This is an official California Judicial Council family law form, which may be used in domestic litigation in California. Enter the information as indicated on the form and file with the court as appropriate.

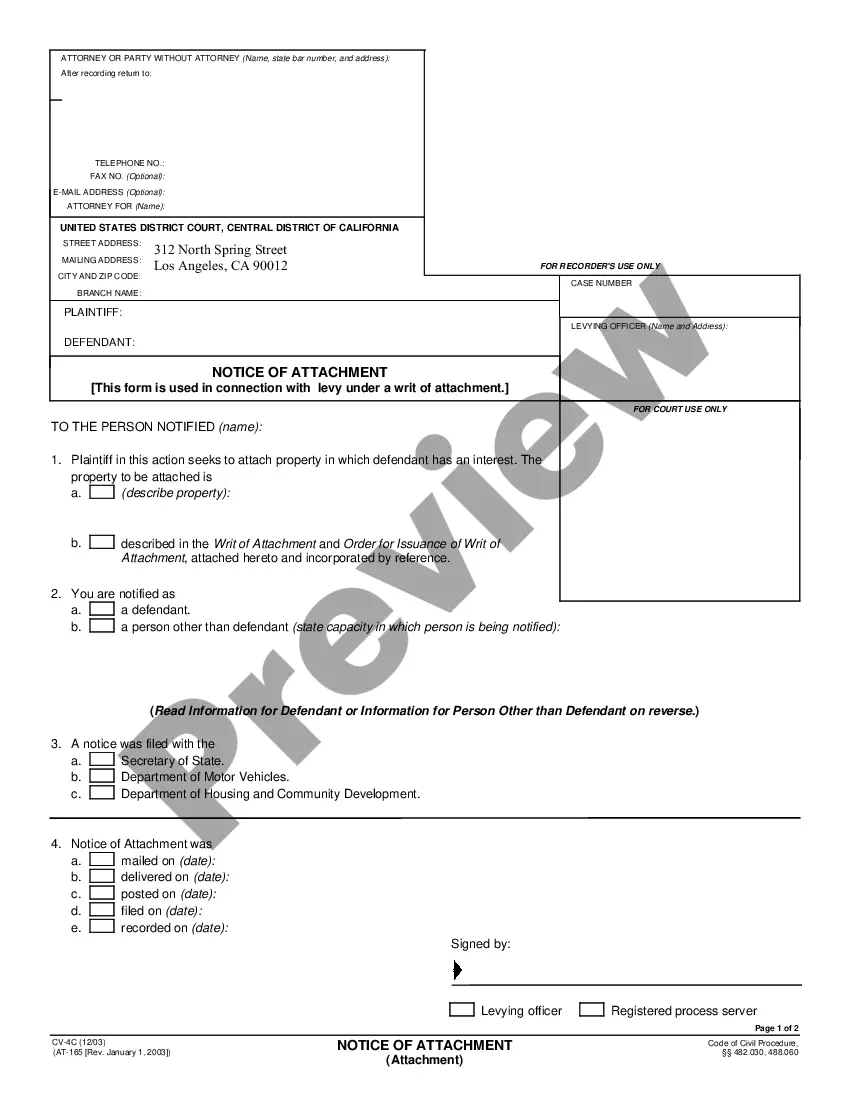

Simi Valley, California Order Determining Claim of Exemption or Third-Party Claim Governmental is a legal process that can arise in certain cases where a debtor claims that certain properties or funds are exempt from being used to satisfy a judgment or claim. This process, typically overseen by a court, involves analyzing the validity of the claimed exemptions and determining the proper course of action. In Simi Valley, California, there are two main types of Orders Determining Claim of Exemption or Third-Party Claim Governmental: 1. Order Determining Claim of Exemption: In this type of order, a debtor claims that certain assets or funds are exempt from being taken by a creditor to satisfy a judgment. Exemptions can be claimed for various reasons, such as being necessary for basic needs like housing or transportation or being protected under specific state or federal laws. The court then evaluates the claimed exemptions, considering relevant factors and evidence, to determine if the debtor is entitled to keep the property or funds. 2. Third-Party Claim Governmental: This type of order involves a third party claiming an interest in certain assets or funds that the debtor possesses. The third party, which can be a government agency or an individual or entity with a valid legal interest, asserts their right to the property or funds as it may be subject to a claim or judgment against the debtor. The court assesses the validity of the third-party claim and determines the appropriate actions to ensure fair treatment of all parties involved. To obtain a Simi Valley, California Order Determining Claim of Exemption or Third-Party Claim Governmental, various steps need to be followed. The debtor or the third party making the claim must first file a motion or application with the court, clearly stating their reasons and providing supporting documentation. This initiates the legal proceedings and prompts the court to review the case. The court then schedules a hearing where all parties have the opportunity to present their arguments and evidence. Based on the presented information, the court makes a decision, issuing an order that either approves or denies the claimed exemptions or third-party claims. It's important to consult an attorney familiar with Simi Valley, California laws and regulations regarding Orders Determining Claim of Exemption or Third-Party Claim Governmental to navigate this legal process effectively. Legal expertise can help ensure the proper claims are made, required documents are provided, and arguments are presented persuasively to maximize the chances of a successful outcome in this complex area of law.