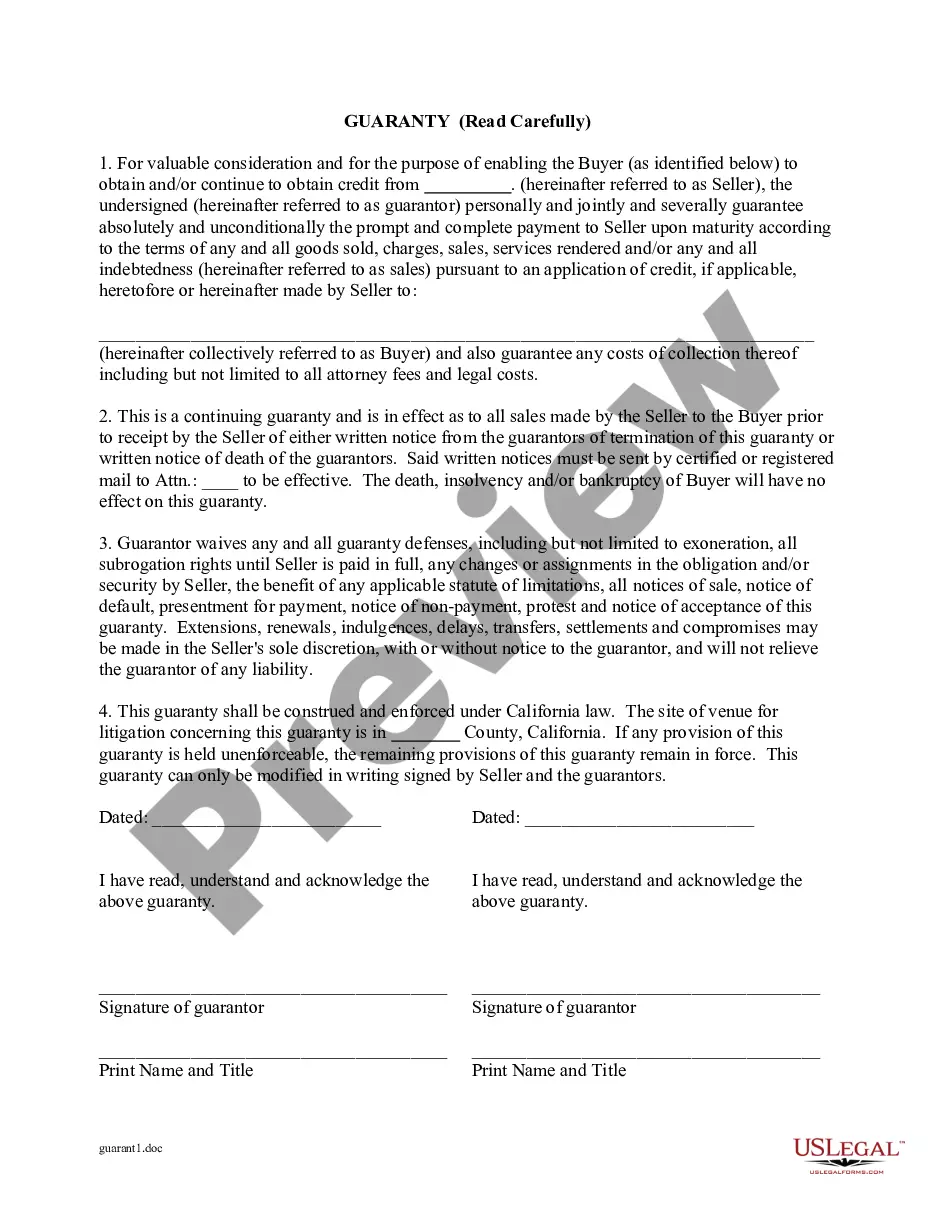

For valuable consideration and for the purpose of enabling the buyer to obtain and/or continue to obtain credit from the seller,the guarantor, personally, jointly and severally guarantee absolutely and unconditionally the prompt and complete payment to the seller upon maturity according to the terms of any and all goods sold, charges, sales, services rendered and/or any and all indebtedness pursuant to an application of credit.

The Orange California Guaranty of Payment of Open Account is a legal agreement that ensures payment for open accounts between businesses in the city of Orange, California. This guarantee acts as a security measure for creditors who extend credit to their customers or clients. By having a guarantor, businesses can minimize the risk of non-payment and protect their financial interests. Keywords: Orange California, guaranty of payment, open account, legal agreement, businesses, creditors, credit, customers, clients, risk, non-payment, financial interests. Different types of Orange California Guaranty of Payment of Open Account: 1. Individual Guaranty of Payment of Open Account: This type of guaranty involves an individual acting as the guarantor. The individual personally guarantees the payment to the creditor if the primary debtor fails to fulfill their financial obligations. 2. Corporate Guaranty of Payment of Open Account: In the case of a corporation, the corporate entity itself becomes the guarantor, ensuring the payment to the creditor. This type of guaranty grants the business the ability to extend credit to its customers or clients with a sense of financial security. 3. Limited Guaranty of Payment of Open Account: A limited guaranty imposes restrictions or limitations on the guarantee provided. It may specify a maximum liability amount or have conditions under which the guarantor's obligation is triggered. This allows the guarantor to specify the extent to which they are willing to assume the financial risk. 4. Continuing Guaranty of Payment of Open Account: Unlike a limited guaranty, a continuing guaranty remains in effect for an extended period, covering multiple transactions. This type of guaranty is often used when businesses engage in continuous credit transactions with their customers or clients and wish to have ongoing protection for their open accounts. 5. Recourse Guaranty of Payment of Open Account: A recourse guaranty gives the creditor the right to seek payment from the guarantor before exhausting all remedies against the primary debtor. This provides an additional layer of security for the creditor, ensuring prompt payment in case of default by the debtor. 6. Joint and Several Guaranty of Payment of Open Account: When multiple individuals or entities act as guarantors, they may collectively sign a joint and several guaranties. This type of guaranty allows the creditor to pursue payment from any of the guarantors individually or collectively, giving more flexibility in the collection process. These different types of Orange California Guaranty of Payment of Open Account provide businesses in Orange, California, with various options to safeguard their financial interests and protect against the risk of non-payment.The Orange California Guaranty of Payment of Open Account is a legal agreement that ensures payment for open accounts between businesses in the city of Orange, California. This guarantee acts as a security measure for creditors who extend credit to their customers or clients. By having a guarantor, businesses can minimize the risk of non-payment and protect their financial interests. Keywords: Orange California, guaranty of payment, open account, legal agreement, businesses, creditors, credit, customers, clients, risk, non-payment, financial interests. Different types of Orange California Guaranty of Payment of Open Account: 1. Individual Guaranty of Payment of Open Account: This type of guaranty involves an individual acting as the guarantor. The individual personally guarantees the payment to the creditor if the primary debtor fails to fulfill their financial obligations. 2. Corporate Guaranty of Payment of Open Account: In the case of a corporation, the corporate entity itself becomes the guarantor, ensuring the payment to the creditor. This type of guaranty grants the business the ability to extend credit to its customers or clients with a sense of financial security. 3. Limited Guaranty of Payment of Open Account: A limited guaranty imposes restrictions or limitations on the guarantee provided. It may specify a maximum liability amount or have conditions under which the guarantor's obligation is triggered. This allows the guarantor to specify the extent to which they are willing to assume the financial risk. 4. Continuing Guaranty of Payment of Open Account: Unlike a limited guaranty, a continuing guaranty remains in effect for an extended period, covering multiple transactions. This type of guaranty is often used when businesses engage in continuous credit transactions with their customers or clients and wish to have ongoing protection for their open accounts. 5. Recourse Guaranty of Payment of Open Account: A recourse guaranty gives the creditor the right to seek payment from the guarantor before exhausting all remedies against the primary debtor. This provides an additional layer of security for the creditor, ensuring prompt payment in case of default by the debtor. 6. Joint and Several Guaranty of Payment of Open Account: When multiple individuals or entities act as guarantors, they may collectively sign a joint and several guaranties. This type of guaranty allows the creditor to pursue payment from any of the guarantors individually or collectively, giving more flexibility in the collection process. These different types of Orange California Guaranty of Payment of Open Account provide businesses in Orange, California, with various options to safeguard their financial interests and protect against the risk of non-payment.