This is an official California Judicial Council form comprising a Notice of Lien for use in a garnishment proceeding or for the purpose of enforcing a money judgment. Enter the information as indicated on the form and file with the court as appropriate.

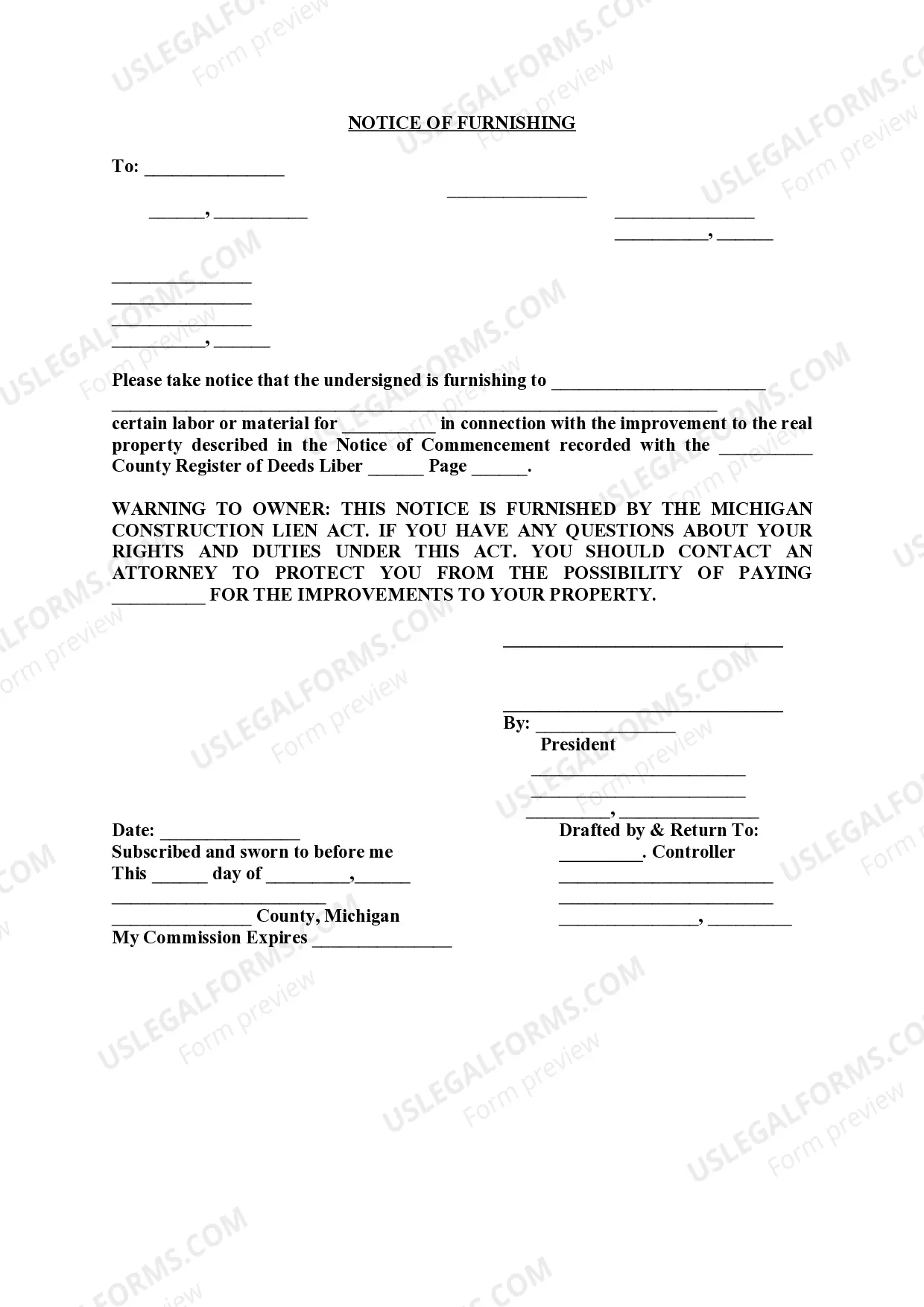

The Santa Maria California Notice of Lien, also known as AT-180, is an official document used to notify individuals or businesses of a lien placed on their property for unpaid taxes or other obligations. This legal notice serves as a warning to the property owner and any potential buyers or lenders, ensuring that they are aware of the outstanding debt. The Santa Maria California Notice of Lien — same as AT-180 is typically issued by the Santa Maria Tax Collector's Office or a similar government agency. It contains important details such as the property owner's name, address, and tax identification number, along with the amount owed and the specific type of lien placed on the property. It is important to note that there can be different types of Santa Maria California Notice of Lien — same as AT-180, each corresponding to a particular type of debt or obligation. Some common types of liens that may be included in this notice are: 1. Tax Lien: This type of lien is placed on a property when the owner fails to pay their property taxes. The tax lien can prevent the property from being sold or transferred until the outstanding taxes are paid. 2. Mechanic's Lien: A mechanic's lien is filed by contractors, subcontractors, or suppliers who have not been paid for labor, materials, or services provided in connection with property improvements or construction. This type of lien allows the claimant to potentially foreclose on the property if the debt remains unpaid. 3. Judgment Lien: A judgment lien may arise when a court issues a judgment against a person or business for an unpaid debt. The lien attaches to the debtor's property and must be satisfied before the property can be sold or transferred. When receiving a Santa Maria California Notice of Lien — same as AT-180, it is crucial for the property owner to take immediate action to resolve the outstanding debt. Ignoring the notice or failing to address the lien can lead to further legal complications, including potential foreclosure or seizure of the property. Property owners who receive this notice should consult with a qualified attorney or tax professional to understand their rights, negotiate a resolution, or explore options for lien removal. Taking proactive steps to resolve the outstanding debt will help protect the property owner's interests and ensure compliance with California laws.The Santa Maria California Notice of Lien, also known as AT-180, is an official document used to notify individuals or businesses of a lien placed on their property for unpaid taxes or other obligations. This legal notice serves as a warning to the property owner and any potential buyers or lenders, ensuring that they are aware of the outstanding debt. The Santa Maria California Notice of Lien — same as AT-180 is typically issued by the Santa Maria Tax Collector's Office or a similar government agency. It contains important details such as the property owner's name, address, and tax identification number, along with the amount owed and the specific type of lien placed on the property. It is important to note that there can be different types of Santa Maria California Notice of Lien — same as AT-180, each corresponding to a particular type of debt or obligation. Some common types of liens that may be included in this notice are: 1. Tax Lien: This type of lien is placed on a property when the owner fails to pay their property taxes. The tax lien can prevent the property from being sold or transferred until the outstanding taxes are paid. 2. Mechanic's Lien: A mechanic's lien is filed by contractors, subcontractors, or suppliers who have not been paid for labor, materials, or services provided in connection with property improvements or construction. This type of lien allows the claimant to potentially foreclose on the property if the debt remains unpaid. 3. Judgment Lien: A judgment lien may arise when a court issues a judgment against a person or business for an unpaid debt. The lien attaches to the debtor's property and must be satisfied before the property can be sold or transferred. When receiving a Santa Maria California Notice of Lien — same as AT-180, it is crucial for the property owner to take immediate action to resolve the outstanding debt. Ignoring the notice or failing to address the lien can lead to further legal complications, including potential foreclosure or seizure of the property. Property owners who receive this notice should consult with a qualified attorney or tax professional to understand their rights, negotiate a resolution, or explore options for lien removal. Taking proactive steps to resolve the outstanding debt will help protect the property owner's interests and ensure compliance with California laws.