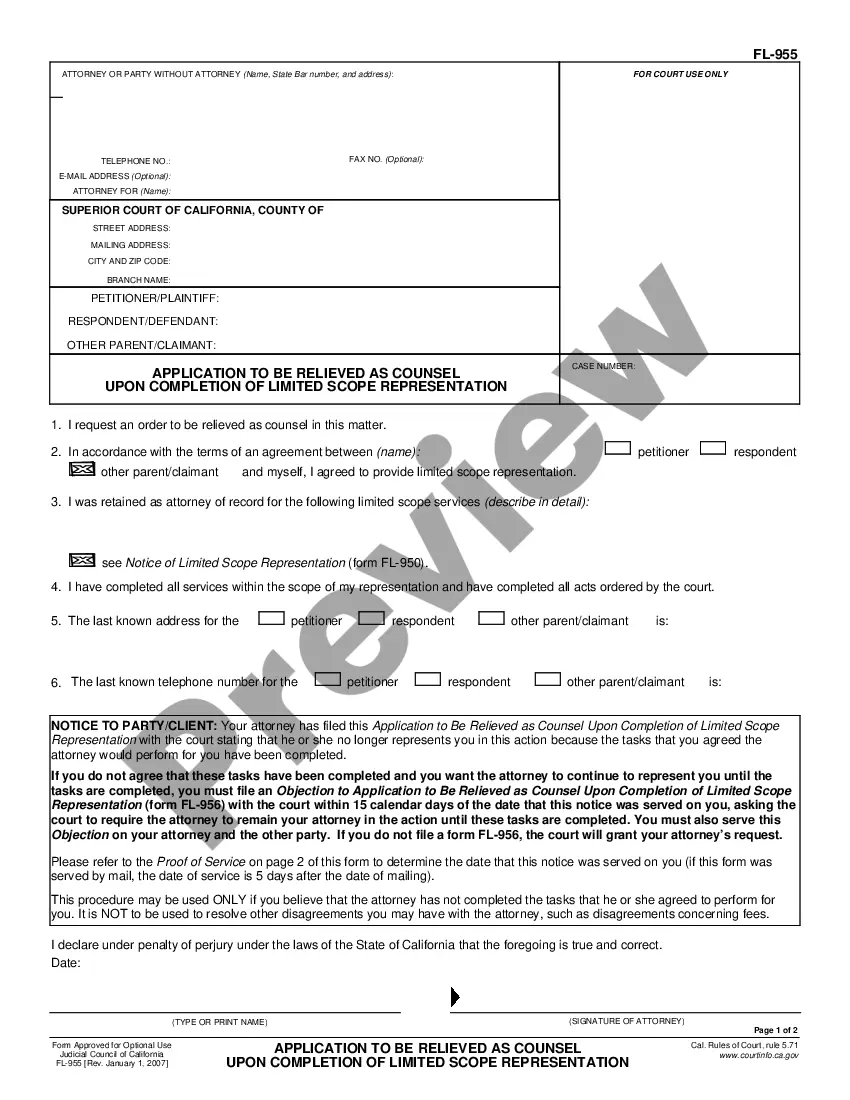

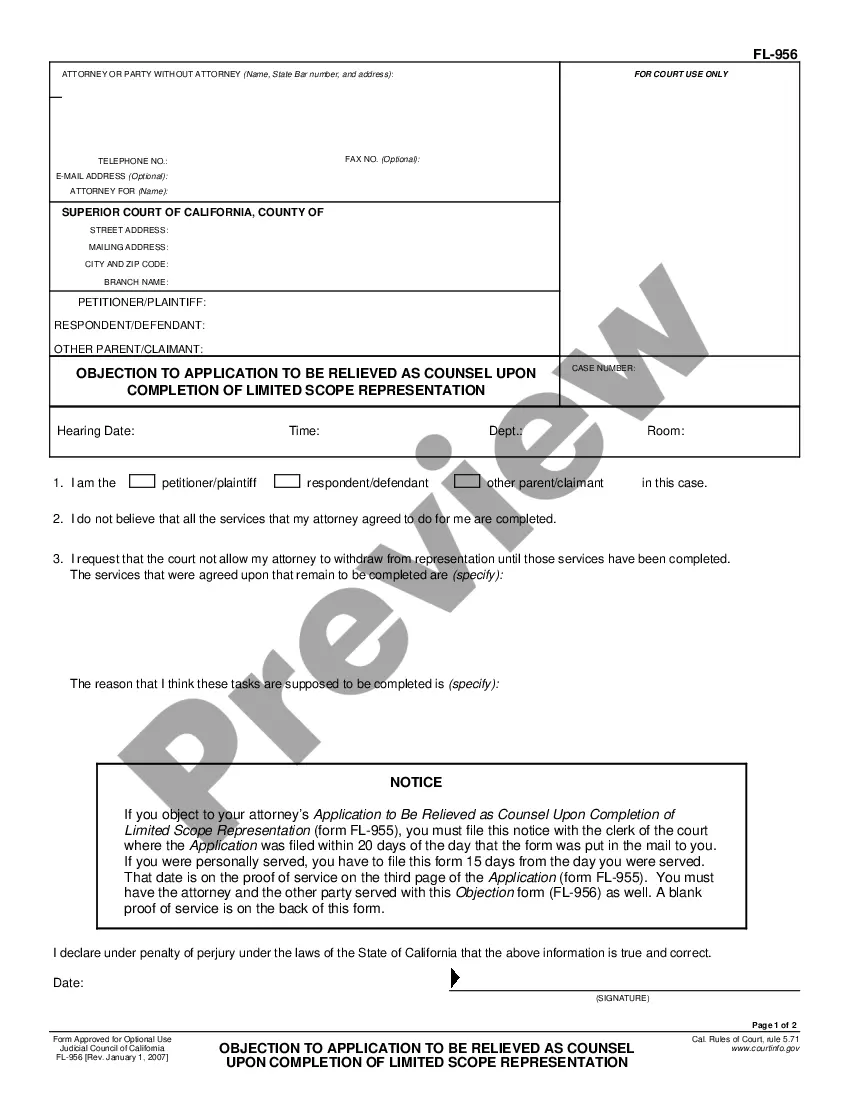

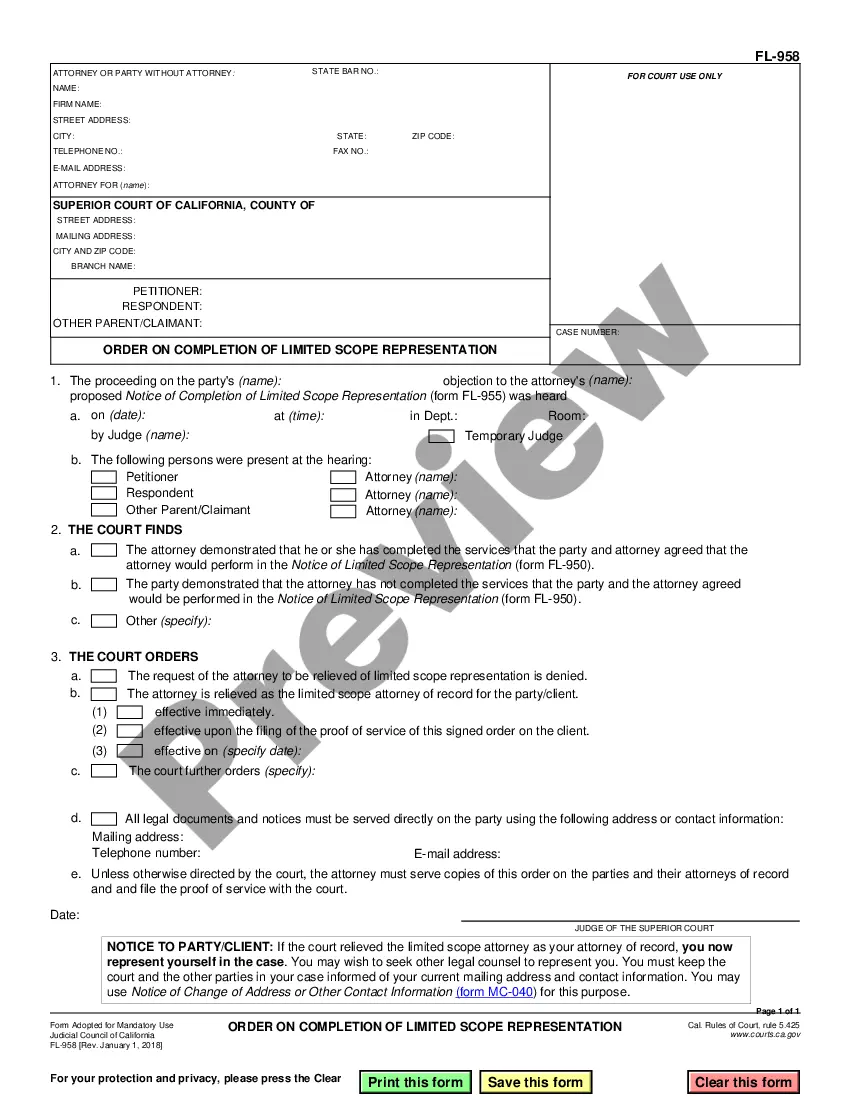

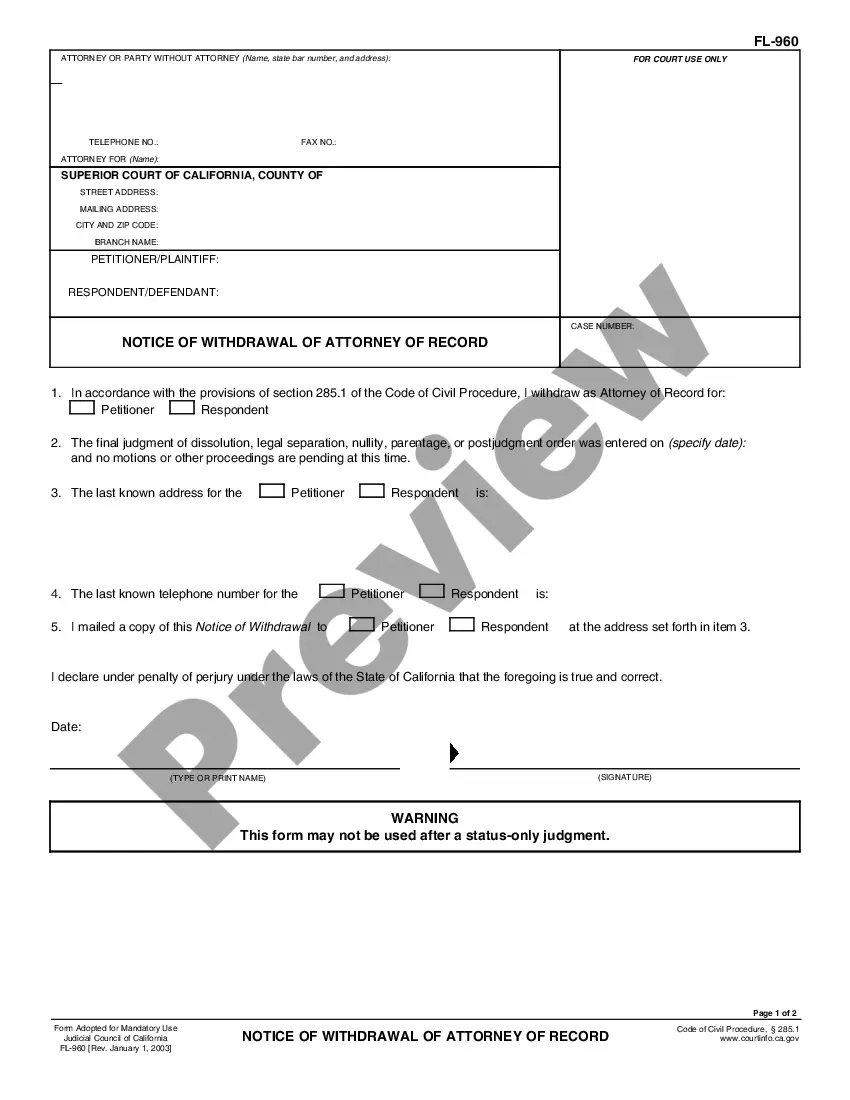

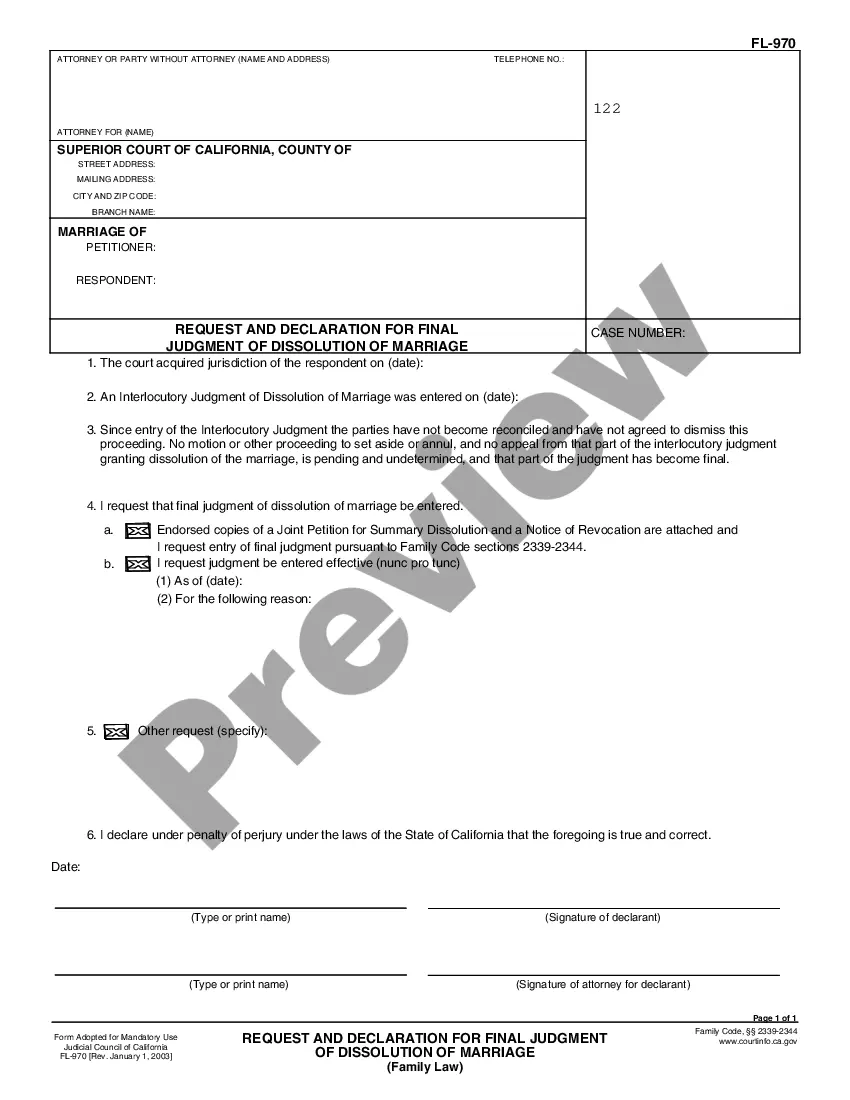

This is an official form from the California Judicial Council, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by California statutes and law.

The Bakersfield California Retirement Plan Joiner — Information Sheet is a document that provides detailed information about retirement plans in Bakersfield, California. It is designed to assist individuals who are considering joining a retirement plan or are already enrolled in one in Bakersfield. This information sheet aims to educate individuals on the various aspects and benefits of retirement plans available in the local area. There are a few different types of Bakersfield California Retirement Plan Joiner — Information Sheets, each tailored to specific retirement plans: 1. Public Employees Retirement System (PEERS) Joiner — Information Sheet: This information sheet focuses on retirement plans available to public employees in Bakersfield, such as government workers, educators, and other public servants. It outlines the specific benefits, contribution options, and eligibility criteria for these retirement plans. 2. Private Sector Retirement Plan Joiner — Information Sheet: This information sheet caters to individuals working in the private sector in Bakersfield. It provides an overview of retirement plans offered by various private sector employers, explaining the different contribution options, vesting schedules, and potential employer matching programs. 3. Individual Retirement Account (IRA) Joiner — Information Sheet: This information sheet addresses retirement plans for individuals who may not have access to employer-sponsored plans or are self-employed. It explains the benefits and contribution limits of opening an IRA account in Bakersfield, along with the tax advantages and investment options available. The Bakersfield California Retirement Plan Joiner — Information Sheet covers essential topics such as plan eligibility, contribution limits, investment options, beneficiary designation, and potential tax implications. It also includes information on how to calculate retirement income, retirement benefits, and resources for additional support. By offering these detailed information sheets, individuals in Bakersfield can make informed decisions about their retirement plans. Whether they are public employees, private sector workers, or self-employed individuals, they can gain knowledge about the specific retirement plan options available to them and how to maximize their retirement savings in Bakersfield, California.The Bakersfield California Retirement Plan Joiner — Information Sheet is a document that provides detailed information about retirement plans in Bakersfield, California. It is designed to assist individuals who are considering joining a retirement plan or are already enrolled in one in Bakersfield. This information sheet aims to educate individuals on the various aspects and benefits of retirement plans available in the local area. There are a few different types of Bakersfield California Retirement Plan Joiner — Information Sheets, each tailored to specific retirement plans: 1. Public Employees Retirement System (PEERS) Joiner — Information Sheet: This information sheet focuses on retirement plans available to public employees in Bakersfield, such as government workers, educators, and other public servants. It outlines the specific benefits, contribution options, and eligibility criteria for these retirement plans. 2. Private Sector Retirement Plan Joiner — Information Sheet: This information sheet caters to individuals working in the private sector in Bakersfield. It provides an overview of retirement plans offered by various private sector employers, explaining the different contribution options, vesting schedules, and potential employer matching programs. 3. Individual Retirement Account (IRA) Joiner — Information Sheet: This information sheet addresses retirement plans for individuals who may not have access to employer-sponsored plans or are self-employed. It explains the benefits and contribution limits of opening an IRA account in Bakersfield, along with the tax advantages and investment options available. The Bakersfield California Retirement Plan Joiner — Information Sheet covers essential topics such as plan eligibility, contribution limits, investment options, beneficiary designation, and potential tax implications. It also includes information on how to calculate retirement income, retirement benefits, and resources for additional support. By offering these detailed information sheets, individuals in Bakersfield can make informed decisions about their retirement plans. Whether they are public employees, private sector workers, or self-employed individuals, they can gain knowledge about the specific retirement plan options available to them and how to maximize their retirement savings in Bakersfield, California.