Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500

Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met. Small estates can be administered with less time and cost. If the deceased had conveyed most property to a trust but there remains some property, small estate laws may also be available. Small Estate procedures may generally be used regardless of whether there was a Will. In general, the two forms of small estate procedures are recognized:

1. Small Estate Affidavit Some States allow an affidavit to be executed by the spouse and/or heirs of the deceased and present the affidavit to the holder of property such as a bank to obtain property of the deceased. Other states require that the affidavit be filed with the Court. The main requirement before you may use an affidavit is that the value of the personal and/or real property of the estate not exceed a certain value.

2. Summary Administration Some states allow a Summary administration. Some States recognize both the Small Estate affidavit and Summary Administration, basing the requirement of which one to use on the value of the estate. Example: If the estate value is 10,000 or less an affidavit is allowed but if the value is between 10,000 to 20,000 a summary administration is allowed.

California Summary: Pursuant to California statute, if the value of an estate does not exceed $150,000, and forty days have elapsed since the death of the decedent, the successor of the decedent may demand payment on any debts owed to the decedent through a small estate affidavit.

California Requirements:

California requirements are found in the following statutes:

13100.

Excluding the property described in Section 13050, if the gross value of the decedent s real and personal property in this state does not exceed one hundred fifty thousand dollars ($150,000) and if 40 days have elapsed since the death of the decedent, the successor of the decedent may, without procuring letters of administration or awaiting probate of the will, do any of the following with respect to one or more particular items of property:

(a) Collect any particular item of property that is money due the decedent.

(b) Receive any particular item of property that is tangible personal property of the decedent.

(c) Have any particular item of property that is evidence of a debt, obligation, interest, right, security, or chose in action belonging to the decedent transferred, whether or not secured by a lien on real property.

(Amended by Stats. 2011, Ch. 117, Sec. 4. Effective January 1, 2012.)

13101.

(a) To collect money, receive tangible personal property, or have evidences of a debt, obligation, interest, right, security, or chose in action transferred under this chapter, an affidavit or a declaration under penalty of perjury under the laws of this state shall be furnished to the holder of the decedent s property stating all of the following:

(1) The decedent's name.

(2) The date and place of the decedent's death.

(3) At least 40 days have elapsed since the death of the decedent, as shown in a certified copy of the decedent s death certificate attached to this affidavit or declaration.

(4) Either of the following, as appropriate:

(A) No proceeding is now being or has been conducted in California for administration of the decedent s estate.

(B) The decedent s personal representative has consented in writing to the payment, transfer, or delivery to the affiant or declarant of the property described in the affidavit or declaration.

(5) The current gross fair market value of the decedent s real and personal property in California, excluding the property described in Section 13050 of the California Probate Code, does not exceed one hundred fifty thousand dollars ($150,000).

(6) A description of the property of the decedent that is to be paid, transferred, or delivered to the affiant or declarant.

(7) The name of the successor of the decedent (as defined in Section 13006 of the California Probate Code) to the described property.

(8) Either of the following, as appropriate:

(A) The affiant or declarant is the successor of the decedent (as defined in Section 13006 of the California Probate Code) to the decedent s interest in the described property.

(B) The affiant or declarant is authorized under Section 13051 of the California Probate Code to act on behalf of the successor of the decedent (as defined in Section 13006 of the California Probate Code) with respect to the decedent s interest in the described property.

(9) No other person has a superior right to the interest of the decedent in the described property.

(10) The affiant or declarant requests that the described property be paid, delivered, or transferred to the affiant or declarant.

(11) The affiant or declarant affirms or declares under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

(b) Where more than one person executes the affidavit or declaration under this section, the statements required by subdivision (a) shall be modified as appropriate to reflect that fact.

(c) If the particular item of property to be transferred under this chapter is a debt or other obligation secured by a lien on real property and the instrument creating the lien has been recorded in the office of the county recorder of the county where the real property is located, the affidavit or declaration shall satisfy the requirements both of this section and of Section 13106.5.

(d) A certified copy of the decedent s death certificate shall be attached to the affidavit or declaration.

(e) If the decedent s personal representative has consented to the payment, transfer, or delivery of the described property to the affiant or declarant, a copy of the consent and of the personal representative s letters shall be attached to the affidavit or declaration.

(Amended by Stats. 2011, Ch. 117, Sec. 5. Effective January 1, 2012.)

13102.

(a) If the decedent had evidence of ownership of the property described in the affidavit or declaration and the holder of the property would have had the right to require presentation of the evidence of ownership before the duty of the holder to pay, deliver, or transfer the property to the decedent would have arisen, the evidence of ownership, if available, shall be presented with the affidavit or declaration to the holder of the decedent s property.

(b) If the evidence of ownership is not presented to the holder pursuant to subdivision (a), the holder may require, as a condition for the payment, delivery, or transfer of the property, that the person presenting the affidavit or declaration provide the holder with a bond or undertaking in a reasonable amount determined by the holder to be sufficient to indemnify the holder against all liability, claims, demands, loss, damages, costs, and expenses that the holder may incur or suffer by reason of the payment, delivery, or transfer of the property. Nothing in this subdivision precludes the holder and the person presenting the affidavit or declaration from dispensing with the requirement that a bond or undertaking be provided and instead entering into an agreement satisfactory to the holder concerning the duty of the person presenting the affidavit or declaration to indemnify the holder.

(Enacted by Stats. 1990, Ch. 79.)

13103

If the estate of the decedent includes any real property in this state, the affidavit or declaration shall be accompanied by an inventory and appraisal of the real property. The inventory and appraisal of the real property shall be made as provided in Part 3 (commencing with Section 8800) of Division 7. The appraisal shall be made by a probate referee selected by the affiant or declarant from those probate referees appointed by the Controller under Section 400 to appraise property in the county where the real property is located.

(Enacted by Stats. 1990, Ch. 79.)

13104.

(a) Reasonable proof of the identity of each person executing the affidavit or declaration shall be provided to the holder of the decedent s property.

(b) Reasonable proof of identity is provided for the purposes of this section if both of the following requirements are satisfied:

(1) The person executing the affidavit or declaration is personally known to the holder.

(2) The person executes the affidavit or declaration in the presence of the holder.

(c) If the affidavit or declaration is executed in the presence of the holder, a written statement under penalty of perjury by a person personally known to the holder affirming the identity of the person executing the affidavit or declaration is reasonable proof of identity for the purposes of this section.

(d) If the affidavit or declaration is executed in the presence of the holder, the holder may reasonably rely on any of the following as reasonable proof of identity for the purposes of this section:

(1) An identification card or driver s license issued by the Department of Motor Vehicles of this state that is current or was issued during the preceding five years.

(2) A passport issued by the Department of State of the United States that is current or was issued during the preceding five years.

(3) Any of the following documents if the document is current or was issued during the preceding five years and contains a photograph and description of the person named on it, is signed by the person, and bears a serial or other identifying number:

(A) A passport issued by a foreign government that has been stamped by the United States Immigration and Naturalization Service.

(B) A driver s license issued by a state other than California.

(C) An identification card issued by a state other than California.

(D) An identification card issued by any branch of the armed forces of the United States.

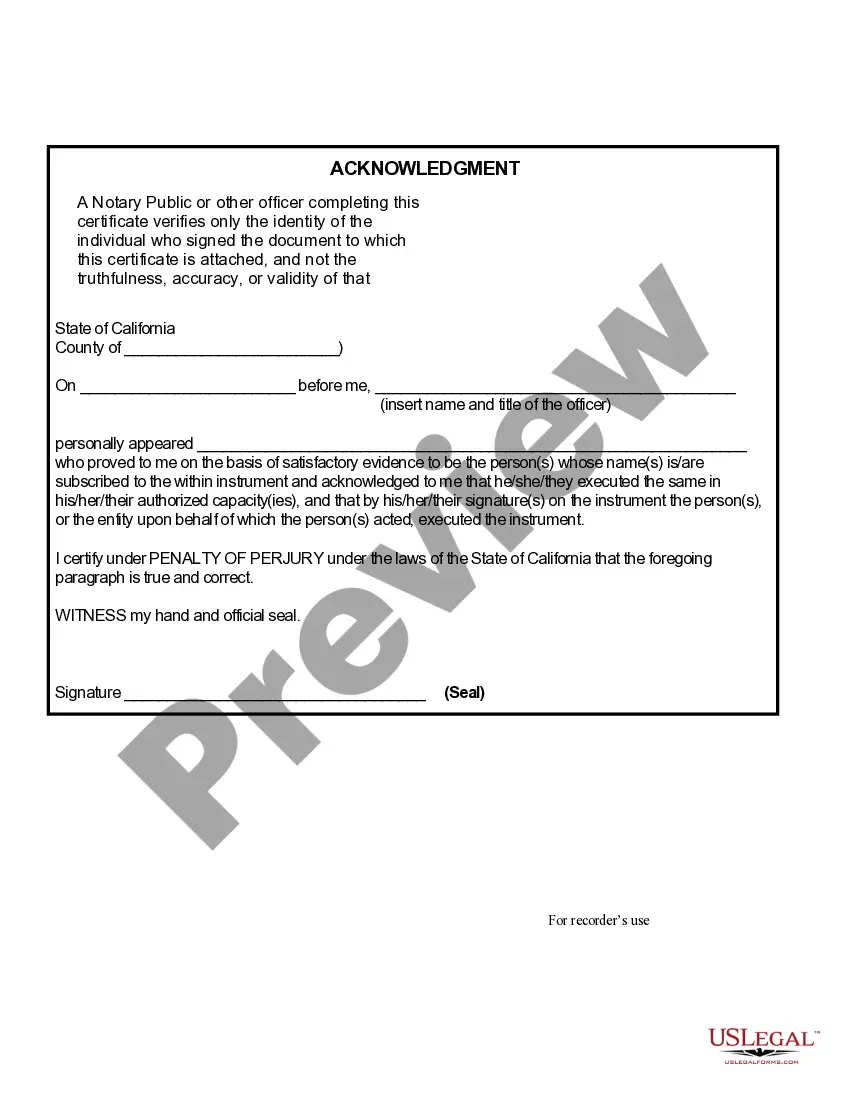

(e) For the purposes of this section, a notary public s certificate of acknowledgment identifying the person executing the affidavit or declaration is reasonable proof of identity of the person executing the affidavit or declaration.

(f) Unless the affidavit or declaration contains a notary public s certificate of acknowledgment of the identity of the person, the holder shall note on the affidavit or declaration either that the person executing the affidavit or declaration is personally known or a description of the identification provided by the person executing the affidavit or declaration.

(Enacted by Stats. 1990, Ch. 79.)