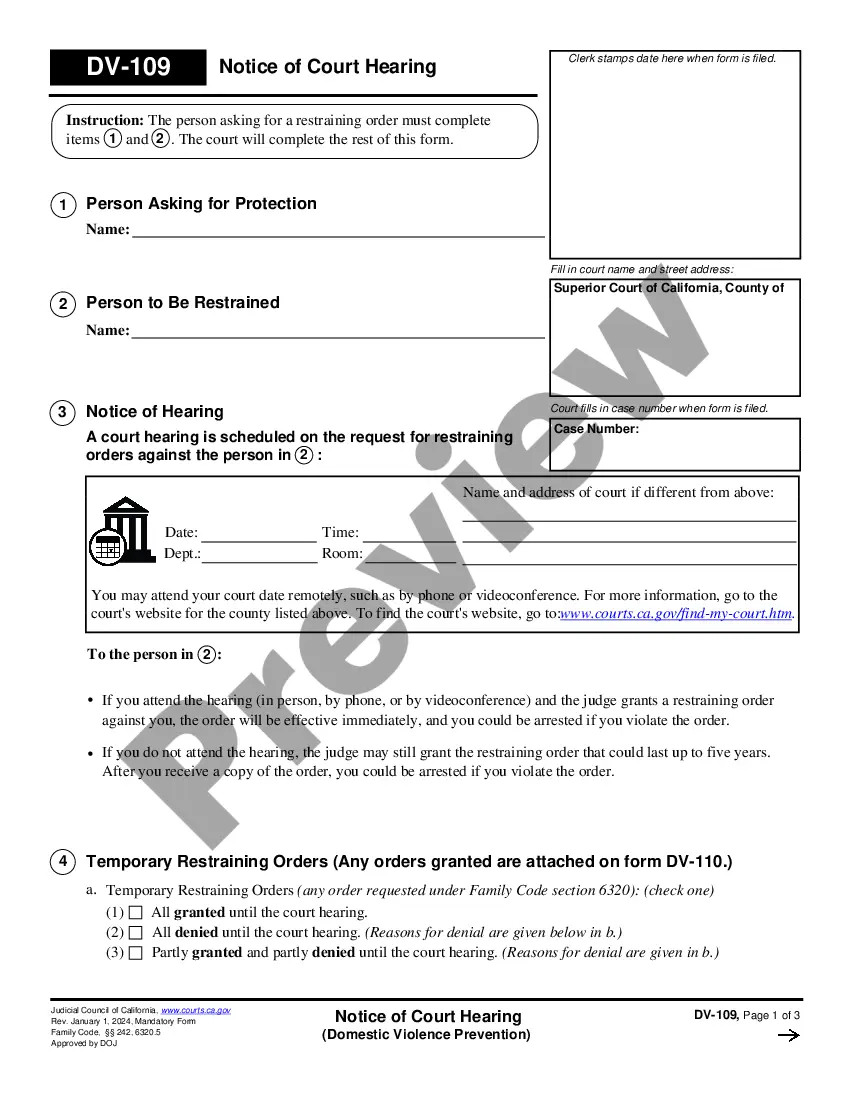

This is an official California Judicial Council family law form, which may be used in domestic litigation in California. Enter the information as indicated on the form and file with the court as appropriate.

The Sacramento California Income and Expense Declaration is a legal document used in family law cases to provide a comprehensive overview of an individual's financial situation. It plays a crucial role in determining child support, spousal support, and property division. The Income and Expense Declaration ensures that all parties involved in a family law case have full transparency regarding each other's income, expenses, assets, and debts. It helps establish a fair and accurate assessment of one's financial capability and needs. Key elements included in the Sacramento California Income and Expense Declaration are: 1. Personal Information: The form requires the individual's personal details, such as name, contact information, and the case number. 2. Income Details: This section requires a detailed account of all sources of income, including wages, salary, self-employment earnings, bonuses, pensions, rental income, and any other financial benefits. 3. Expense Breakdown: The individual must disclose their monthly expenses, such as housing costs (rent or mortgage), utilities, transportation, insurance, medical expenses, childcare, education costs, and personal expenses. 4. Assets and Debts: The form also requires the disclosure of individual and marital assets, including real estate, vehicles, bank accounts, investments, retirement accounts, and any outstanding debts such as credit cards, loans, or mortgages. 5. Supporting Documentation: It is essential to attach supporting documents corroborating the income and expenses claimed in the declaration. These may include pay stubs, bank statements, tax returns, and other financial records. Sacramento California Income and Expense Declaration — Family Law may have specific variations depending on the circumstances of the case. Some common types include: 1. Individual Income and Expense Declaration: This version is used when only one party is required to provide their financial information, as in cases of child support or spousal support determination. 2. Joint Income and Expense Declaration: In cases where both parties are required to provide their financial information, this version ensures both individuals complete the form. 3. Modified Income and Expense Declaration: This variation may be necessary if the court grants specific modifications to accommodate unique circumstances, such as shared custody or a significant change in financial circumstances. Filling out the Sacramento California Income and Expense Declaration is crucial, as it provides a clear snapshot of each party's financial standing, enabling the court to make informed decisions based on accurate information. It assists in ensuring fairness and equity in family law cases related to financial support, property division, and other financial aspects.