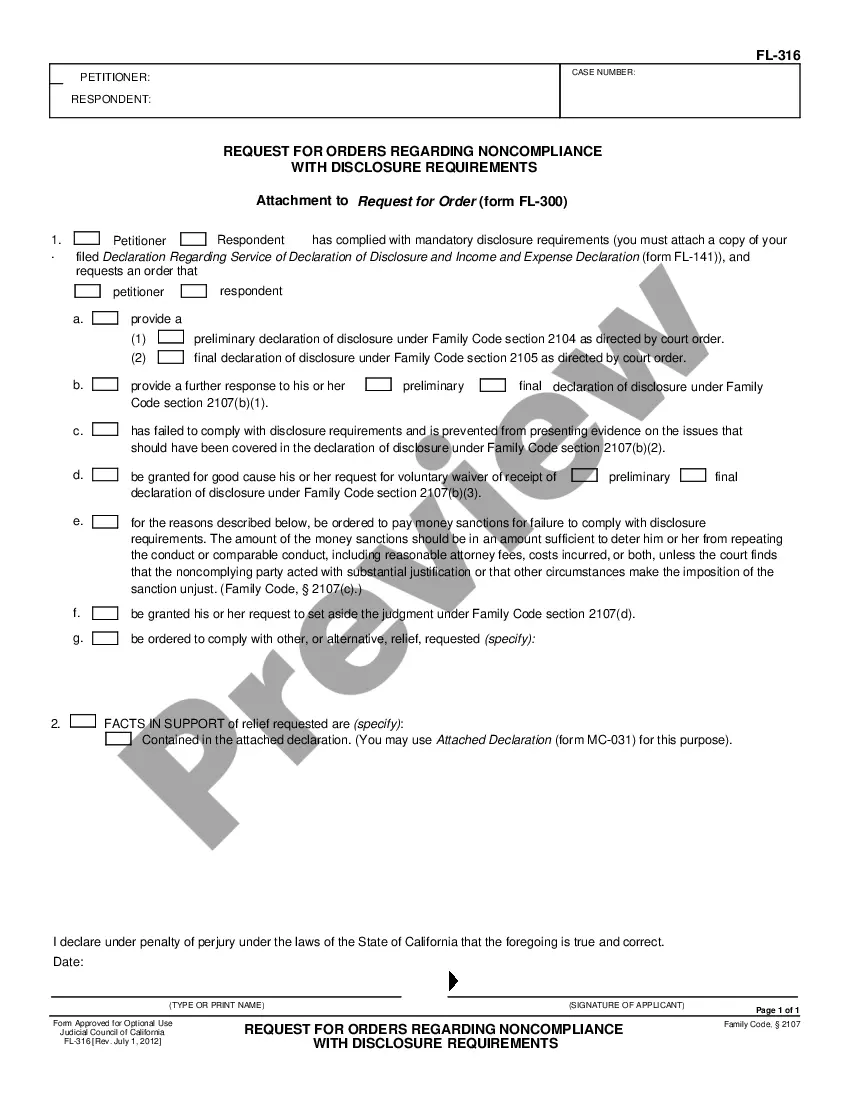

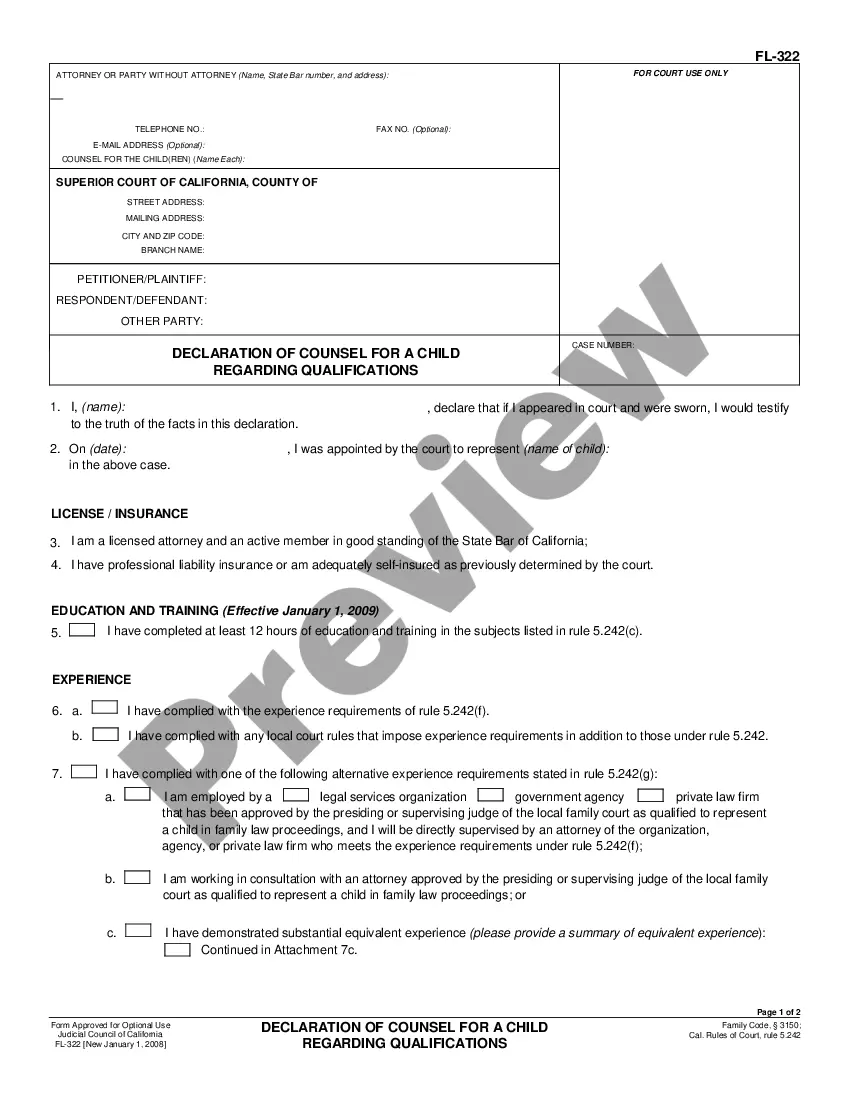

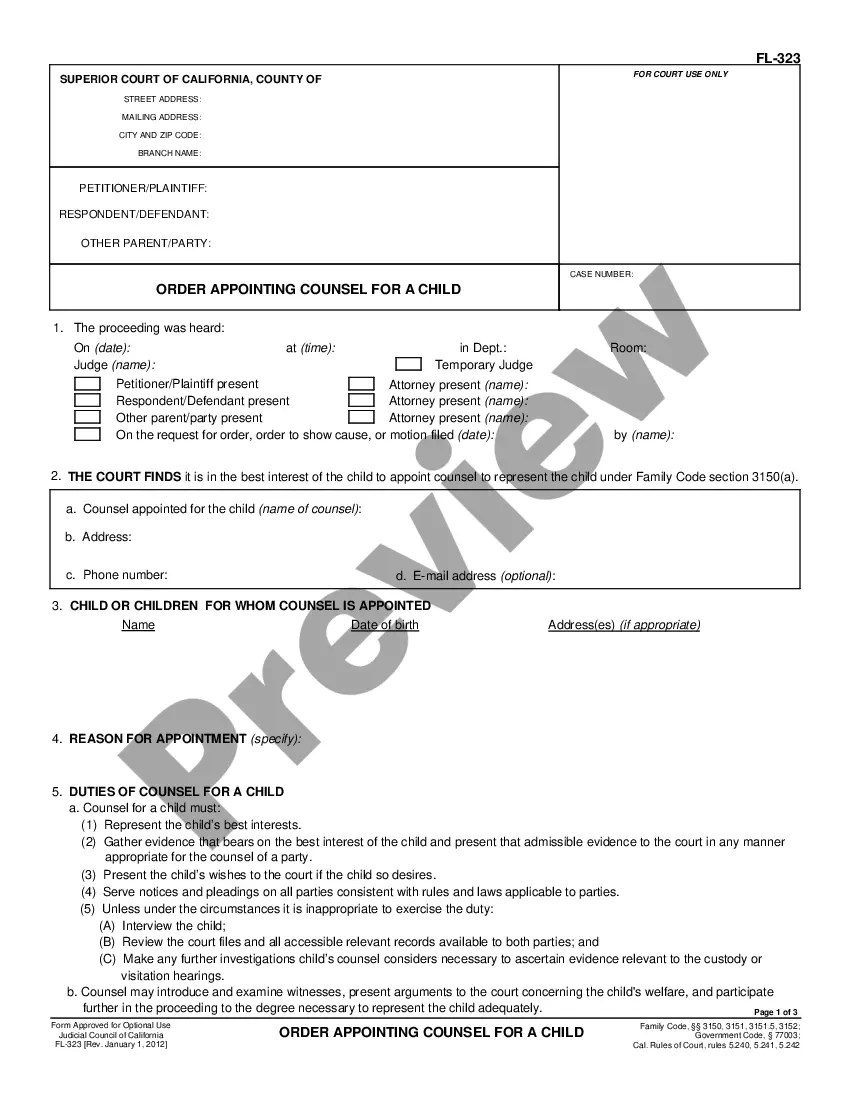

This is an official California Judicial Council family law form, which may be used in domestic litigation in California. Enter the information as indicated on the form and file with the court as appropriate.

Bakersfield California Income Withholding for Support — Instructions are guidelines provided by the County of Bakersfield, California, for employers on how to enforce income withholding for child or spousal support. These instructions aim to ensure that support payments are withheld from the employee's income and properly distributed to the designated recipient. The Bakersfield California Income Withholding for Support — Instructions cover various aspects, including the legal obligations of employers, the process of setting up income withholding, and the necessary forms to be completed. Employers play a crucial role in facilitating this process and ensuring compliance with court-ordered support payments. Here are a few types of Bakersfield California Income Withholding for Support — Instructions: 1. Instructions for Employers: These instructions provide step-by-step guidance on how employers should implement the income withholding process. It explains the legal basis, requirements, and responsibilities of employers, such as calculating the amount to withhold, notifying employees, and remitting payments to the appropriate agency. 2. Withholding Order Instructions: This type of instruction focuses on the process of obtaining an income withholding order from the court. It outlines the necessary steps, forms, and documents that employers and support recipients need to provide to initiate the income withholding process. 3. Electronic Payment Instructions: Some Bakersfield California Income Withholding for Support — Instructions may include information on electronic payment options. These instructions explain how employers can make support payments electronically, ensuring a faster and more efficient transfer of funds to the recipient. 4. Employer Reporting Instructions: These instructions specify the reporting requirements of employers once income withholding are in effect. Employers may need to provide reports to the appropriate child support agency, detailing the amount withheld, the employee's earnings, and other relevant information necessary for proper record-keeping and monitoring. Overall, Bakersfield California Income Withholding for Support — Instructions serve as a comprehensive resource for employers, ensuring that child or spousal support payments are consistently and accurately processed. Following these instructions and fulfilling their obligations helps maintain a smooth and efficient income withholding system, ultimately benefiting the well-being of supported families in Bakersfield, California.Bakersfield California Income Withholding for Support — Instructions are guidelines provided by the County of Bakersfield, California, for employers on how to enforce income withholding for child or spousal support. These instructions aim to ensure that support payments are withheld from the employee's income and properly distributed to the designated recipient. The Bakersfield California Income Withholding for Support — Instructions cover various aspects, including the legal obligations of employers, the process of setting up income withholding, and the necessary forms to be completed. Employers play a crucial role in facilitating this process and ensuring compliance with court-ordered support payments. Here are a few types of Bakersfield California Income Withholding for Support — Instructions: 1. Instructions for Employers: These instructions provide step-by-step guidance on how employers should implement the income withholding process. It explains the legal basis, requirements, and responsibilities of employers, such as calculating the amount to withhold, notifying employees, and remitting payments to the appropriate agency. 2. Withholding Order Instructions: This type of instruction focuses on the process of obtaining an income withholding order from the court. It outlines the necessary steps, forms, and documents that employers and support recipients need to provide to initiate the income withholding process. 3. Electronic Payment Instructions: Some Bakersfield California Income Withholding for Support — Instructions may include information on electronic payment options. These instructions explain how employers can make support payments electronically, ensuring a faster and more efficient transfer of funds to the recipient. 4. Employer Reporting Instructions: These instructions specify the reporting requirements of employers once income withholding are in effect. Employers may need to provide reports to the appropriate child support agency, detailing the amount withheld, the employee's earnings, and other relevant information necessary for proper record-keeping and monitoring. Overall, Bakersfield California Income Withholding for Support — Instructions serve as a comprehensive resource for employers, ensuring that child or spousal support payments are consistently and accurately processed. Following these instructions and fulfilling their obligations helps maintain a smooth and efficient income withholding system, ultimately benefiting the well-being of supported families in Bakersfield, California.