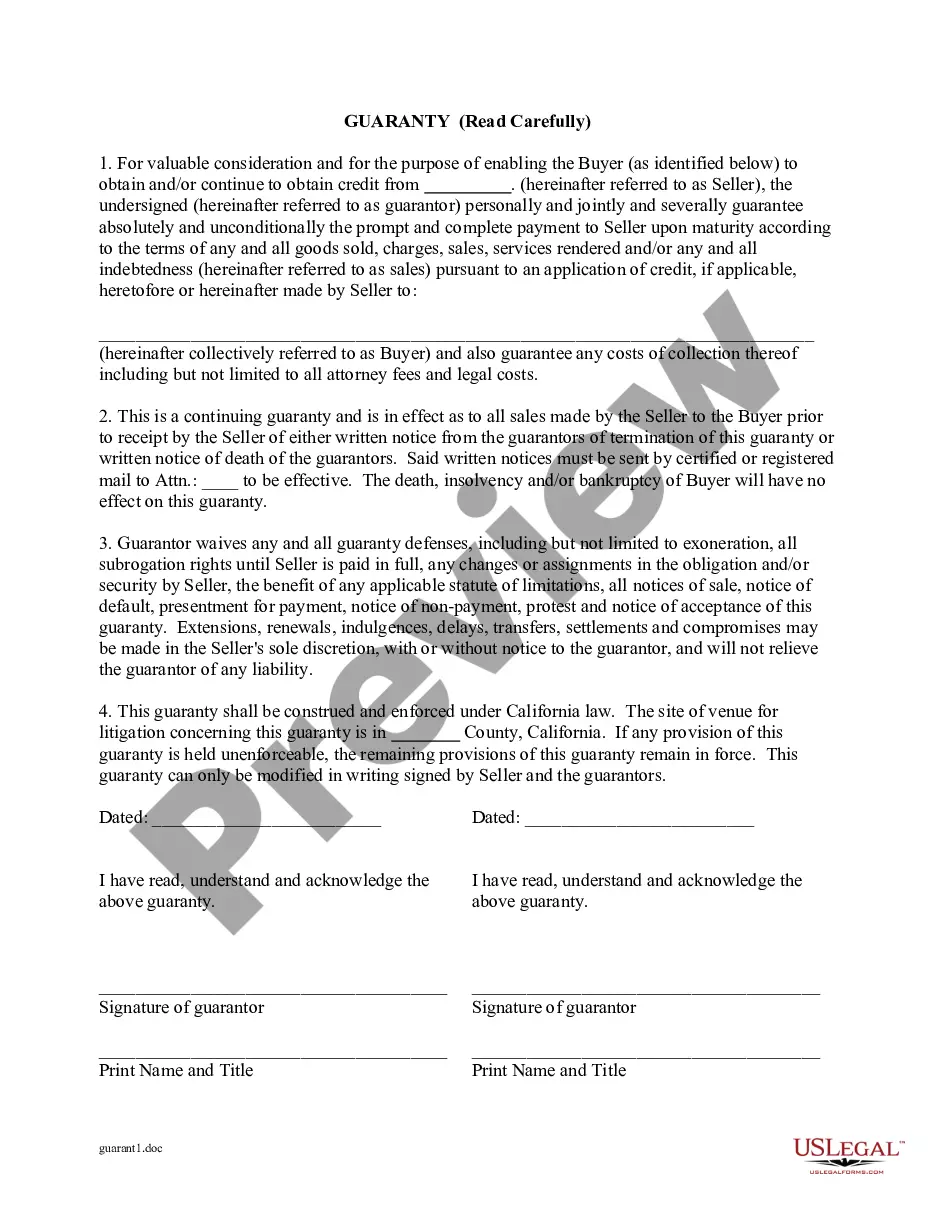

For valuable consideration and for the purpose of enabling the buyer to obtain and/or continue to obtain credit from the seller,the guarantor, personally, jointly and severally guarantee absolutely and unconditionally the prompt and complete payment to the seller upon maturity according to the terms of any and all goods sold, charges, sales, services rendered and/or any and all indebtedness pursuant to an application of credit.

The Downey California Guaranty of Payment of Open Account is a legally binding agreement that provides assurance and security between parties involved in a business transaction. It ensures that a guarantor will be responsible for the payment of an open account if the debtor defaults. This type of guaranty is commonly used in the business world, particularly in Downey, California, where it adds an extra layer of protection for creditors. By having a guarantor in place, businesses can minimize the risk of non-payment and secure their financial interests. There are different variations of the Downey California Guaranty of Payment of Open Account depending on the specific terms and conditions. These variations can customize the agreement to suit the unique needs of the creditors and debtors involved. Some commonly named types of Downey California Guaranty of Payment of Open Account include: 1. Limited Guaranty: This type of guaranty limits the guarantor's liability by specifying a maximum amount that they are responsible for. It allows the guarantor to have a cap on their financial obligations. 2. Unlimited Guaranty: In contrast to the limited guaranty, the unlimited guaranty holds the guarantor fully responsible for the entire open account balance. The guarantor's liability is not capped or restricted in any way. 3. Joint and Several guaranties: This type of guaranty involves multiple guarantors who are collectively responsible for the payment of the open account. In case one guarantor defaults, the remaining guarantors bear the burden of covering the outstanding balance. 4. Continuing Guaranty: A continuing guaranty is a long-term agreement that extends beyond a single transaction. It provides ongoing protection for future open accounts, ensuring that the guarantor remains liable for any debt incurred during a specific period. All of these variations of the Downey California Guaranty of Payment of Open Account are designed to protect the interests of both creditors and debtors. They serve as a valuable tool in fostering trust and ensuring financial stability in business transactions, particularly in Downey, California, where such agreements are widely utilized. In conclusion, the Downey California Guaranty of Payment of Open Account is a crucial legal document for businesses involved in open account transactions. It minimizes the risk of non-payment and secures the interests of creditors. The various types of this guaranty, including limited, unlimited, joint and several, and continuing guaranties, provide flexibility and customization options to suit the specific needs of the parties involved in the agreement.The Downey California Guaranty of Payment of Open Account is a legally binding agreement that provides assurance and security between parties involved in a business transaction. It ensures that a guarantor will be responsible for the payment of an open account if the debtor defaults. This type of guaranty is commonly used in the business world, particularly in Downey, California, where it adds an extra layer of protection for creditors. By having a guarantor in place, businesses can minimize the risk of non-payment and secure their financial interests. There are different variations of the Downey California Guaranty of Payment of Open Account depending on the specific terms and conditions. These variations can customize the agreement to suit the unique needs of the creditors and debtors involved. Some commonly named types of Downey California Guaranty of Payment of Open Account include: 1. Limited Guaranty: This type of guaranty limits the guarantor's liability by specifying a maximum amount that they are responsible for. It allows the guarantor to have a cap on their financial obligations. 2. Unlimited Guaranty: In contrast to the limited guaranty, the unlimited guaranty holds the guarantor fully responsible for the entire open account balance. The guarantor's liability is not capped or restricted in any way. 3. Joint and Several guaranties: This type of guaranty involves multiple guarantors who are collectively responsible for the payment of the open account. In case one guarantor defaults, the remaining guarantors bear the burden of covering the outstanding balance. 4. Continuing Guaranty: A continuing guaranty is a long-term agreement that extends beyond a single transaction. It provides ongoing protection for future open accounts, ensuring that the guarantor remains liable for any debt incurred during a specific period. All of these variations of the Downey California Guaranty of Payment of Open Account are designed to protect the interests of both creditors and debtors. They serve as a valuable tool in fostering trust and ensuring financial stability in business transactions, particularly in Downey, California, where such agreements are widely utilized. In conclusion, the Downey California Guaranty of Payment of Open Account is a crucial legal document for businesses involved in open account transactions. It minimizes the risk of non-payment and secures the interests of creditors. The various types of this guaranty, including limited, unlimited, joint and several, and continuing guaranties, provide flexibility and customization options to suit the specific needs of the parties involved in the agreement.