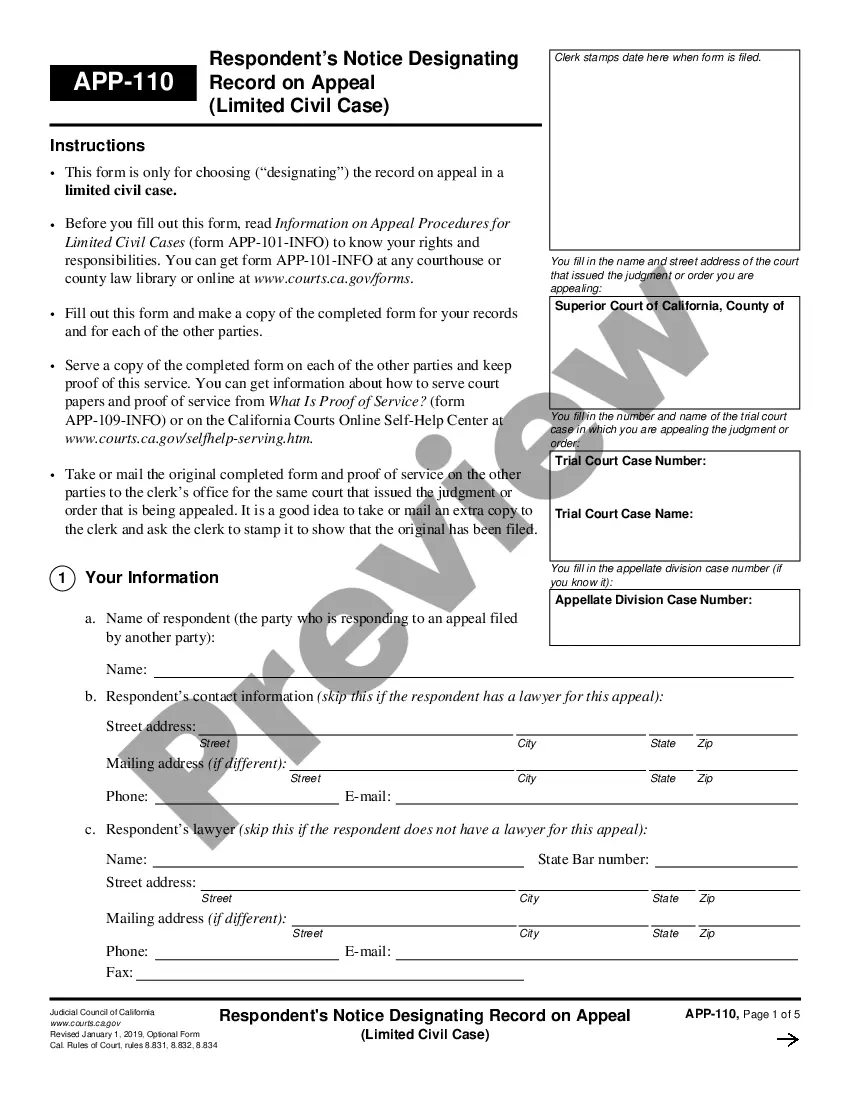

This is an official California Judicial Council form comprising a Notice of Lien for use in a garnishment proceeding or for the purpose of enforcing a money judgment. Enter the information as indicated on the form and file with the court as appropriate.

Elk Grove California Notice of Lien — same as AT-180 serves as an official document filed by the City of Elk Grove to enforce payment for outstanding municipal fees, fines, or taxes. When an individual, business or property owner fails to fulfill their financial obligations to the city, this notice of lien is issued, imposing a legal claim on their property or assets until the delinquent dues are settled. This ensures that the city receives the rightful payment it is owed. The Elk Grove California Notice of Lien is also known as AT-180, which refers to the specific form used by the city to initiate the lien process. This standardized template streamlines the process, making it clearer for all parties involved. It is important to note that there are different types of Elk Grove California Notice of Lien — same as AT-180, depending on the specific reason for the imposition of the lien. Some noteworthy categories include: 1. Property Tax Lien: If a property owner fails to pay their property taxes, the City of Elk Grove can issue a Notice of Lien to recover the unpaid taxes. This type of lien grants the city the right to seize and sell the property to satisfy the debt. 2. Municipal Fee Lien: When an individual or business neglects to pay various municipal fees, such as water bills, business licenses, or building permits, the City of Elk Grove can file a Notice of Lien. This type of lien enables the city to claim the unpaid fees from the individual or business's assets or properties. 3. Fine and Penalty Lien: Failure to pay fines, penalties, or tickets related to violations of city ordinances or regulations may result in a Notice of Lien being issued. This type of lien gives the city the authority to seize and liquidate assets or properties to recover the unpaid fines. To avoid facing a Notice of Lien, it is crucial for individuals, businesses, and property owners to fulfill their financial responsibilities to the City of Elk Grove in a timely manner. Failure to do so can have severe consequences, including potential loss of property or assets, difficulties in obtaining credit, and damage to one's financial reputation. If you have received an Elk Grove California Notice of Lien — same as AT-180, it is essential to seek legal advice and promptly address the outstanding dues to avoid any further complications.Elk Grove California Notice of Lien — same as AT-180 serves as an official document filed by the City of Elk Grove to enforce payment for outstanding municipal fees, fines, or taxes. When an individual, business or property owner fails to fulfill their financial obligations to the city, this notice of lien is issued, imposing a legal claim on their property or assets until the delinquent dues are settled. This ensures that the city receives the rightful payment it is owed. The Elk Grove California Notice of Lien is also known as AT-180, which refers to the specific form used by the city to initiate the lien process. This standardized template streamlines the process, making it clearer for all parties involved. It is important to note that there are different types of Elk Grove California Notice of Lien — same as AT-180, depending on the specific reason for the imposition of the lien. Some noteworthy categories include: 1. Property Tax Lien: If a property owner fails to pay their property taxes, the City of Elk Grove can issue a Notice of Lien to recover the unpaid taxes. This type of lien grants the city the right to seize and sell the property to satisfy the debt. 2. Municipal Fee Lien: When an individual or business neglects to pay various municipal fees, such as water bills, business licenses, or building permits, the City of Elk Grove can file a Notice of Lien. This type of lien enables the city to claim the unpaid fees from the individual or business's assets or properties. 3. Fine and Penalty Lien: Failure to pay fines, penalties, or tickets related to violations of city ordinances or regulations may result in a Notice of Lien being issued. This type of lien gives the city the authority to seize and liquidate assets or properties to recover the unpaid fines. To avoid facing a Notice of Lien, it is crucial for individuals, businesses, and property owners to fulfill their financial responsibilities to the City of Elk Grove in a timely manner. Failure to do so can have severe consequences, including potential loss of property or assets, difficulties in obtaining credit, and damage to one's financial reputation. If you have received an Elk Grove California Notice of Lien — same as AT-180, it is essential to seek legal advice and promptly address the outstanding dues to avoid any further complications.