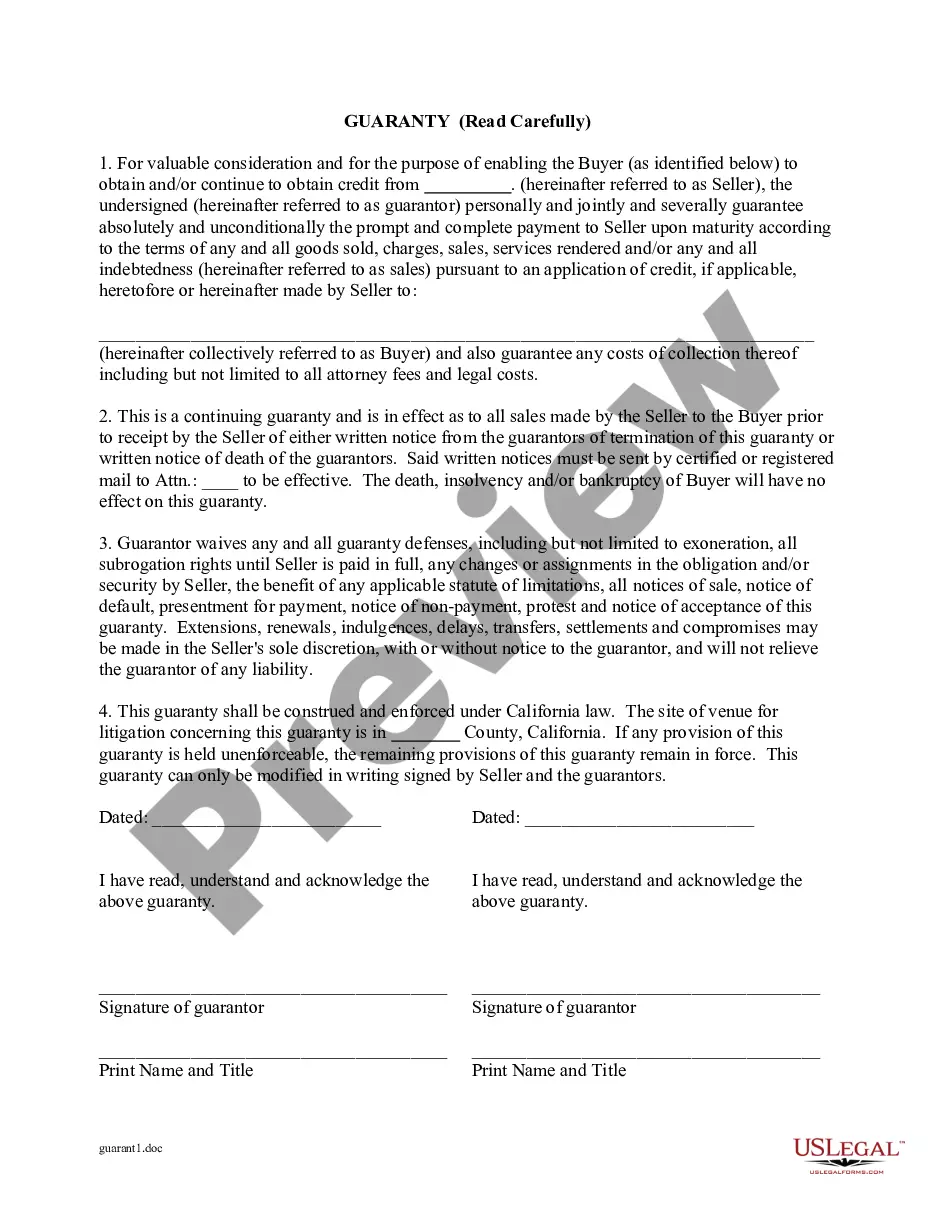

For valuable consideration and for the purpose of enabling the buyer to obtain and/or continue to obtain credit from the seller,the guarantor, personally, jointly and severally guarantee absolutely and unconditionally the prompt and complete payment to the seller upon maturity according to the terms of any and all goods sold, charges, sales, services rendered and/or any and all indebtedness pursuant to an application of credit.

Pomona California Guaranty of Payment of Open Account is a legal document that outlines the terms and conditions under which a guarantor agrees to pay off any outstanding debts or invoices on behalf of a debtor. This guarantees that the creditor will receive the payment for goods or services provided, even if the debtor fails to fulfill their financial obligations. The Guaranty of Payment of Open Account is an important protective measure for businesses and creditors operating in Pomona, California. By executing this agreement, creditors can secure their financial interests and minimize the risk of non-payment. The guarantor, also known as the surety, assumes the responsibility of covering the debtor's debts if they default on payment. This type of guaranty is commonly used in various industries, including manufacturing, construction, and retail. It ensures that businesses can continue their operations smoothly without worrying about unpaid invoices or outstanding debts. The Pomona California Guaranty of Payment of Open Account is often utilized when establishing trade credit relationships or extending credit to customers. There are different variations of the Pomona California Guaranty of Payment of Open Account, tailored to specific circumstances and requirements: 1. Absolute Guaranty: This form of guaranty is the most comprehensive and ensures complete payment coverage for any outstanding balance on the open account. It offers the highest level of protection for creditors, as the guarantor is fully liable for the debtor's debts. 2. Limited Guaranty: In this type of guaranty, the surety's liability is limited to a specific amount or a certain timeframe. The terms and conditions of the limited guaranty are negotiated and agreed upon by all parties involved. 3. Continuing Guaranty: This guaranty remains in effect until it is explicitly terminated by the guarantor or the creditor. It covers all present and future obligations of the debtor, providing long-term protection for the creditor. 4. Conditional Guaranty: This form of guaranty becomes effective only under specific conditions, such as default on payment or breach of contract. It allows the guarantor to be released from liability if the debtor meets certain criteria. When executing a Pomona California Guaranty of Payment of Open Account, it is crucial to consult legal professionals familiar with state laws and regulations. This document should be carefully drafted to encompass all necessary details, including the names and addresses of the parties involved, the amount guaranteed, the term of the guaranty, and any additional terms or conditions. By utilizing the Pomona California Guaranty of Payment of Open Account, businesses in Pomona can safeguard their financial interests, minimize risks, and foster trustworthy relationships with their customers.Pomona California Guaranty of Payment of Open Account is a legal document that outlines the terms and conditions under which a guarantor agrees to pay off any outstanding debts or invoices on behalf of a debtor. This guarantees that the creditor will receive the payment for goods or services provided, even if the debtor fails to fulfill their financial obligations. The Guaranty of Payment of Open Account is an important protective measure for businesses and creditors operating in Pomona, California. By executing this agreement, creditors can secure their financial interests and minimize the risk of non-payment. The guarantor, also known as the surety, assumes the responsibility of covering the debtor's debts if they default on payment. This type of guaranty is commonly used in various industries, including manufacturing, construction, and retail. It ensures that businesses can continue their operations smoothly without worrying about unpaid invoices or outstanding debts. The Pomona California Guaranty of Payment of Open Account is often utilized when establishing trade credit relationships or extending credit to customers. There are different variations of the Pomona California Guaranty of Payment of Open Account, tailored to specific circumstances and requirements: 1. Absolute Guaranty: This form of guaranty is the most comprehensive and ensures complete payment coverage for any outstanding balance on the open account. It offers the highest level of protection for creditors, as the guarantor is fully liable for the debtor's debts. 2. Limited Guaranty: In this type of guaranty, the surety's liability is limited to a specific amount or a certain timeframe. The terms and conditions of the limited guaranty are negotiated and agreed upon by all parties involved. 3. Continuing Guaranty: This guaranty remains in effect until it is explicitly terminated by the guarantor or the creditor. It covers all present and future obligations of the debtor, providing long-term protection for the creditor. 4. Conditional Guaranty: This form of guaranty becomes effective only under specific conditions, such as default on payment or breach of contract. It allows the guarantor to be released from liability if the debtor meets certain criteria. When executing a Pomona California Guaranty of Payment of Open Account, it is crucial to consult legal professionals familiar with state laws and regulations. This document should be carefully drafted to encompass all necessary details, including the names and addresses of the parties involved, the amount guaranteed, the term of the guaranty, and any additional terms or conditions. By utilizing the Pomona California Guaranty of Payment of Open Account, businesses in Pomona can safeguard their financial interests, minimize risks, and foster trustworthy relationships with their customers.