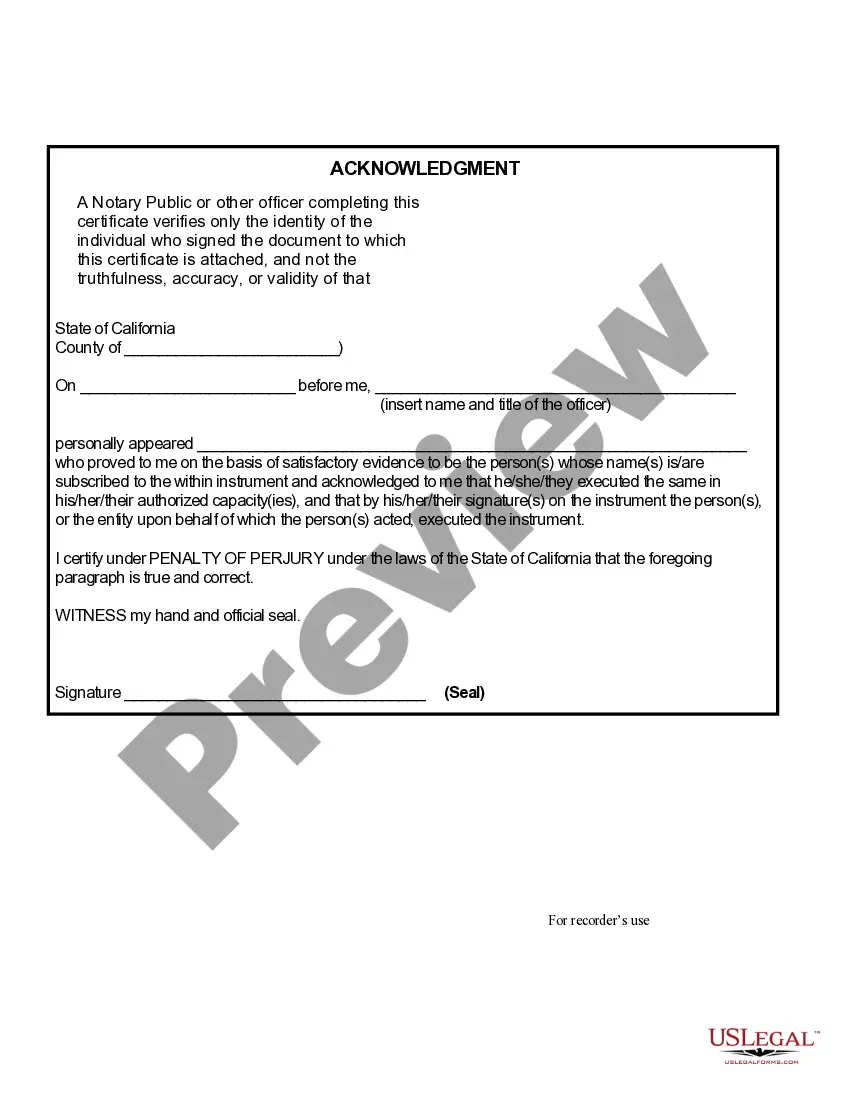

The Oxnard California Affidavit for Collection of Personal Property — Probate Code Section 1310— - Small Estates under $166,250 is a legal document used in the state of California to transfer the property of a deceased individual to their rightful heirs or beneficiaries. This affidavit serves as a simplified probate process for small estates, where the total value of the assets does not exceed $166,250. There are three different types of Oxnard California Affidavit for Collection of Personal Property — Probate Code Section 1310— - Small Estates under $166,250: 1. Spouse's Affidavit: This type of affidavit is used when the deceased person left behind a surviving spouse. The spouse is entitled to claim the personal property of the deceased, including bank accounts, vehicles, personal belongings, and other assets. 2. Domestic Partner's Affidavit: If the deceased individual had a registered domestic partner, the domestic partner can use this affidavit to claim the personal property of the deceased. The process and requirements are similar to the spouse's affidavit. 3. Successor's Affidavit: This option is available when there is no surviving spouse or registered domestic partner. In such cases, the successor(s) named in the decedent's will or living trust can use this affidavit to collect the personal property of the deceased. To initiate the process, the affine (the person submitting the affidavit) must complete the Oxnard California Affidavit for Collection of Personal Property form. This form includes specific information about the deceased person, such as their name, address, date of death, and a statement confirming that the estate falls under the small estate limit. The affine must provide a detailed list of the decedent's assets and their respective estimated values. This may include bank accounts, investments, real property with minimal equity, vehicles, personal belongings, and other assets, excluding real estate properties with significant equity. Once the completed affidavit is signed, it must be notarized before submission to the relevant institution holding the deceased person's assets, such as banks or financial institutions. The affine may need to provide additional supporting documents, such as a copy of the death certificate. It's important to note that the Oxnard California Affidavit for Collection of Personal Property — Probate Code Section 1310— - Small Estates under $166,250 is not applicable if the deceased person had a will that is being probated or if there is a pending probate case in court. In such cases, a full probate process would be required. The purpose of this simplified affidavit process is to expedite the transfer of small estates without involving a formal probate court case.

Oxnard California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500

Description

How to fill out Oxnard California Affidavit For Collection Of Personal Property - Probate Code Section 13100 - Small Estates Under $184,500?

No matter the social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for someone without any law background to create such paperwork from scratch, mostly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our service provides a huge catalog with more than 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you require the Oxnard California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under 166,250 or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Oxnard California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under 166,250 in minutes using our trustworthy service. In case you are presently a subscriber, you can proceed to log in to your account to get the needed form.

Nevertheless, in case you are new to our platform, ensure that you follow these steps before obtaining the Oxnard California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under 166,250:

- Be sure the template you have found is specific to your area considering that the regulations of one state or area do not work for another state or area.

- Preview the document and read a brief outline (if available) of scenarios the document can be used for.

- In case the one you chosen doesn’t meet your requirements, you can start over and search for the necessary document.

- Click Buy now and pick the subscription plan you prefer the best.

- Log in to your account credentials or register for one from scratch.

- Select the payment gateway and proceed to download the Oxnard California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under 166,250 once the payment is through.

You’re good to go! Now you can proceed to print out the document or fill it out online. In case you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.