Santa Clara California Affidavit for Collection of Personal Property — Probate Code Section 1310— - Small Estates under 166,250 is a legal document used to transfer property from a deceased person's estate to their beneficiaries without going through the formal probate process. This affidavit is specifically designed for small estates valued at or below $166,250 in Santa Clara, California. The purpose of the Santa Clara California Affidavit for Collection of Personal Property is to simplify and expedite the transfer of assets from the deceased person to their rightful heirs or beneficiaries. It provides a streamlined procedure that eliminates the need for a probate court proceeding when the estate meets the small estate threshold. To be eligible to use this affidavit, certain criteria must be met. These criteria include: 1. The deceased person passed away in Santa Clara County, California. 2. The fair market value of the decedent's assets does not exceed $166,250, excluding joint tenancy or payable-on-death accounts. 3. 40 days have passed since the person's death. 4. No probate proceeding has been initiated or is pending. By filing the Santa Clara California Affidavit for Collection of Personal Property, the estate's personal representative can collect and distribute the decedent's property to the rightful beneficiaries without the need for a formal probate process. This affidavit allows for a faster and simpler transfer of assets, saving time and money for the parties involved. Different types of Santa Clara California Affidavit for Collection of Personal Property under Probate Code Section 13100 include: 1. Santa Clara California Affidavit for Collection of Personal Property — Single Decedent: This is used when the deceased person was an individual with no co-owners or joint tenants. It allows for the transfer of the entire estate to the beneficiaries listed in the affidavit. 2. Santa Clara California Affidavit for Collection of Personal Property — Joint Tenancy: This affidavit is used when the decedent held property in joint tenancy with another person who is now the surviving joint tenant. It enables the surviving joint tenant to claim ownership of the property without the need for probate. 3. Santa Clara California Affidavit for Collection of Personal Property — Payable-on-Death (POD): This affidavit is used when the deceased person held assets such as bank accounts, retirement accounts, or life insurance policies with a designated beneficiary. It allows the beneficiary to claim the assets directly without involving probate. 4. Santa Clara California Affidavit for Collection of Personal Property — Surviving Spouse or Domestic Partner: This affidavit is used when the decedent was married or in a registered domestic partnership at the time of death and the property is community property. It allows the surviving spouse or domestic partner to claim the community property. In conclusion, Santa Clara California Affidavit for Collection of Personal Property — Probate Code Section 1310— - Small Estates under 166,250 is a useful legal tool to facilitate the transfer of property in small estates. It simplifies and expedites the process, benefiting both the estate's personal representative and the beneficiaries.

Santa Clara California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500

Description

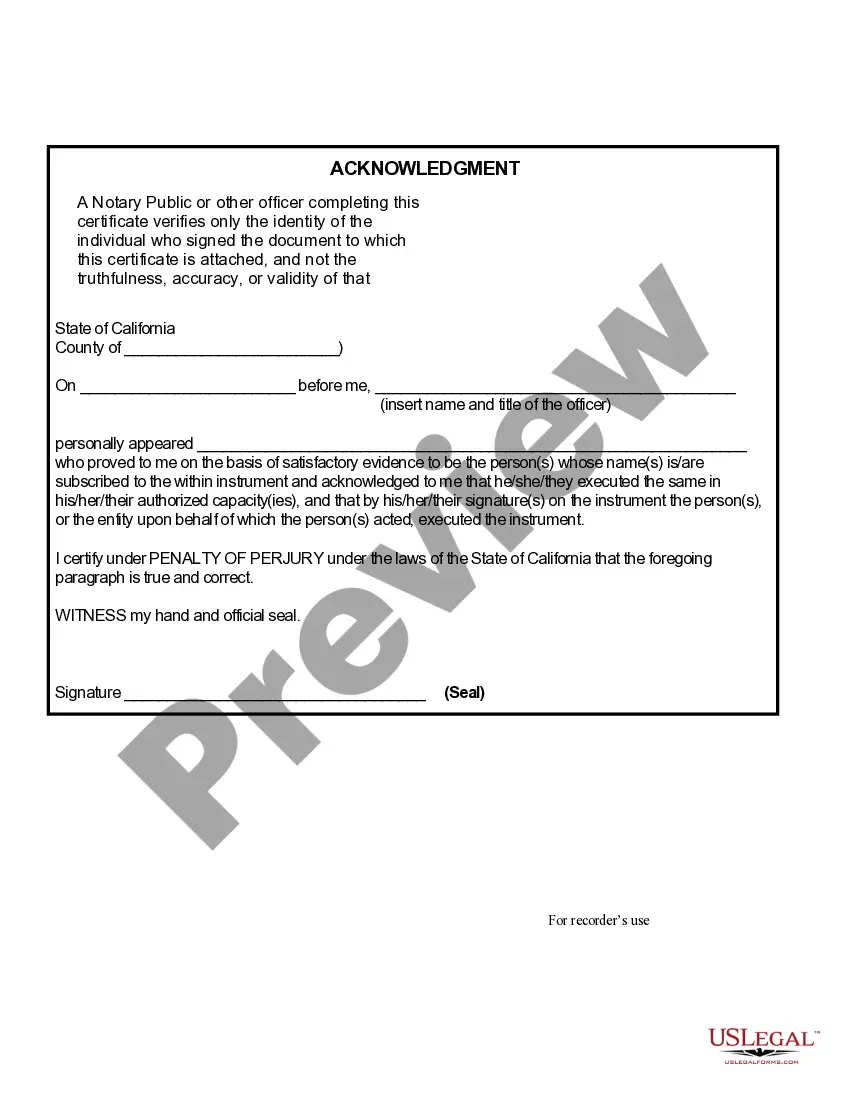

How to fill out Santa Clara California Affidavit For Collection Of Personal Property - Probate Code Section 13100 - Small Estates Under $184,500?

If you are looking for a valid form, it’s difficult to find a better platform than the US Legal Forms site – one of the most considerable libraries on the web. With this library, you can find thousands of document samples for business and individual purposes by categories and regions, or keywords. With the high-quality search option, finding the latest Santa Clara California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under 166,250 is as easy as 1-2-3. In addition, the relevance of each and every file is confirmed by a team of expert lawyers that regularly review the templates on our platform and revise them according to the most recent state and county demands.

If you already know about our system and have a registered account, all you should do to receive the Santa Clara California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under 166,250 is to log in to your account and click the Download button.

If you make use of US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have discovered the sample you require. Check its description and utilize the Preview option to explore its content. If it doesn’t suit your needs, use the Search field near the top of the screen to discover the appropriate file.

- Confirm your decision. Click the Buy now button. Next, pick your preferred pricing plan and provide credentials to sign up for an account.

- Make the financial transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Get the form. Indicate the format and save it to your system.

- Make adjustments. Fill out, revise, print, and sign the obtained Santa Clara California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under 166,250.

Every single form you add to your account has no expiry date and is yours forever. It is possible to gain access to them using the My Forms menu, so if you want to receive an extra duplicate for enhancing or printing, you may return and download it once more at any moment.

Make use of the US Legal Forms professional library to gain access to the Santa Clara California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under 166,250 you were looking for and thousands of other professional and state-specific templates on a single platform!