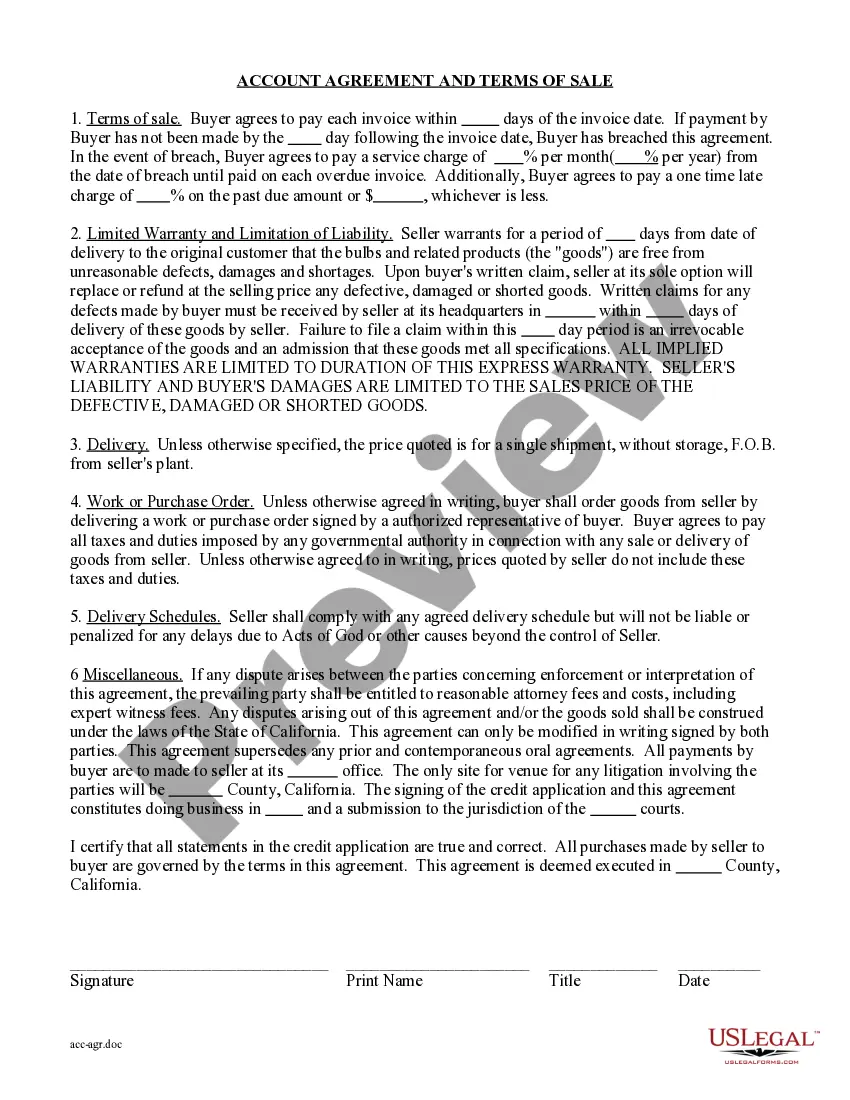

Account Agreement; Terms of Sale: This is an agreement between the Buyer and Seller. It lists, in detail, every element concerning the sale and purchase of the property in question. In particular, the duties of each party are defined, and a description of the property to be sold is included. This form is available in both Word and Rich Text formats.

Title: Understanding Murrieta California Account Agreement and Terms of Sale: A Comprehensive Overview Introduction: The Murrieta California Account Agreement and Terms of Sale provide crucial information to individuals and businesses engaging in financial transactions within the city. To provide a clear understanding, this article will delve into the specifics of these agreements, highlighting their types and components. 1. Murrieta California Account Agreement: The Murrieta California Account Agreement refers to a legally binding contract established between a financial institution and an account holder. This agreement outlines the terms and conditions governing various financial services, including but not limited to: — Deposit accounts: Covers terms regarding minimum deposits, interest rates, fees, withdrawals, overdraft protection, and account closure procedures. — Checking accounts: Specifies guidelines related to check clearing, debit card usage, online and mobile banking features, and related services. — Savings accounts: Describes the terms of interest accrual, account maintenance requirements, withdrawal limitations, and any related perks or benefits. — Certificates of deposit (CDs): Outlines the specifics of CD terms, such as duration, early withdrawal penalties, interest rates, renewal or rollover options, and maturity details. 2. Murrieta California Terms of Sale: The Murrieta California Terms of Sale are agreements that facilitate the purchase or sale of goods and services within the jurisdiction. These terms ensure transparent business transactions by defining crucial aspects such as: — Product specifications: Provides a detailed description of the goods or services involved, including features, quantity, quality standards, and any applicable warranties or guarantees. — Pricing and payment terms: Specifies the agreed-upon prices, applicable taxes, payment methods, installment options, and potential penalties or discounts related to late or missed payments. — Delivery and shipping: Outlines the terms concerning order fulfillment, shipping options, responsibilities of the seller and buyer, insurance coverage, and delivery timelines. — Dispute resolution: Defines the procedures to follow in case of conflicts or disagreements between the parties involved, including arbitration or mediation clauses to settle disputes amicably. — Refunds and returns: Clarifies the conditions under which refunds or exchanges are possible, outlining any applicable restocking fees, time limits, and warranty terms. Conclusion: Understanding the Murrieta California Account Agreement and Terms of Sale is essential for individuals and businesses engaging in financial activities within the jurisdiction. Whether it pertains to account management, deposits, withdrawals, or purchasing goods and services, being aware of the specific terms and conditions is crucial for a smooth and transparent transaction process.Title: Understanding Murrieta California Account Agreement and Terms of Sale: A Comprehensive Overview Introduction: The Murrieta California Account Agreement and Terms of Sale provide crucial information to individuals and businesses engaging in financial transactions within the city. To provide a clear understanding, this article will delve into the specifics of these agreements, highlighting their types and components. 1. Murrieta California Account Agreement: The Murrieta California Account Agreement refers to a legally binding contract established between a financial institution and an account holder. This agreement outlines the terms and conditions governing various financial services, including but not limited to: — Deposit accounts: Covers terms regarding minimum deposits, interest rates, fees, withdrawals, overdraft protection, and account closure procedures. — Checking accounts: Specifies guidelines related to check clearing, debit card usage, online and mobile banking features, and related services. — Savings accounts: Describes the terms of interest accrual, account maintenance requirements, withdrawal limitations, and any related perks or benefits. — Certificates of deposit (CDs): Outlines the specifics of CD terms, such as duration, early withdrawal penalties, interest rates, renewal or rollover options, and maturity details. 2. Murrieta California Terms of Sale: The Murrieta California Terms of Sale are agreements that facilitate the purchase or sale of goods and services within the jurisdiction. These terms ensure transparent business transactions by defining crucial aspects such as: — Product specifications: Provides a detailed description of the goods or services involved, including features, quantity, quality standards, and any applicable warranties or guarantees. — Pricing and payment terms: Specifies the agreed-upon prices, applicable taxes, payment methods, installment options, and potential penalties or discounts related to late or missed payments. — Delivery and shipping: Outlines the terms concerning order fulfillment, shipping options, responsibilities of the seller and buyer, insurance coverage, and delivery timelines. — Dispute resolution: Defines the procedures to follow in case of conflicts or disagreements between the parties involved, including arbitration or mediation clauses to settle disputes amicably. — Refunds and returns: Clarifies the conditions under which refunds or exchanges are possible, outlining any applicable restocking fees, time limits, and warranty terms. Conclusion: Understanding the Murrieta California Account Agreement and Terms of Sale is essential for individuals and businesses engaging in financial activities within the jurisdiction. Whether it pertains to account management, deposits, withdrawals, or purchasing goods and services, being aware of the specific terms and conditions is crucial for a smooth and transparent transaction process.