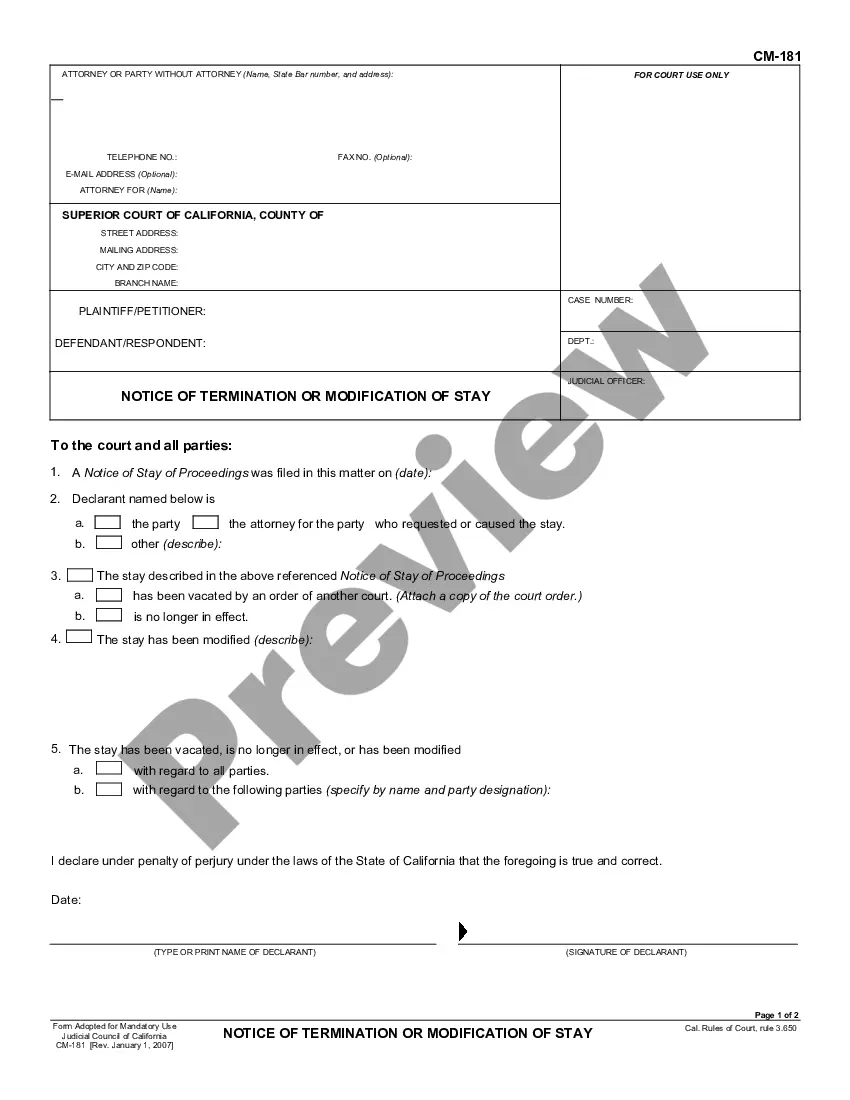

This is an official California Judicial Council family law form, which may be used in domestic litigation in California. Enter the information as indicated on the form and file with the court as appropriate.

Corona California Income Withholding for Support — Instructions is a document that provides detailed guidelines and information about the process of income withholding for child or spousal support in Corona, California. This legal procedure ensures that support payments are deducted directly from the obliged's income and disbursed to the recipient. The Corona California Income Withholding for Support — Instructions include step-by-step instructions on how to initiate and manage income withholding for support. Here are some key points covered in these instructions: 1. Purpose: These instructions aim to assist individuals involved in child or spousal support cases in Corona, California who need to establish income withholding as a means of consistent and timely support payments. 2. Initiating the Process: The instructions provide information on how to start the income withholding process, including the necessary forms to be completed, such as the Income Withholding for Support Order and Employer's Acknowledgment. 3. Parties Involved: The document explains the roles and responsibilities of the parties involved in the income withholding process, such as the obliged (the person responsible for paying support), the obliged (the person receiving support), and the employer (the entity responsible for deducting and remitting the support payments). 4. Employer Obligations: The instructions outline the obligations of the employer in implementing income withholding, including the frequency and method of remitting the support payments, handling arbitrages, and providing necessary notifications to all parties involved. 5. Calculating Support Amount: The document may include guidelines on how to calculate the appropriate amount to be withheld from the obliged's income, taking into account factors such as the support order, income deductions, and applicable state laws or guidelines. It's important to note that the specific instructions for Corona California Income Withholding for Support may vary depending on the circumstances or jurisdiction. Additional instructions or variations of the process may exist for situations like modifications to the support order, requesting exemptions, or handling self-employment income. Always refer to the official documentation provided by the Corona, California Child Support Services Department or consult with a legal professional for accurate and up-to-date guidance.