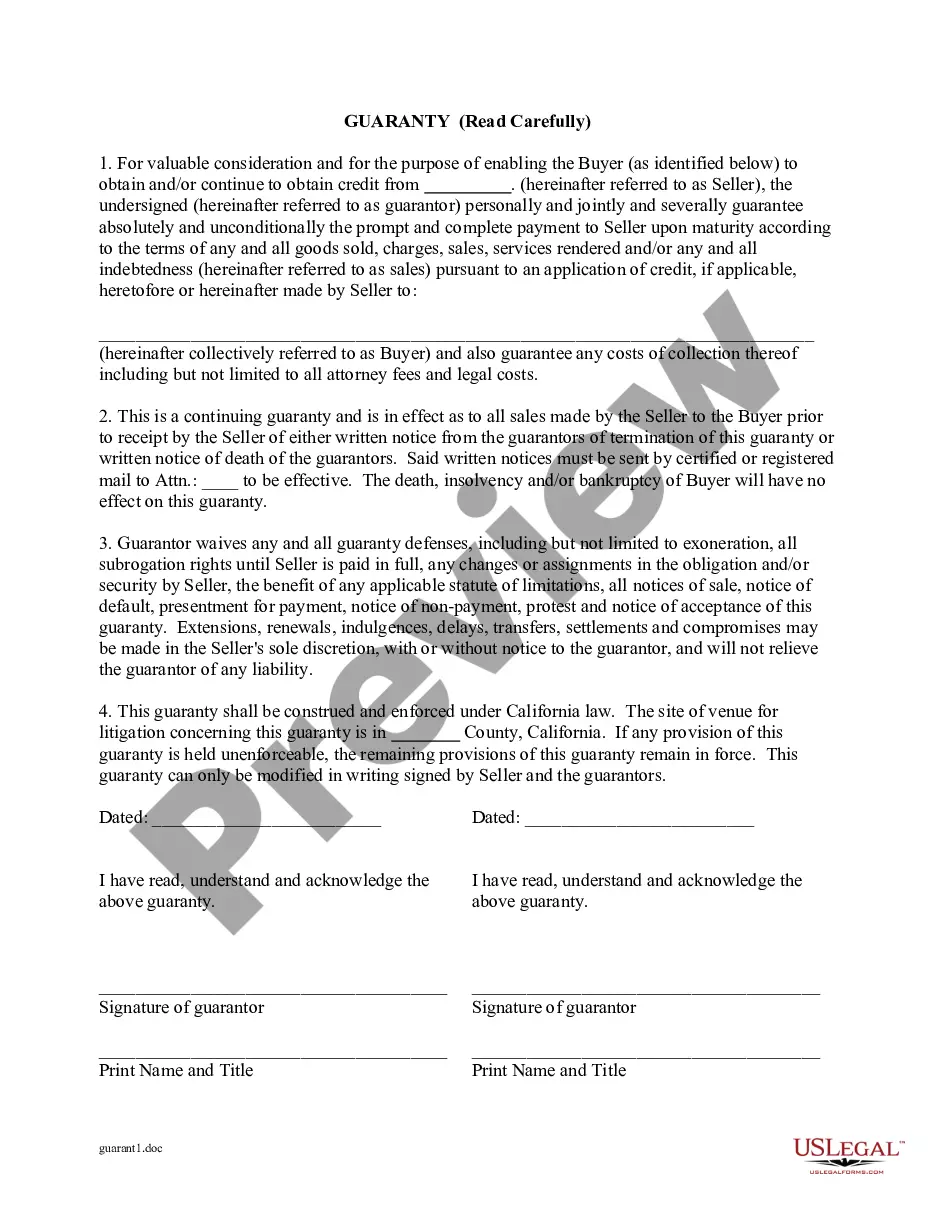

For valuable consideration and for the purpose of enabling the buyer to obtain and/or continue to obtain credit from the seller,the guarantor, personally, jointly and severally guarantee absolutely and unconditionally the prompt and complete payment to the seller upon maturity according to the terms of any and all goods sold, charges, sales, services rendered and/or any and all indebtedness pursuant to an application of credit.

Moreno Valley California Guaranty of Payment of Open Account refers to a legal document that ensures payment for open accounts or debts owed in Moreno Valley, California. This type of guaranty provides security to creditors or lenders who have extended credit to individuals, businesses, or organizations. The Moreno Valley California Guaranty of Payment of Open Account is relevant in various financial transactions where parties want assurance that they will receive payment for goods, services, or loans provided. It acts as a legally binding contract between the debtor, creditor, and the guarantor, specifying the terms and conditions of payment. By offering this guaranty, the guarantor agrees to assume responsibility for the debt if the debtor fails to fulfill their obligation to pay. This ensures that the creditor has a secondary source for collecting their outstanding debt, reducing the risk of financial loss. There may be different types or variations of the Moreno Valley California Guaranty of Payment of Open Account based on specific requirements, such as: 1. Individual Guaranty: In this type of guaranty, an individual personally guarantees the payment of an open account debt. The guarantor's personal assets may be used to satisfy the debt if the debtor defaults. 2. Corporate Guaranty: A company or business entity acts as the guarantor for payment of the open account. This type of guaranty allows businesses to secure credit for their operations while providing additional security for creditors. 3. Limited Guaranty: A limited guaranty defines specific conditions and limitations to the guarantor's liability. It might include factors like a maximum liability amount, duration of guarantor's obligation, or the requirement of creditor's notice prior to invoking the guaranty. 4. Unconditional Guaranty: An unconditional guaranty places no conditions or limitations on the guarantor's obligation. The guarantor is fully responsible for payment if the debtor defaults on the open account. 5. Continuing Guaranty: This type of guaranty remains in effect for an extended period, covering multiple transactions or future obligations between the debtor and the creditor. It provides ongoing security for the creditor, especially in cases of recurring credit needs. In summary, the Moreno Valley California Guaranty of Payment of Open Account provides reassurance for creditors, ensuring they have an alternative source for payment if debtors fail to fulfill their payment obligations. Various types of guaranties, such as individual, corporate, limited, unconditional, and continuing, exist to accommodate specific circumstances and preferences of the parties involved in the financial transaction.Moreno Valley California Guaranty of Payment of Open Account refers to a legal document that ensures payment for open accounts or debts owed in Moreno Valley, California. This type of guaranty provides security to creditors or lenders who have extended credit to individuals, businesses, or organizations. The Moreno Valley California Guaranty of Payment of Open Account is relevant in various financial transactions where parties want assurance that they will receive payment for goods, services, or loans provided. It acts as a legally binding contract between the debtor, creditor, and the guarantor, specifying the terms and conditions of payment. By offering this guaranty, the guarantor agrees to assume responsibility for the debt if the debtor fails to fulfill their obligation to pay. This ensures that the creditor has a secondary source for collecting their outstanding debt, reducing the risk of financial loss. There may be different types or variations of the Moreno Valley California Guaranty of Payment of Open Account based on specific requirements, such as: 1. Individual Guaranty: In this type of guaranty, an individual personally guarantees the payment of an open account debt. The guarantor's personal assets may be used to satisfy the debt if the debtor defaults. 2. Corporate Guaranty: A company or business entity acts as the guarantor for payment of the open account. This type of guaranty allows businesses to secure credit for their operations while providing additional security for creditors. 3. Limited Guaranty: A limited guaranty defines specific conditions and limitations to the guarantor's liability. It might include factors like a maximum liability amount, duration of guarantor's obligation, or the requirement of creditor's notice prior to invoking the guaranty. 4. Unconditional Guaranty: An unconditional guaranty places no conditions or limitations on the guarantor's obligation. The guarantor is fully responsible for payment if the debtor defaults on the open account. 5. Continuing Guaranty: This type of guaranty remains in effect for an extended period, covering multiple transactions or future obligations between the debtor and the creditor. It provides ongoing security for the creditor, especially in cases of recurring credit needs. In summary, the Moreno Valley California Guaranty of Payment of Open Account provides reassurance for creditors, ensuring they have an alternative source for payment if debtors fail to fulfill their payment obligations. Various types of guaranties, such as individual, corporate, limited, unconditional, and continuing, exist to accommodate specific circumstances and preferences of the parties involved in the financial transaction.