Los Angeles California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500

Description

How to fill out California Affidavit For Collection Of Personal Property - Probate Code Section 13100 - Small Estates Under $184,500?

Obtaining verified templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms library.

This is an online repository containing over 85,000 legal documents suited for both personal and professional requirements in various real-life scenarios.

All the paperwork is neatly categorized based on usage areas and jurisdictions, allowing you to locate the Los Angeles California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under 166,250 swiftly and effortlessly.

Acquiring paperwork that is organized and adheres to legal standards is extremely significant. Take advantage of the US Legal Forms library to always have crucial document templates readily available for any requirements!

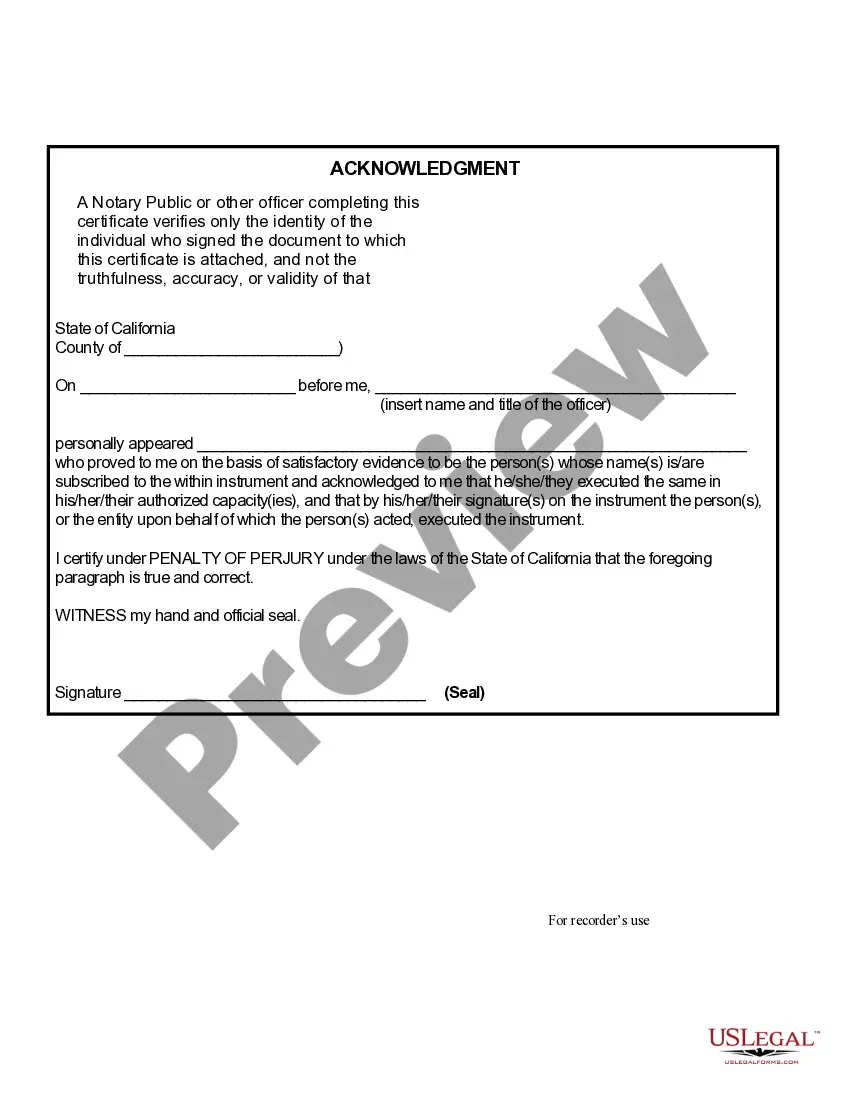

- Examine the Preview mode and form description.

- Ensure that you've chosen the correct option that fulfills your needs and aligns with your local jurisdiction criteria.

- Look for another template if necessary.

- If you find any discrepancies, utilize the Search tab above to find the appropriate one. If it fits your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Section 13100 of the California Probate Code allows heirs to collect personal property from a decedent's estate without going through full probate, provided the estate's value does not exceed $184,500. This option significantly streamlines the process for small estates in Los Angeles, California. Understanding this section can help you navigate the legal requirements more easily, ensuring a smoother transition during difficult times.

Filling out an affidavit of inheritance requires gathering information about the deceased and their assets. In Los Angeles, California, you would outline details such as your relationship to the decedent and a description of the property you wish to claim under the small estate provisions of Probate Code Section 13100. Consider using US Legal Forms to access a structured template that can simplify this process and ensure you include all necessary details.

The small estate limit in New York is currently $50,000 for estates not requiring a formal probate process. This is significantly lower than the limit set by the Los Angeles California Affidavit for Collection of Personal Property under Probate Code Section 13100 for small estates under $184,500. It's essential to be aware of these differences when managing estates across different states.

To obtain a small estate affidavit in California, you must first confirm that the estate qualifies under Probate Code Section 13100, which applies to estates valued under $184,500. Next, you can fill out the required forms, which are available online or at your local courthouse. Utilizing platforms like US Legal Forms can simplify this process by providing you with the necessary templates and guidance you need to complete your Los Angeles California Affidavit for Collection of Personal Property.

When handling a small estate affidavit in Los Angeles, California, specifically under Probate Code Section 13100 for estates valued under $184,500, you typically do not need an Employer Identification Number (EIN). The affidavit itself serves as a legal document that allows heirs to claim personal property without the need for an EIN. However, if the estate includes income-producing assets, discussing your situation with a tax professional may be beneficial.

To complete a small estate affidavit, begin by collecting the required details about the estate and beneficiaries. Use the Los Angeles California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500 form, filling in all necessary fields accurately. Consulting with a legal professional or utilizing the tools available on USLegalForms can streamline this process, ensuring you meet all legal requirements.

Filling out an affidavit of inheritance requires gathering necessary information about the deceased, including names of heirs and the distribution of assets. When you utilize the Los Angeles California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500, make sure to follow the provided guidelines meticulously to ensure the document’s acceptance. Resources like USLegalForms can assist you in understanding the steps and requirements for this form.

The 13101 probate form relates to the legal documentation used in probate proceedings. It is essential when utilizing the Los Angeles California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500. This form helps facilitate the transfer of property or assets under specific estate circumstances, emphasizing the need for proper completion for legal clarity.

The timeframe to obtain a small estate affidavit can vary based on several factors, such as court backlog and document completeness. Generally, once you file the Los Angeles California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500, you may expect a response within a few weeks, given that all required documents are in order. Engaging a legal professional can often expedite this process.

In Washington state, real property does typically require probate unless it is held in a manner that avoids it, such as joint tenancy. If the property value falls under the threshold allowed for small estates, which is defined under the Los Angeles California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500, heirs may utilize specific forms to collect property. It's important to understand that processes differ from state to state, so reviewing local laws is essential.