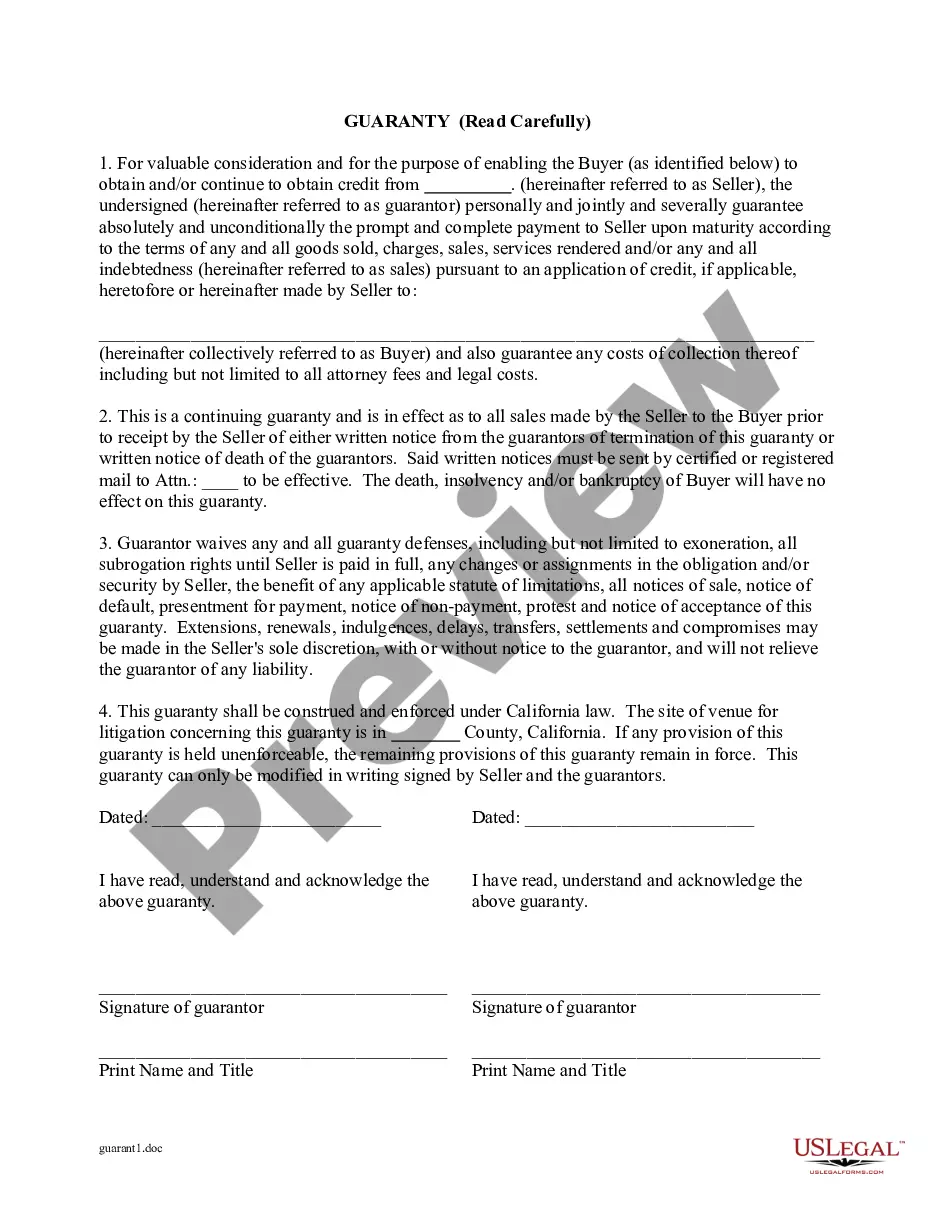

For valuable consideration and for the purpose of enabling the buyer to obtain and/or continue to obtain credit from the seller,the guarantor, personally, jointly and severally guarantee absolutely and unconditionally the prompt and complete payment to the seller upon maturity according to the terms of any and all goods sold, charges, sales, services rendered and/or any and all indebtedness pursuant to an application of credit.

Corona California Guaranty of Payment of Open Account is a legal document that serves as a financial protection agreement between a creditor and debtor. This agreement ensures that any outstanding debts or open accounts will be guaranteed and paid by a third party known as the guarantor. Terms and conditions may vary depending on the type of guaranty being used. There are primarily two types of Corona California Guaranty of Payment of Open Account: 1. Absolute Guaranty of Payment of Open Account: This type of guaranty holds the guarantor fully responsible for the payment of the open account or debt in case the debtor fails to fulfill their financial obligations. The creditor has the right to directly pursue the guarantor for any outstanding amounts owing. 2. Conditional Guaranty of Payment of Open Account: In this type of guaranty, the liability of the guarantor is limited to certain conditions or events. The guarantor's responsibility to pay arises only when specified conditions, such as default by the debtor, are met. This conditional guaranty provides the guarantor with some protection against unwarranted liability. When entering into a Corona California Guaranty of Payment of Open Account, it is crucial to include specific provisions to safeguard the interests of all parties involved. Some important elements to consider include: 1. Clear Identification of the Parties: The guaranty agreement should clearly state the names and contact information of the creditor, debtor, and guarantor. This ensures the legal enforceability of the agreement. 2. Obligations and Responsibilities: The document should outline the debtor's obligations to make timely payments on the open account and the guarantor's responsibility to guarantee those payments if the debtor defaults. 3. Guarantee Amount and Limitations: The guaranty agreement should specify the maximum amount for which the guarantor can be held responsible. This amount might be tied to the outstanding balance of the open account or set at a fixed value. 4. Notice and Demand: The agreement should include provisions for notification requirements such as when the creditor must provide notice to the guarantor in case of debtor default. It also establishes a set period within which the guarantor must respond. 5. Governing Law and Jurisdiction: It's important to mention the governing law and jurisdiction that will apply in the event of any legal disputes arising from the guaranty agreement. Overall, a Corona California Guaranty of Payment of Open Account provides protection and assurance for creditors, ensuring that they will receive payment if the debtor fails to fulfill their obligations. It is advisable for all parties involved to seek legal counsel to draft or review the agreement to ensure compliance with relevant laws and regulations.Corona California Guaranty of Payment of Open Account is a legal document that serves as a financial protection agreement between a creditor and debtor. This agreement ensures that any outstanding debts or open accounts will be guaranteed and paid by a third party known as the guarantor. Terms and conditions may vary depending on the type of guaranty being used. There are primarily two types of Corona California Guaranty of Payment of Open Account: 1. Absolute Guaranty of Payment of Open Account: This type of guaranty holds the guarantor fully responsible for the payment of the open account or debt in case the debtor fails to fulfill their financial obligations. The creditor has the right to directly pursue the guarantor for any outstanding amounts owing. 2. Conditional Guaranty of Payment of Open Account: In this type of guaranty, the liability of the guarantor is limited to certain conditions or events. The guarantor's responsibility to pay arises only when specified conditions, such as default by the debtor, are met. This conditional guaranty provides the guarantor with some protection against unwarranted liability. When entering into a Corona California Guaranty of Payment of Open Account, it is crucial to include specific provisions to safeguard the interests of all parties involved. Some important elements to consider include: 1. Clear Identification of the Parties: The guaranty agreement should clearly state the names and contact information of the creditor, debtor, and guarantor. This ensures the legal enforceability of the agreement. 2. Obligations and Responsibilities: The document should outline the debtor's obligations to make timely payments on the open account and the guarantor's responsibility to guarantee those payments if the debtor defaults. 3. Guarantee Amount and Limitations: The guaranty agreement should specify the maximum amount for which the guarantor can be held responsible. This amount might be tied to the outstanding balance of the open account or set at a fixed value. 4. Notice and Demand: The agreement should include provisions for notification requirements such as when the creditor must provide notice to the guarantor in case of debtor default. It also establishes a set period within which the guarantor must respond. 5. Governing Law and Jurisdiction: It's important to mention the governing law and jurisdiction that will apply in the event of any legal disputes arising from the guaranty agreement. Overall, a Corona California Guaranty of Payment of Open Account provides protection and assurance for creditors, ensuring that they will receive payment if the debtor fails to fulfill their obligations. It is advisable for all parties involved to seek legal counsel to draft or review the agreement to ensure compliance with relevant laws and regulations.