This is an official California Judicial Council family law form, which may be used in domestic litigation in California. Enter the information as indicated on the form and file with the court as appropriate.

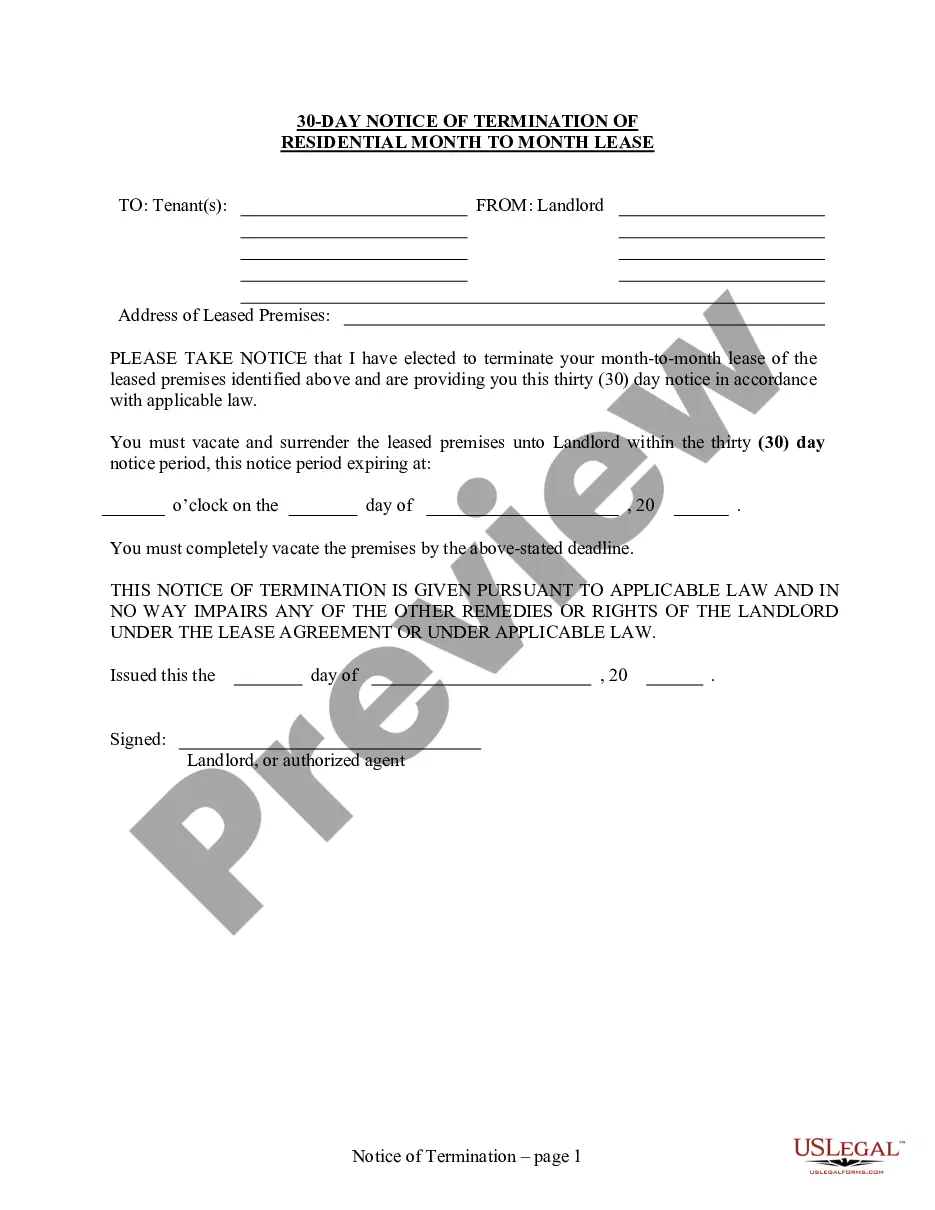

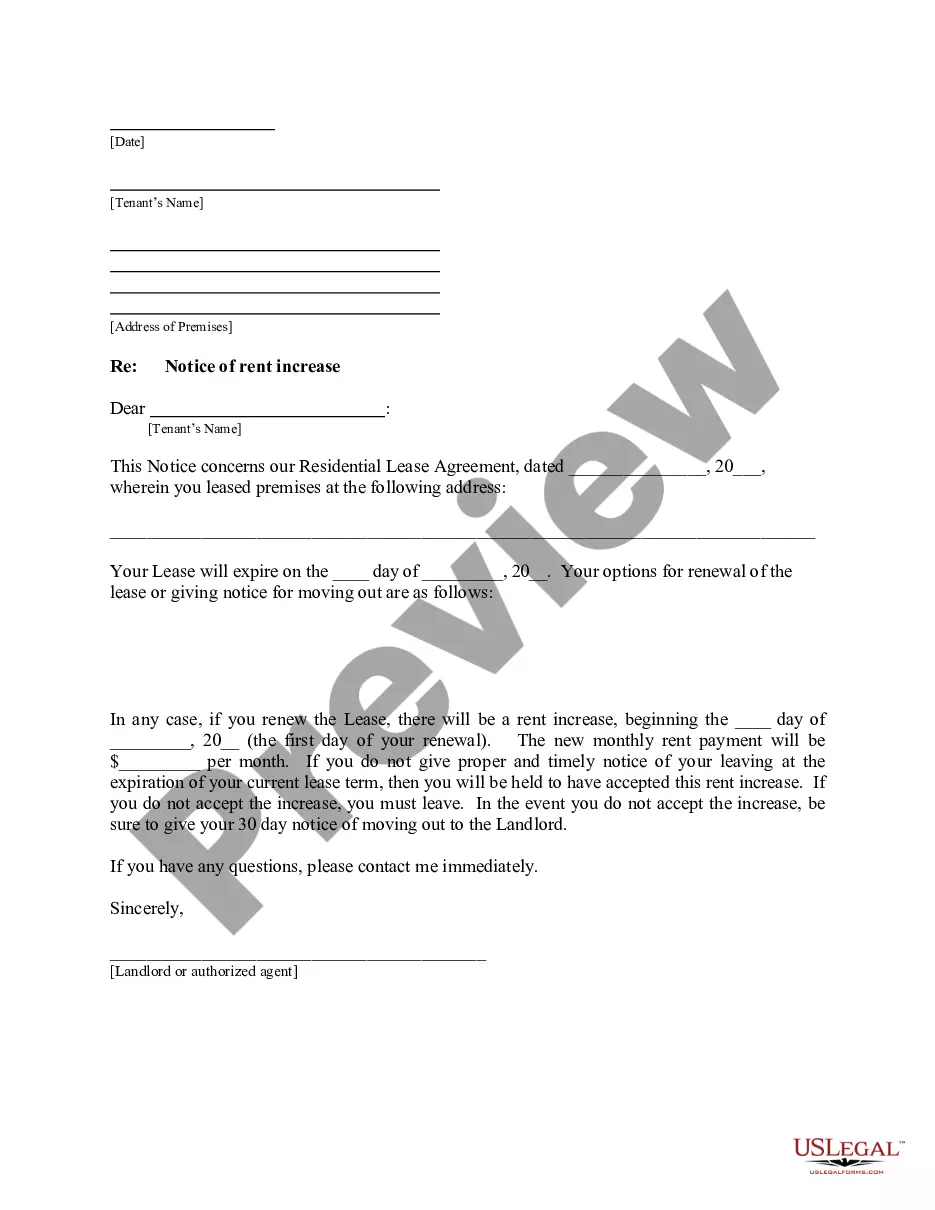

Jurupa Valley California Income Withholding for Support — Instructions provide a comprehensive guide on how to effectively enforce child support payments in the city of Jurupa Valley, California. This process is crucial in ensuring financial stability and well-being for children. The main objective of Jurupa Valley California Income Withholding for Support is to guarantee that child support payments are deducted from the income of the noncustodial parent in a timely manner. By following these instructions, both custodial and noncustodial parents can understand the process and its associated requirements. Here are the key steps involved in the Jurupa Valley California Income Withholding for Support process: 1. Determination of Support Obligation: The initial step is to determine the appropriate amount of child support required by using the guidelines established by the state of California. The amount is based on factors such as the noncustodial parent's income, the number of children involved, and any special circumstances. 2. Serving a Notice: Once the support obligation is determined, a notice is served to the noncustodial parent's employer. This notice informs the employer about their legal responsibilities and outlines the amount to be withheld from the employee's income. The notice also includes essential details like the effective date and the duration of the income withholding order. 3. Employer Obligations: Employers play a vital role in the income withholding process. They are required to deduct the specified amount from the noncustodial parent's income and remit it to the appropriate agency. Instructions are provided on how employers should handle these deductions, including the timelines for payment and reporting. 4. Income Withholding Order Modifications: In some cases, modifications to the income withholding order may be necessary due to changes in the support obligation or the employment status of the noncustodial parent. These instructions guide both parents on how to request modifications and the required documentation to support these requests. Different types of Jurupa Valley California Income Withholding for Support instructions may exist based on specific circumstances. These may include: 1. Initial Income Withholding: Instructions for initiating income withholding for the first time, typically when a child support order is established or modified. 2. Out-of-State Income Withholding: Instructions for cases where the noncustodial parent resides outside of California but works for an employer within the state. These instructions address the necessary steps to enforce income withholding across state lines. 3. Notice of Termination: Instructions for both the custodial parent and the noncustodial parent on how to proceed with suspending or terminating income withholding when it is no longer required. By following the Jurupa Valley California Income Withholding for Support — Instructions, parents can ensure that child support obligations are met consistently, ensuring the well-being of their children.