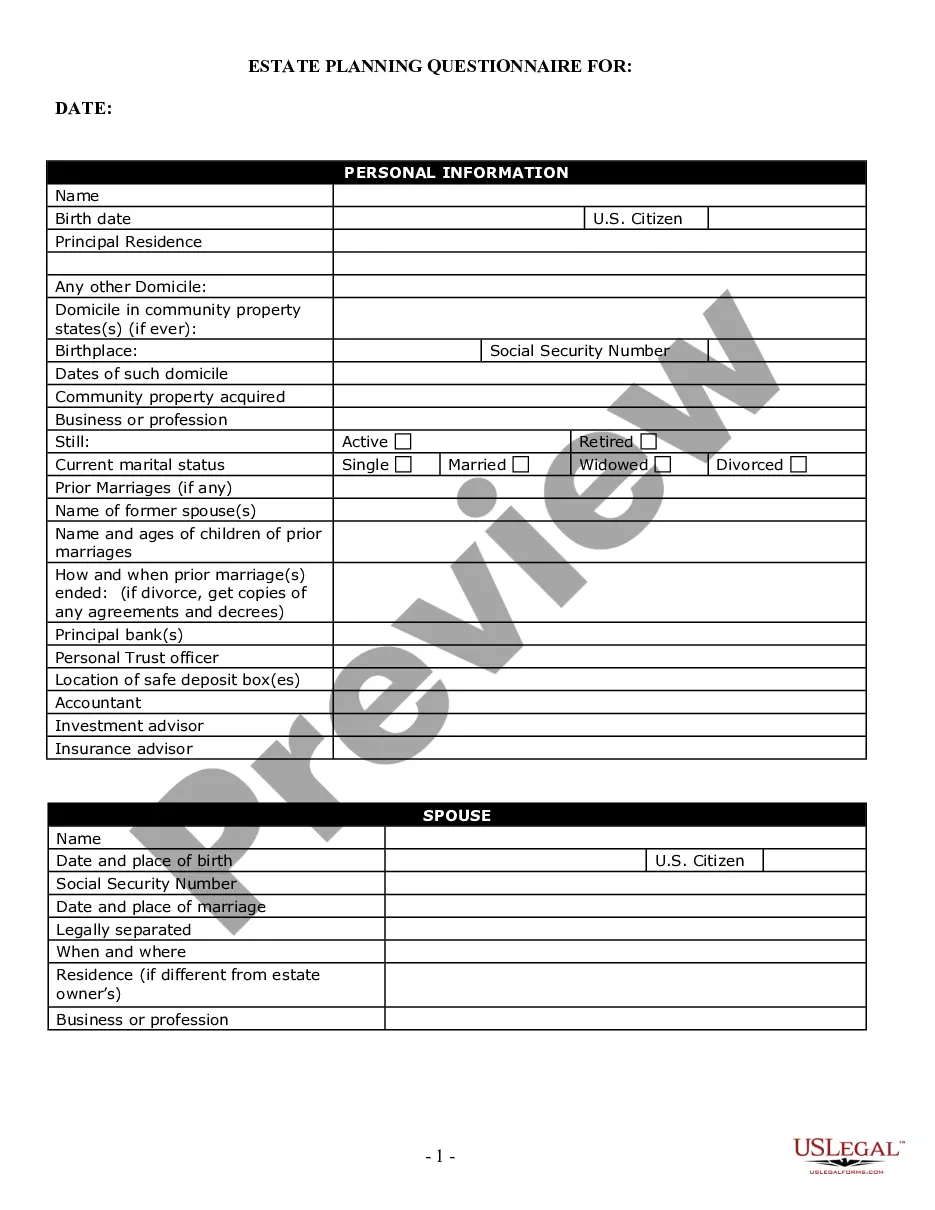

This is an official California Judicial Council form comprising a financial statement for use in divorce or support proceedings, or for the purposes of enforcing a money judgment. Enter the information as indicated on the form and file with the court as appropriate.

Jurupa Valley California Financial Statement — same as 982.5(5.5) is a comprehensive report that provides an overview of the financial aspects of Jurupa Valley, a city located in Riverside County, California. This financial statement is specifically aligned with California Government Code Section 982.5(5.5), which outlines requirements for the content and format of financial statements for local government entities. This financial statement serves as a crucial tool for ensuring transparency and accountability in Jurupa Valley's fiscal operations. It provides detailed information on the city's fiscal health, revenue sources, expenditures, assets, liabilities, and cash flows. By adhering to the prescribed format under Section 982.5(5.5), Jurupa Valley ensures that its financial information is consistent and easily comparable with other local government entities in California. The Jurupa Valley California Financial Statement — same as 982.5(5.5) can be categorized into different types based on the reporting period and the level of detail provided. Some notable types of these financial statements include: 1. Annual Financial Statement — This report is prepared on an annual basis and provides a comprehensive overview of Jurupa Valley's financial performance throughout the fiscal year. It includes a balance sheet, income statement, statement of changes in net assets, cash flow statement, and other supplementary schedules. 2. Quarterly Financial Statement — This statement is prepared every three months and provides an interim analysis of Jurupa Valley's financial position and performance. It offers a snapshot of the city's revenues, expenses, and cash flows for the specific quarter. 3. Special Purpose Financial Statement — In certain situations, Jurupa Valley may need to prepare financial statements tailored to address specific purposes or requirements. These statements address unique financial aspects, such as grants, capital projects, or special funds, and provide detailed information specific to those purposes. Jurupa Valley California Financial Statement — same as 982.5(5.5) plays a crucial role in ensuring fiscal responsibility, aiding decision-making processes, and fostering transparency within the city's financial operations. This statement serves as a reference point for various stakeholders, including government officials, citizens, investors, creditors, and regulatory bodies, to assess the financial health and accountability of Jurupa Valley. It enables stakeholders to evaluate the city's management of public funds, identify areas of improvement, and ensure compliance with financial regulations.Jurupa Valley California Financial Statement — same as 982.5(5.5) is a comprehensive report that provides an overview of the financial aspects of Jurupa Valley, a city located in Riverside County, California. This financial statement is specifically aligned with California Government Code Section 982.5(5.5), which outlines requirements for the content and format of financial statements for local government entities. This financial statement serves as a crucial tool for ensuring transparency and accountability in Jurupa Valley's fiscal operations. It provides detailed information on the city's fiscal health, revenue sources, expenditures, assets, liabilities, and cash flows. By adhering to the prescribed format under Section 982.5(5.5), Jurupa Valley ensures that its financial information is consistent and easily comparable with other local government entities in California. The Jurupa Valley California Financial Statement — same as 982.5(5.5) can be categorized into different types based on the reporting period and the level of detail provided. Some notable types of these financial statements include: 1. Annual Financial Statement — This report is prepared on an annual basis and provides a comprehensive overview of Jurupa Valley's financial performance throughout the fiscal year. It includes a balance sheet, income statement, statement of changes in net assets, cash flow statement, and other supplementary schedules. 2. Quarterly Financial Statement — This statement is prepared every three months and provides an interim analysis of Jurupa Valley's financial position and performance. It offers a snapshot of the city's revenues, expenses, and cash flows for the specific quarter. 3. Special Purpose Financial Statement — In certain situations, Jurupa Valley may need to prepare financial statements tailored to address specific purposes or requirements. These statements address unique financial aspects, such as grants, capital projects, or special funds, and provide detailed information specific to those purposes. Jurupa Valley California Financial Statement — same as 982.5(5.5) plays a crucial role in ensuring fiscal responsibility, aiding decision-making processes, and fostering transparency within the city's financial operations. This statement serves as a reference point for various stakeholders, including government officials, citizens, investors, creditors, and regulatory bodies, to assess the financial health and accountability of Jurupa Valley. It enables stakeholders to evaluate the city's management of public funds, identify areas of improvement, and ensure compliance with financial regulations.