This is an official California Judicial Council family law form, which may be used in domestic litigation in California. Enter the information as indicated on the form and file with the court as appropriate.

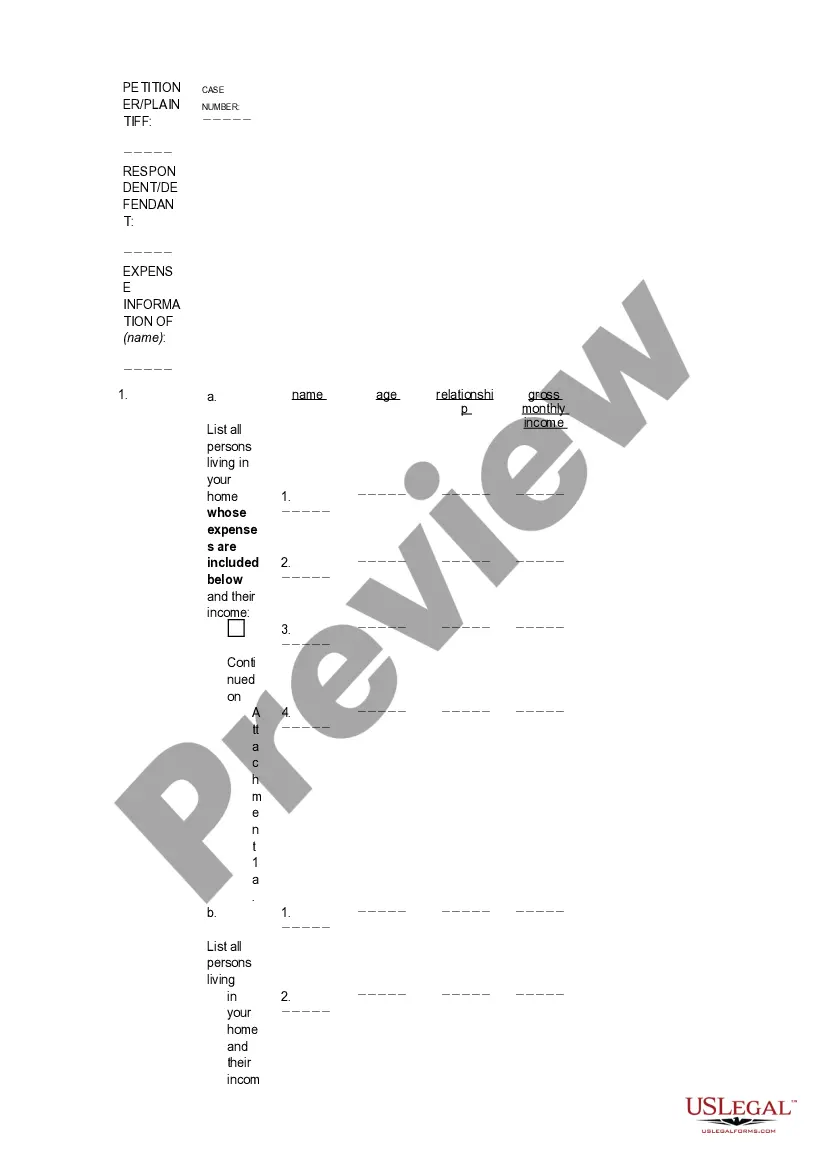

San Bernardino California Income and Expense Declaration is a crucial document used in family law cases to provide comprehensive financial information about the parties involved. This declaration is used by individuals residing in San Bernardino, California, who are going through divorce, legal separation, child custody, or spousal support proceedings. The San Bernardino California Income and Expense Declaration — Family Law form encompasses multiple sections focusing on gathering data related to income, expenses, assets, and debts. It requires individuals to provide accurate information in order to determine appropriate child support or spousal support amounts and to evaluate the financial situation of both parties involved in the case. Some essential keywords associated with the San Bernardino California Income and Expense Declaration — Family Law are: 1. California Family Law: Refers to the set of laws and regulations governing domestic relations and family-related legal matters in the state of California. 2. San Bernardino County: Specific region within California where the income and expense declaration is applicable. 3. Divorce: Formal legal termination of a marriage, involving the division of assets, determination of child custody, and settlements regarding support payments. 4. Legal Separation: A court-approved arrangement allowing spouses to live separately while remaining married, handling issues related to property division, support, and child custody without legally ending the marriage. 5. Child Custody: The legal determination of rights and responsibilities regarding the care and upbringing of children when parents separate or divorce. 6. Spousal Support: Financial assistance provided from one spouse to another after separation or divorce to maintain the standard of living enjoyed during the marriage. 7. Income: All sources of earnings and financial resources received by an individual, including employment wages, self-employment income, rental income, dividends, etc. 8. Expenses: The regular and necessary costs incurred by an individual, such as housing, utilities, food, transportation, healthcare, childcare, education, and other daily living expenses. 9. Assets: Any valuable possessions owned by an individual, including real estate, vehicles, investments, bank accounts, retirement accounts, and personal property. 10. Debts: The financial obligations, such as loans, credit card debt, mortgages, and other liabilities held by an individual. Though there might not be different types of San Bernardino California Income and Expense Declarations — Family Law, the form may vary depending on specific circumstances. However, the content and purpose of the document generally remain consistent, aiming to provide a transparent overview of the financial situation of the parties involved.