This form is used in child support matters to document the income of the parent required to pay child support. This information is gathered to calculate the correct amount of support.

San Bernardino California Declaration of Obligor's Income During Judgment Period - Presumed Income Set - Aside

State:

California

County:

San Bernardino

Control #:

CA-FL-643

Format:

PDF

Instant download

Public form

Description

How to fill out California Declaration Of Obligor's Income During Judgment Period - Presumed Income Set - Aside?

Locating validated templates tailored to your regional regulations can be difficult unless you access the US Legal Forms library.

This is an online resource comprising over 85,000 legal documents for both personal and professional requirements and any real-world scenarios.

All the forms are appropriately categorized by usage area and jurisdictional divisions, making the retrieval of the San Bernardino California Declaration of Obligor's Income During Judgment Period - Presumed Income Set - Aside as swift and straightforward as 1-2-3.

Purchase the document. Click on the Buy Now button and choose the subscription option that you desire. You will need to create an account to gain access to the library’s offerings.

- For those already familiar with our platform and have utilized it previously, acquiring the San Bernardino California Declaration of Obligor's Income During Judgment Period - Presumed Income Set - Aside only requires a few clicks.

- All you need to do is sign in to your account, select the document, and click Download to store it on your device.

- This procedure will involve just a few extra steps for new users.

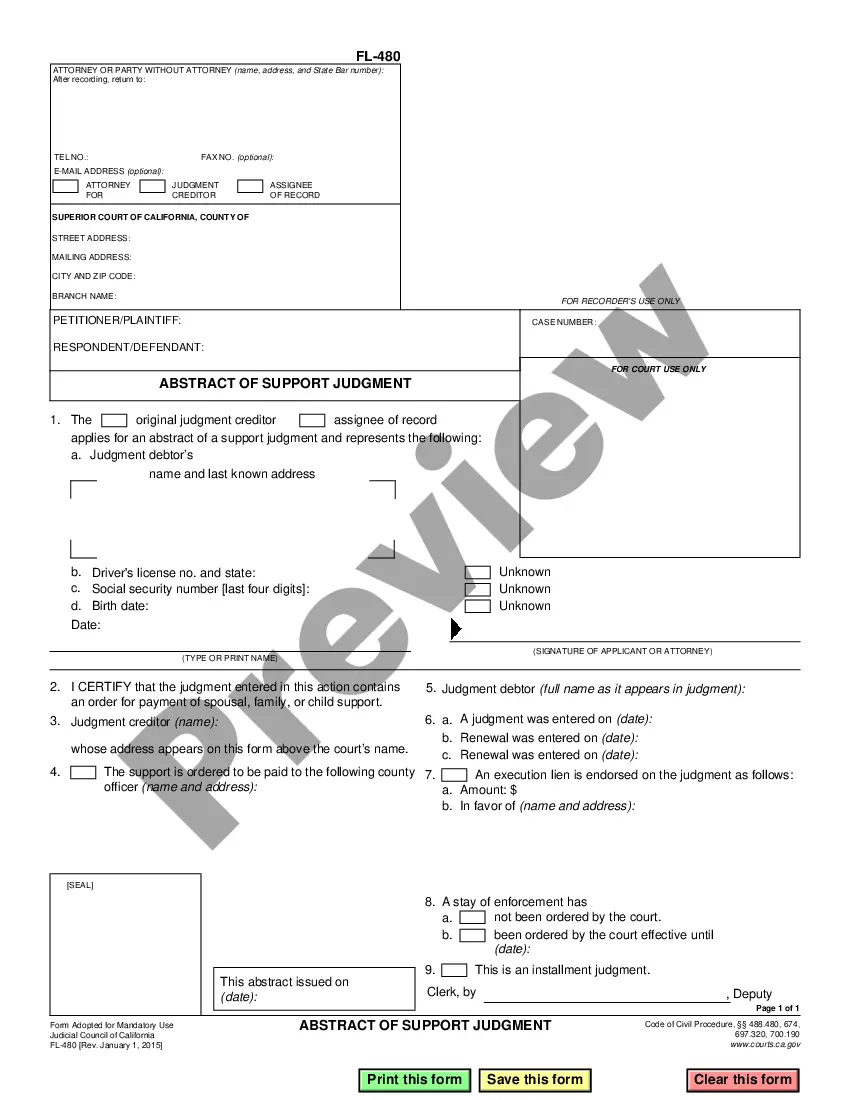

- Examine the Preview mode and form description. Ensure you've selected the correct document that aligns with your needs and fully complies with your local jurisdiction's requirements.

- Look for another template if necessary. If you notice any discrepancies, use the Search tab above to find the appropriate one. If it fits your needs, proceed to the next stage.