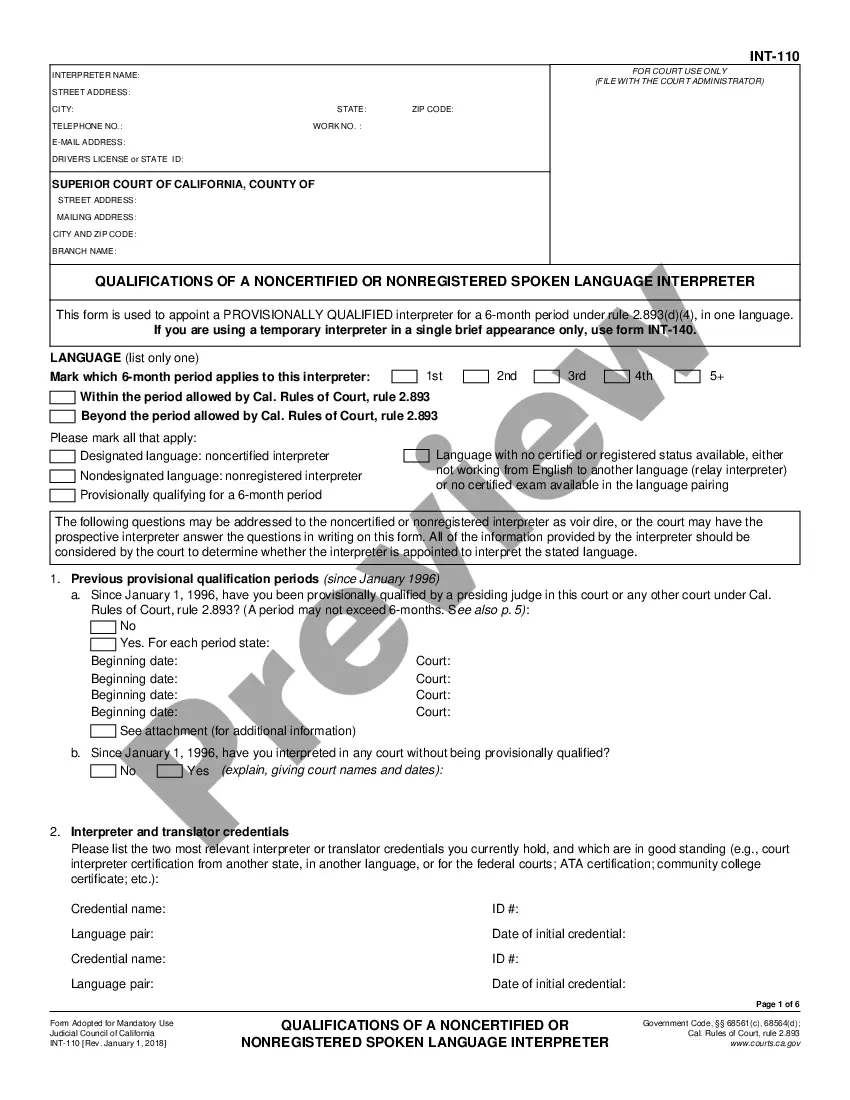

This form is an official document from the California Judicial Council, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

The Irvine California Income and Expense Declaration (Declaration de Ingresos y Gaston de Irvine California en Español) is a vital legal document used in the state of California to assess a person's income, expenses, assets, and liabilities during a legal process, such as a divorce or child custody case. This document provides a detailed overview of an individual's financial situation and plays a crucial role in determining child support, spousal support, or division of assets. There are several types of Irvine California Income and Expense Declaration — Spanish, each designed for specific circumstances: 1. Divorce Income and Expense Declaration: This form is utilized when individuals are going through a divorce and need to disclose their financial information to determine spousal support or division of assets accurately. It includes sections for reporting income from various sources like employment, self-employment, investments, and pensions. Additionally, it captures detailed expense information such as housing costs, insurance, child support payments from previous relationships, and other essential expenses. 2. Child Support Income and Expense Declaration: This particular form focuses on assessing an individual's financial status when determining child support obligations. It includes similar sections for reporting income and expenses but emphasizes factors more relevant to supporting biological or adopted children, such as child care costs, health insurance premiums, and extraordinary medical expenses. 3. Modification Income and Expense Declaration: This form is used to request a modification of an existing support order due to significant changes in financial circumstances. It requires detailed information on any variations in income, expenses, or assets since the last income and expense declaration was filed. Regardless of the type, the Irvine California Income and Expense Declaration — Spanish is a highly significant document as it ensures both parties provide complete and accurate information about their financial situation, promoting fairness and transparency in legal proceedings. It is essential to fill out this form thoroughly, honestly, and seek professional assistance if needed to ensure compliance with the state's laws and regulations.The Irvine California Income and Expense Declaration (Declaration de Ingresos y Gaston de Irvine California en Español) is a vital legal document used in the state of California to assess a person's income, expenses, assets, and liabilities during a legal process, such as a divorce or child custody case. This document provides a detailed overview of an individual's financial situation and plays a crucial role in determining child support, spousal support, or division of assets. There are several types of Irvine California Income and Expense Declaration — Spanish, each designed for specific circumstances: 1. Divorce Income and Expense Declaration: This form is utilized when individuals are going through a divorce and need to disclose their financial information to determine spousal support or division of assets accurately. It includes sections for reporting income from various sources like employment, self-employment, investments, and pensions. Additionally, it captures detailed expense information such as housing costs, insurance, child support payments from previous relationships, and other essential expenses. 2. Child Support Income and Expense Declaration: This particular form focuses on assessing an individual's financial status when determining child support obligations. It includes similar sections for reporting income and expenses but emphasizes factors more relevant to supporting biological or adopted children, such as child care costs, health insurance premiums, and extraordinary medical expenses. 3. Modification Income and Expense Declaration: This form is used to request a modification of an existing support order due to significant changes in financial circumstances. It requires detailed information on any variations in income, expenses, or assets since the last income and expense declaration was filed. Regardless of the type, the Irvine California Income and Expense Declaration — Spanish is a highly significant document as it ensures both parties provide complete and accurate information about their financial situation, promoting fairness and transparency in legal proceedings. It is essential to fill out this form thoroughly, honestly, and seek professional assistance if needed to ensure compliance with the state's laws and regulations.