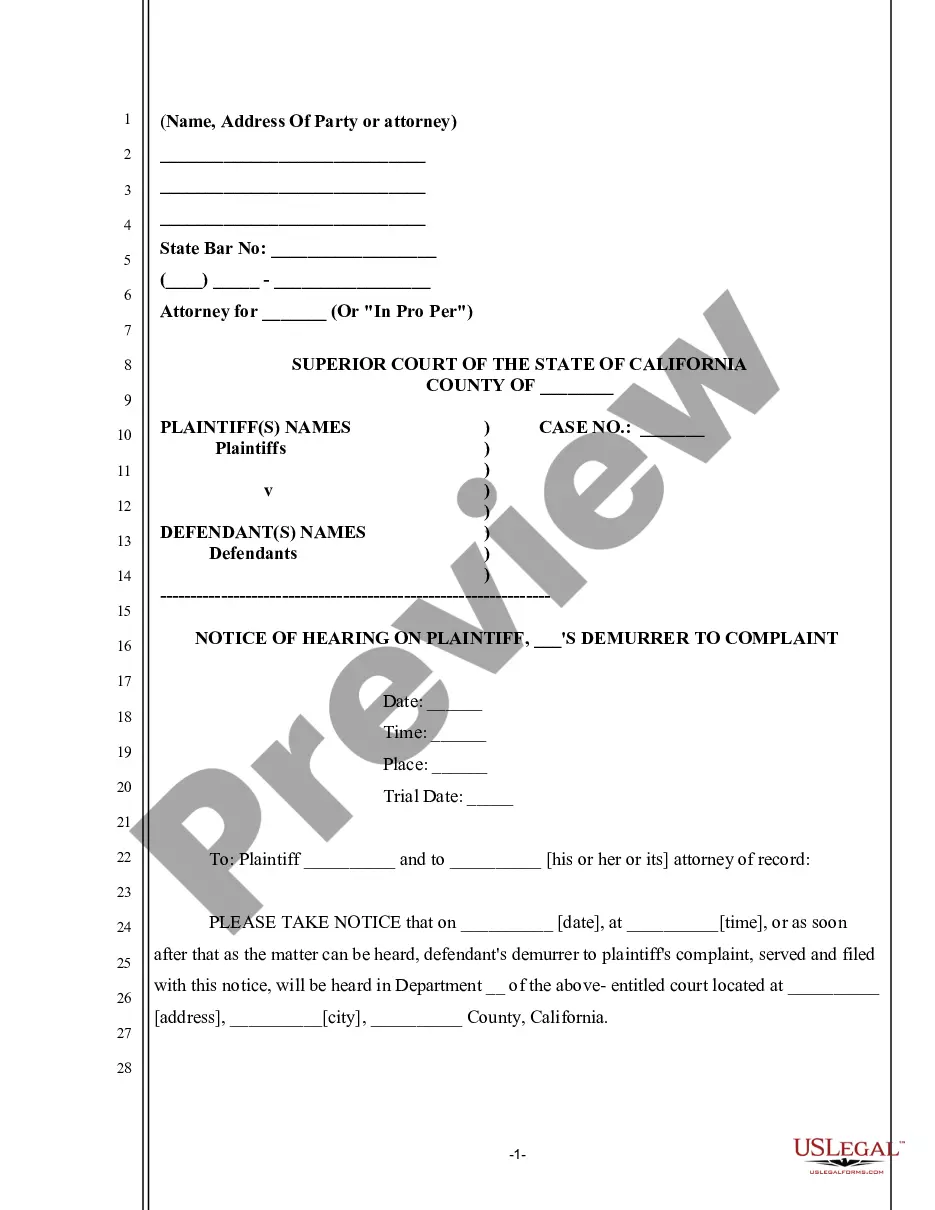

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice of Hearing on Claim of Exemption - same as 982.58, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. USLF control number CA-EJ-175

The Norwalk California Notice of Hearing on Claim of Exemption, also referred to as Form 982.5(8), serves as an official notice informing individuals about an upcoming hearing related to their claim of exemption. This process aims to protect individuals from having certain assets seized or wages garnished in cases where they are legally entitled to exemptions. The notice informs the parties involved of the hearing date, time, and location, providing an opportunity for the claimant to present their case and defend their right to retain the exempted property. Keywords: Norwalk California, Notice of Hearing, Claim of Exemption, 982.5(8), hearing date, time, location, claimant, assets, wages, garnishment, exemptions, property. There are no different types of Norwalk California Notice of Hearing on Claim of Exemption — same as 982.5(8).