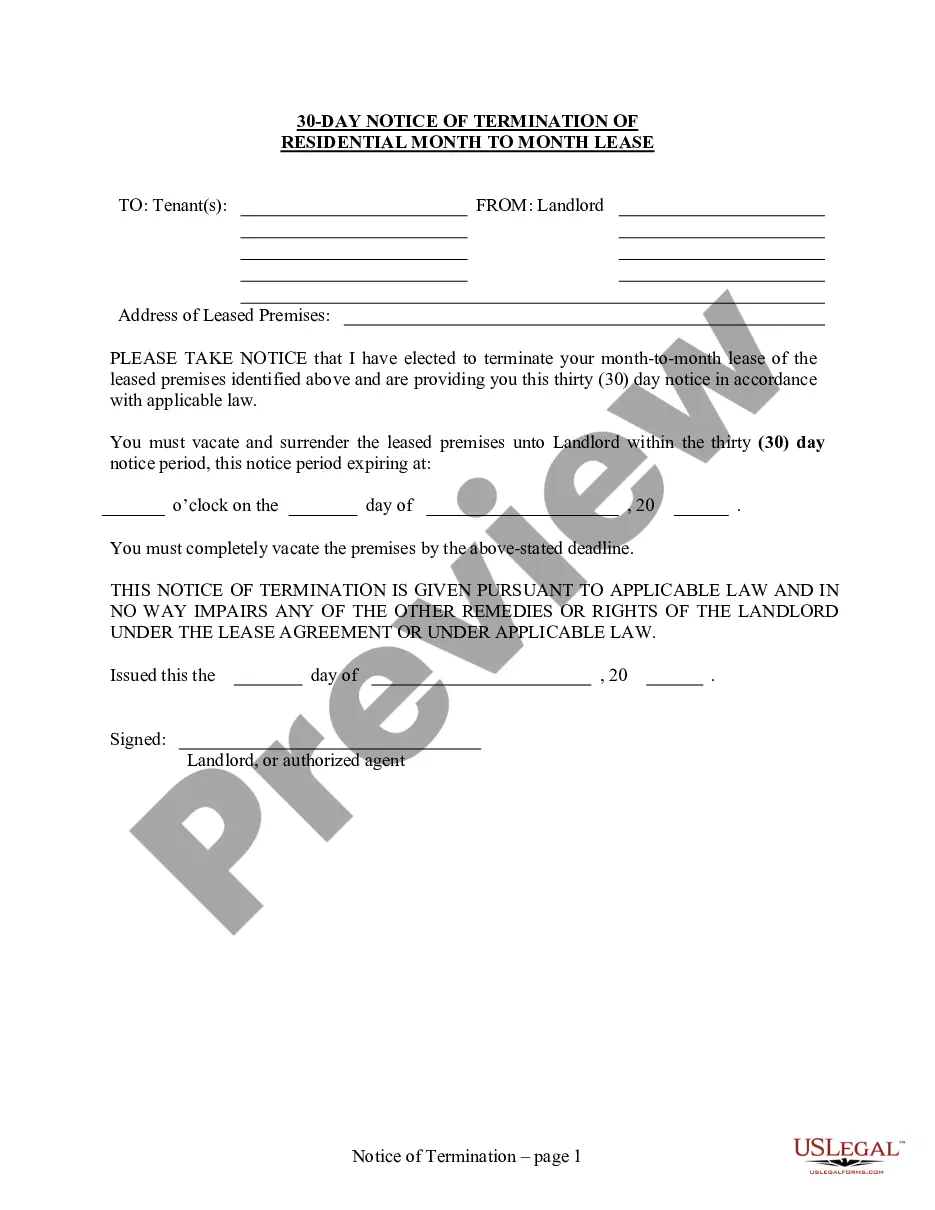

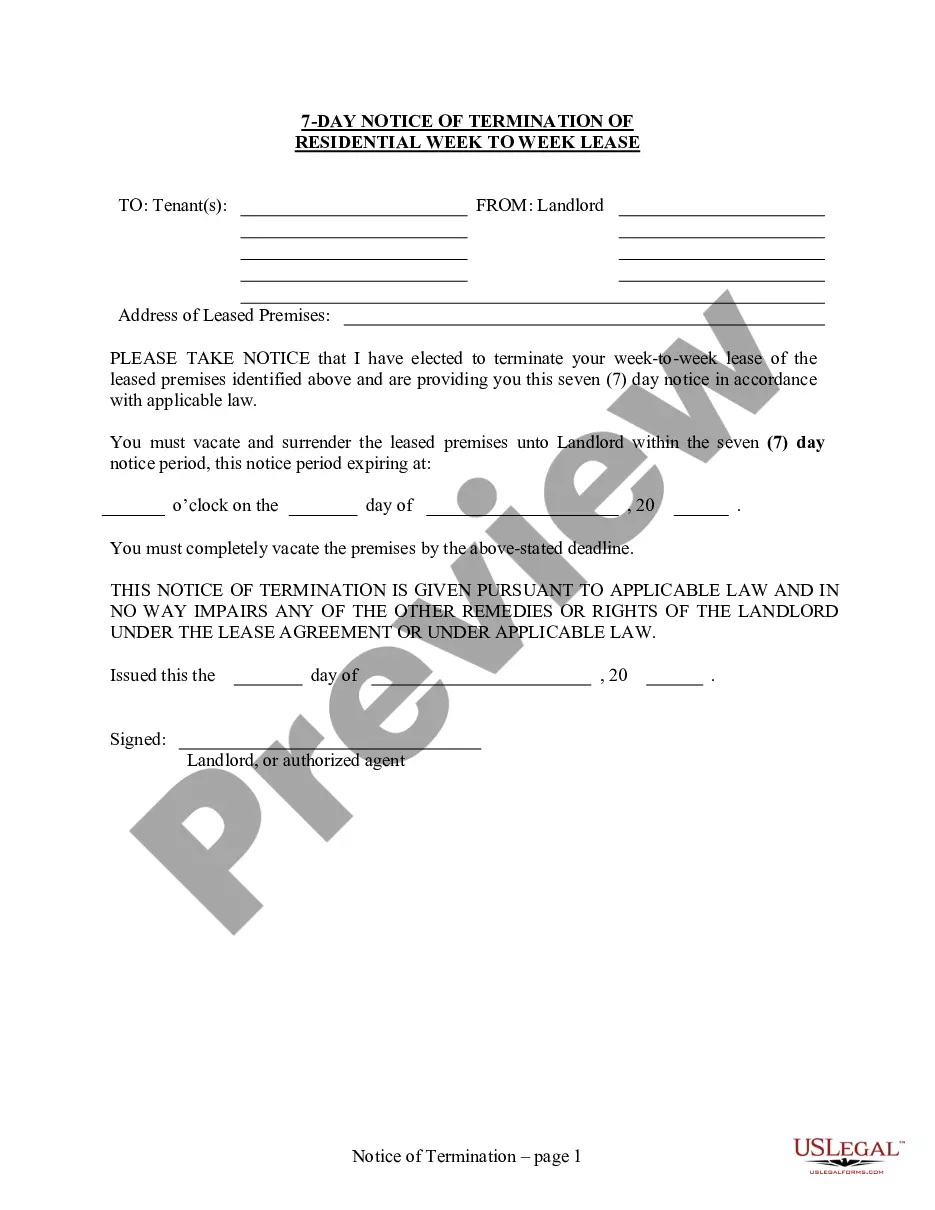

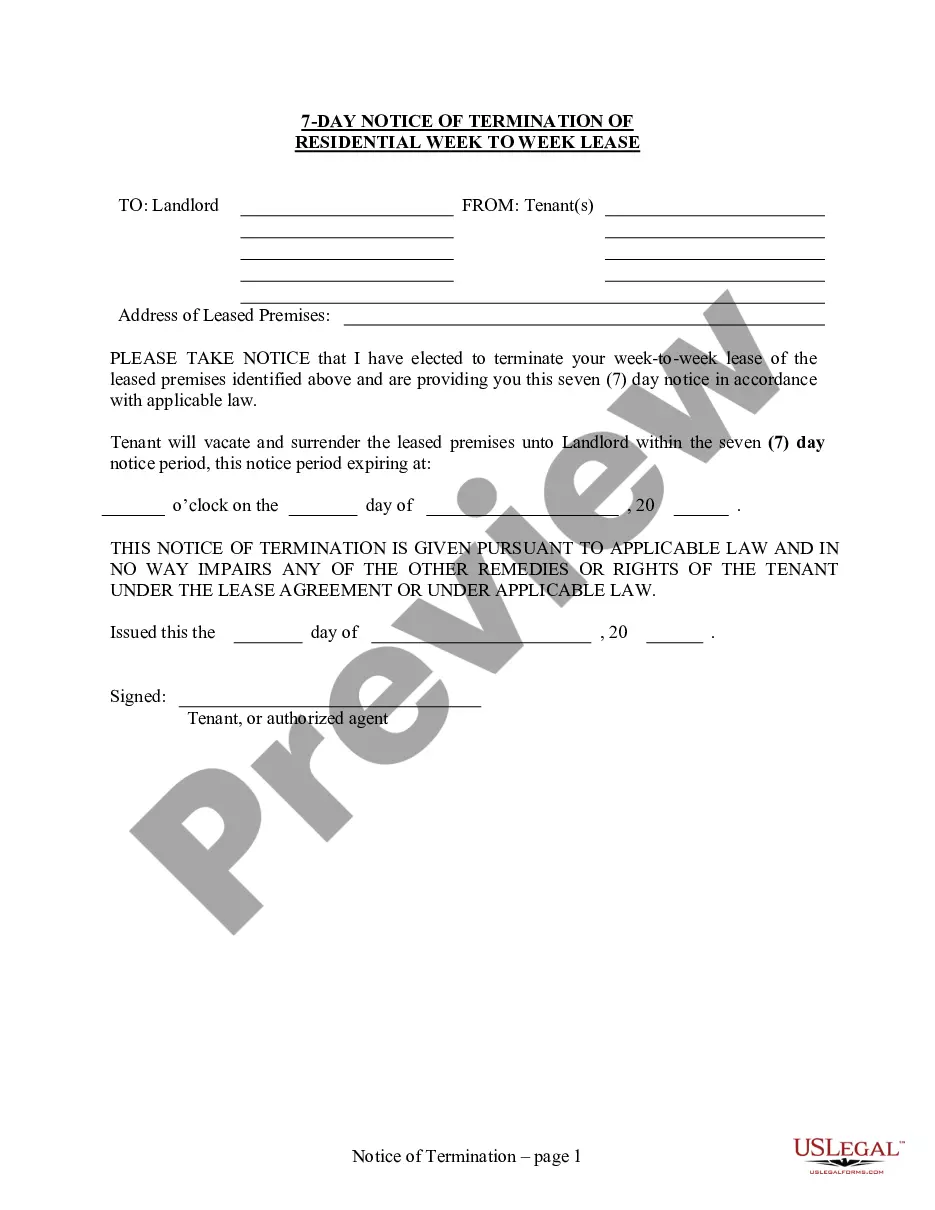

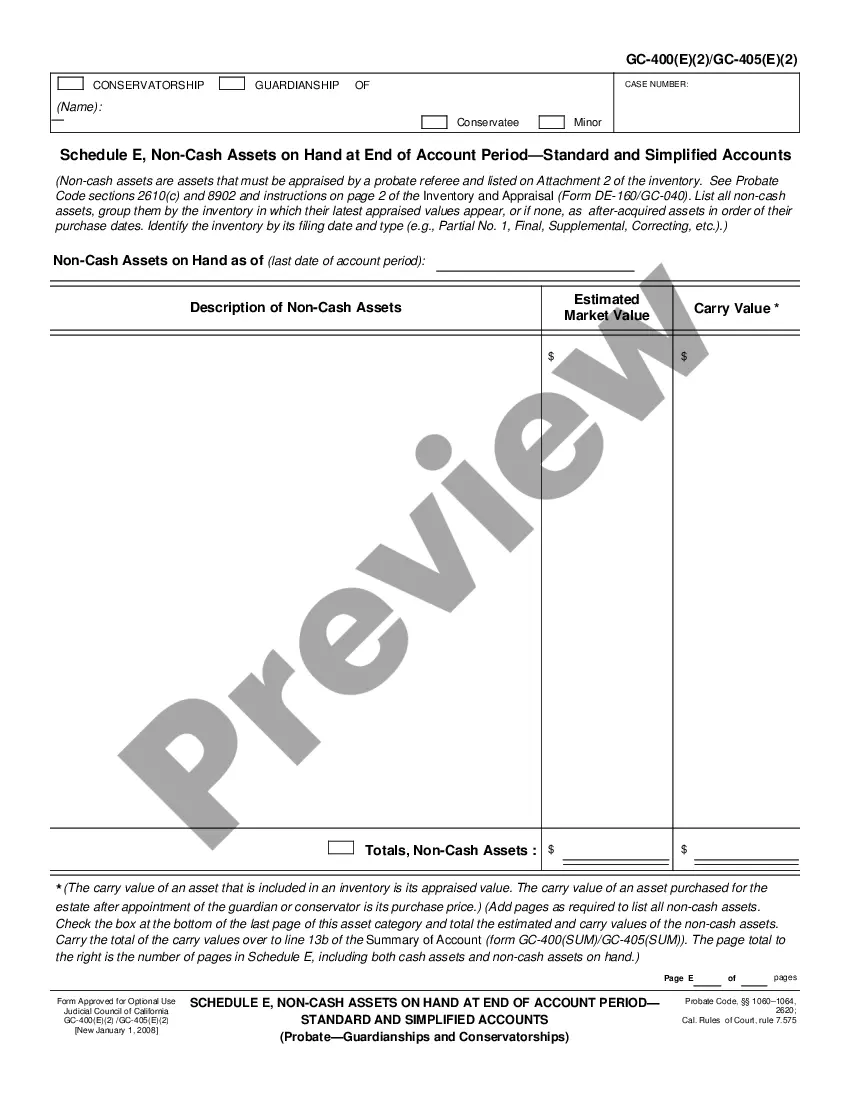

Chula Vista California Affidavit for Collection of Personal Property — Probate Code Section 1310— - Small Estates under $166,250: A Comprehensive Guide In Chula Vista, California, the Affidavit for Collection of Personal Property under Probate Code Section 13100 offers a simplified procedure for estate administration in cases where the decedent's assets fall within the small estate threshold (which is currently $166,250). This affidavit allows eligible individuals to collect the deceased person's personal property without the need for a formal probate proceeding. There are indeed different types of Chula Vista California Affidavit for Collection of Personal Property — Probate Code Section 1310— - Small Estates under $166,250, categorized based on the specific circumstances of the estate. These include: 1. Individual Affidavit: If you are the sole beneficiary entitled to the property, you can complete an individual affidavit. This type of affidavit applies when there is only one eligible individual who is entitled to collect the property of the decedent. 2. Joint Affidavit: In cases where there are multiple beneficiaries who are jointly entitled to collect the personal property, a joint affidavit may be used. This affidavit type requires all eligible beneficiaries to jointly sign the document. 3. Successor Affidavit: When the original intended recipient of the property passes away before completing the affidavit, a successor affidavit comes into play. This affidavit allows a successor to step into the original recipient's shoes and collect the personal property. It is vital to note that these affidavits can only be used for personal property, excluding real property (such as land and buildings) and vehicles. Additionally, there are some requirements and conditions that must be met to utilize these affidavits effectively. These include: — The total value of the decedent's non-real property assets must not exceed $166,250. This threshold is subject to change as per California law. — The deceased person must have passed away at least 40 days before the affidavit is filed. — To use an affidavit, the petitioner must present a certified copy of the decedent's death certificate and complete the appropriate affidavit form. — The person filing the affidavit must be entitled to receive the property and must accept personal liability for any debts of the decedent. — If the estate's value exceeds the small estate limit or if there is a dispute over the property, a formal probate proceeding may be necessary. It is crucial to consult an experienced attorney or seek legal advice to ensure that all requirements are met and documents are completed accurately when utilizing the Chula Vista California Affidavit for Collection of Personal Property under Probate Code Section 13100 for Small Estates under $166,250. Proper execution of this affidavit can streamline the process and alleviate the need for a lengthy and costly probate process.

Chula Vista California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500

Description

How to fill out Chula Vista California Affidavit For Collection Of Personal Property - Probate Code Section 13100 - Small Estates Under $184,500?

If you have previously made use of our service, Log In to your account and retrieve the Chula Vista California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under 166,250 on your device by selecting the Download button. Ensure your subscription is current. Otherwise, renew it following your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have acquired: you can find it in your profile within the My documents section whenever you need to access it again. Utilize the US Legal Forms service to conveniently locate and store any template for your personal or business requirements!

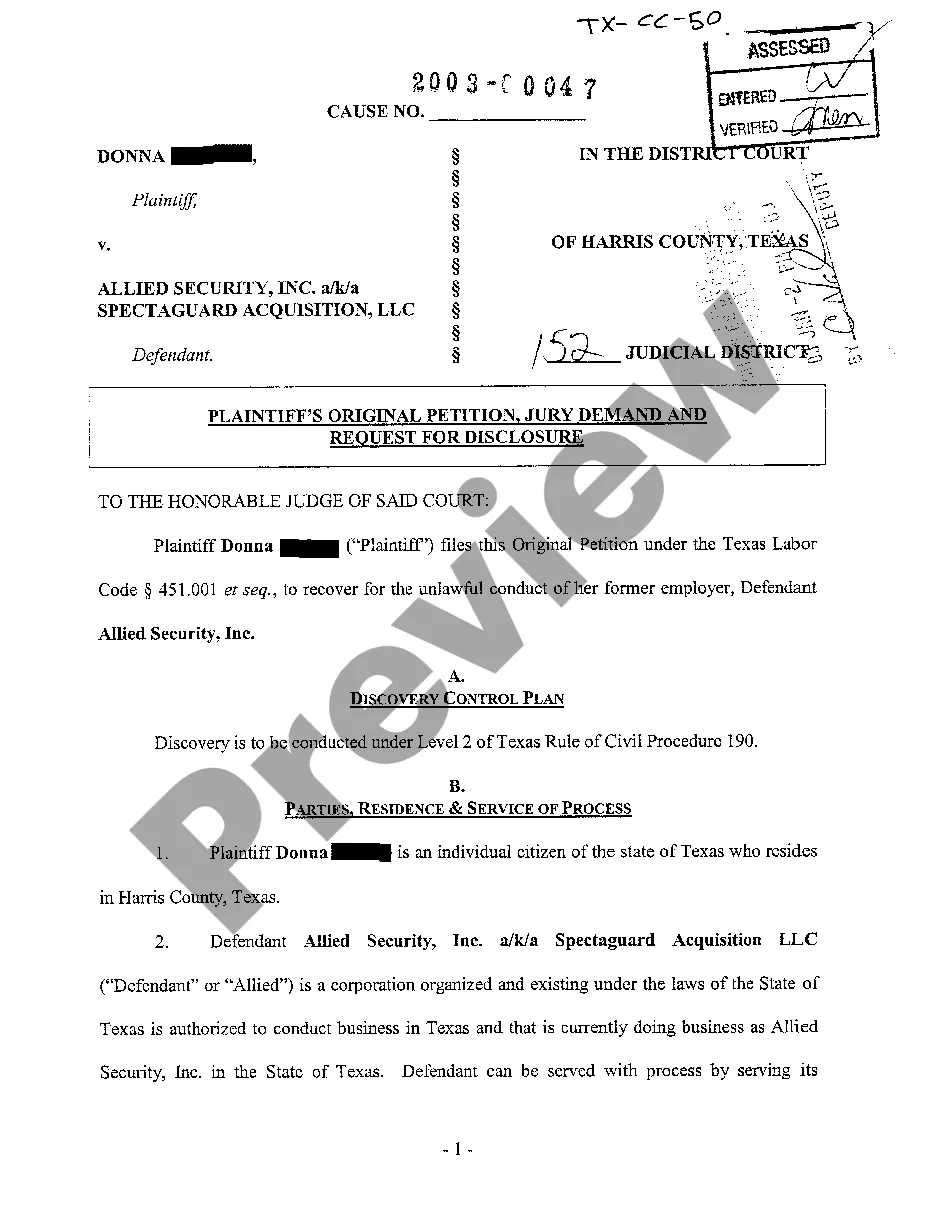

- Confirm you’ve found a suitable document. Review the description and utilize the Preview feature, if available, to verify if it suits your requirements. If it doesn’t meet your needs, utilize the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and complete payment. Provide your credit card information or select the PayPal option to finalize the transaction.

- Receive your Chula Vista California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under 166,250. Choose the desired file format for your document and save it to your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

California Small Estate Affidavit (Affidavit for Collection of Personal Property) Create a high quality document online now! A California small estate affidavit, or ?Petition to Determine Succession to Real Property,? is used by the rightful heirs to an estate of a person who died (the ?decedent?).

Use the Court Locator and find the probate court where the decedent was a resident. The State filing fee is $435.

Code §§ 13100-13116, the person(s) entitled to the property may present a Small Estate Affidavit, commonly known as an Affidavit for Collection of Personal Property, to the person or institution having custody of the property, requesting that the property be delivered or transferred to the successor.

Probate Code §§ 13100 ? 13115 provide for a summary procedure to transfer the personal property of a decedent without going through a probate action if the decedent's estate is valued at less than $150,000 and at least forty (40) days have elapsed since the death of the decedent.

Obtain and complete the California small estate affidavit. You must obtain the form used by the probate court in the county where the deceased was a resident. You can obtain it in person or by accessing your court's self-help center online and downloading the form there.

Probate Code §§ 13100 ? 13115 provide for a summary procedure to transfer the personal property of a decedent without going through a probate action if the decedent's estate is valued at less than $150,000 and at least forty (40) days have elapsed since the death of the decedent.

AFFIDAVIT FOR COLLECTION OF PERSONAL PROPERTY UNDER CALIFORNIA PROBATE CODE SECTIONS 13100-13106.

As of April 1, 2022, the California Probate Code has been updated to increase the gross value of a deceased person's property from $166,250 to $184,500.