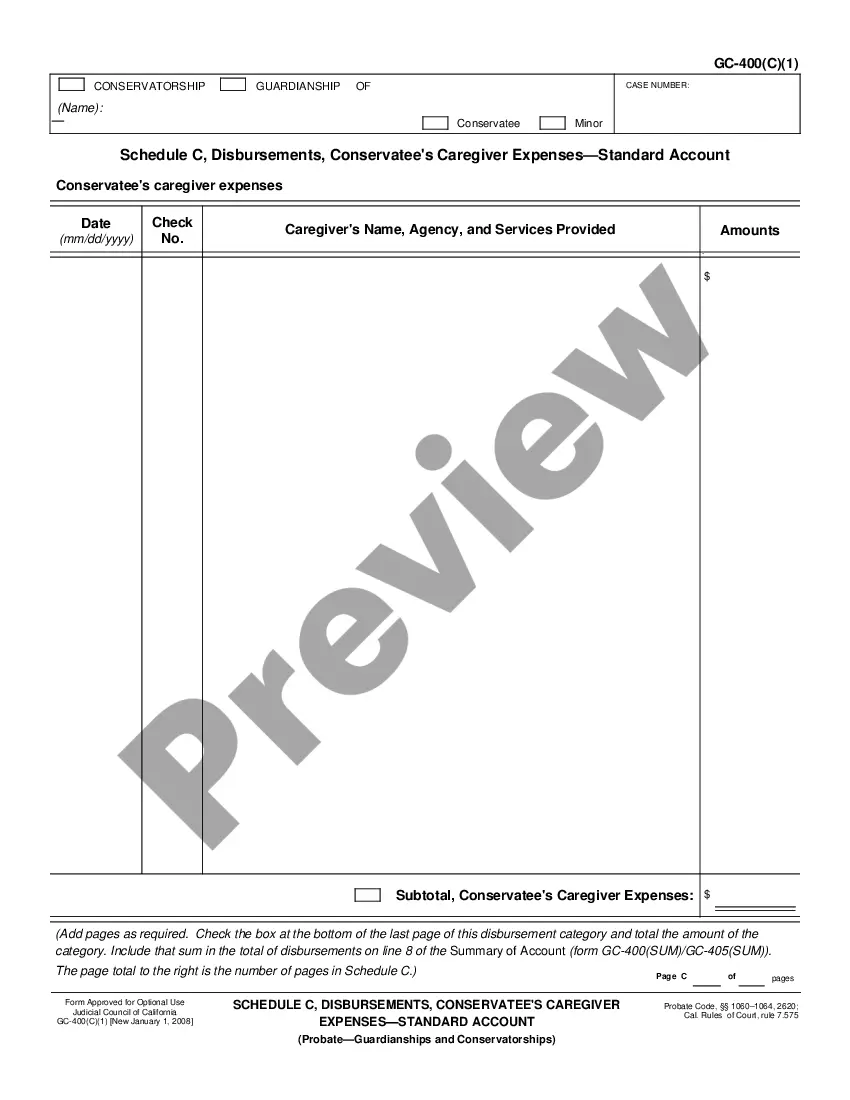

This is an official California Judicial Council family law form, which may be used in domestic litigation in California. Enter the information as indicated on the form and file with the court as appropriate.

Vista California Order Determining Claim of Exemption or Third-Party Claim Governmental is a legal process that aims to protect individuals and entities from having their property seized or wages garnished by creditors. This order is specifically designed for situations where a debtor claims exemptions or a third party claims that the property in question is exempt from seizure. In Vista California, there are two main types of orders associated with exemptions and third-party claims: 1. Order Determining Claim of Exemption: This order is issued by the court after a debtor files a claim of exemption to protect their property from being taken to satisfy a debt. The debtor must provide enough evidence to demonstrate that the property they are seeking exemption for falls within the allowed categories. These categories typically include necessary household items, certain personal belongings, and wages essential for sustenance. The court will review the evidence provided and make a determination on whether the claimed property is exempt from seizure. 2. Third-Party Claim Governmental: In certain cases, a third party may lay claim to the property in question, arguing that it belongs to them and not the debtor. This often occurs when the debtor has transferred ownership of the property to someone else, such as a family member or a business entity, in an attempt to shield it from creditors. If such a third-party claim is made, the court will assess the validity of the claim and decide whether the property should be considered exempt from seizure or subject to collection to satisfy the debt. Both types of orders referred to as Vista California Order Determining Claim of Exemption or Third-Party Claim Governmental play a critical role in preventing unjust seizures or garnishments. They allow debtors and third parties to assert their rights and provide evidence supporting their claims. By carefully considering the specific circumstances of each case, the court ensures a fair and impartial judgment, safeguarding the interests of both debtors and creditors in the Vista California area.