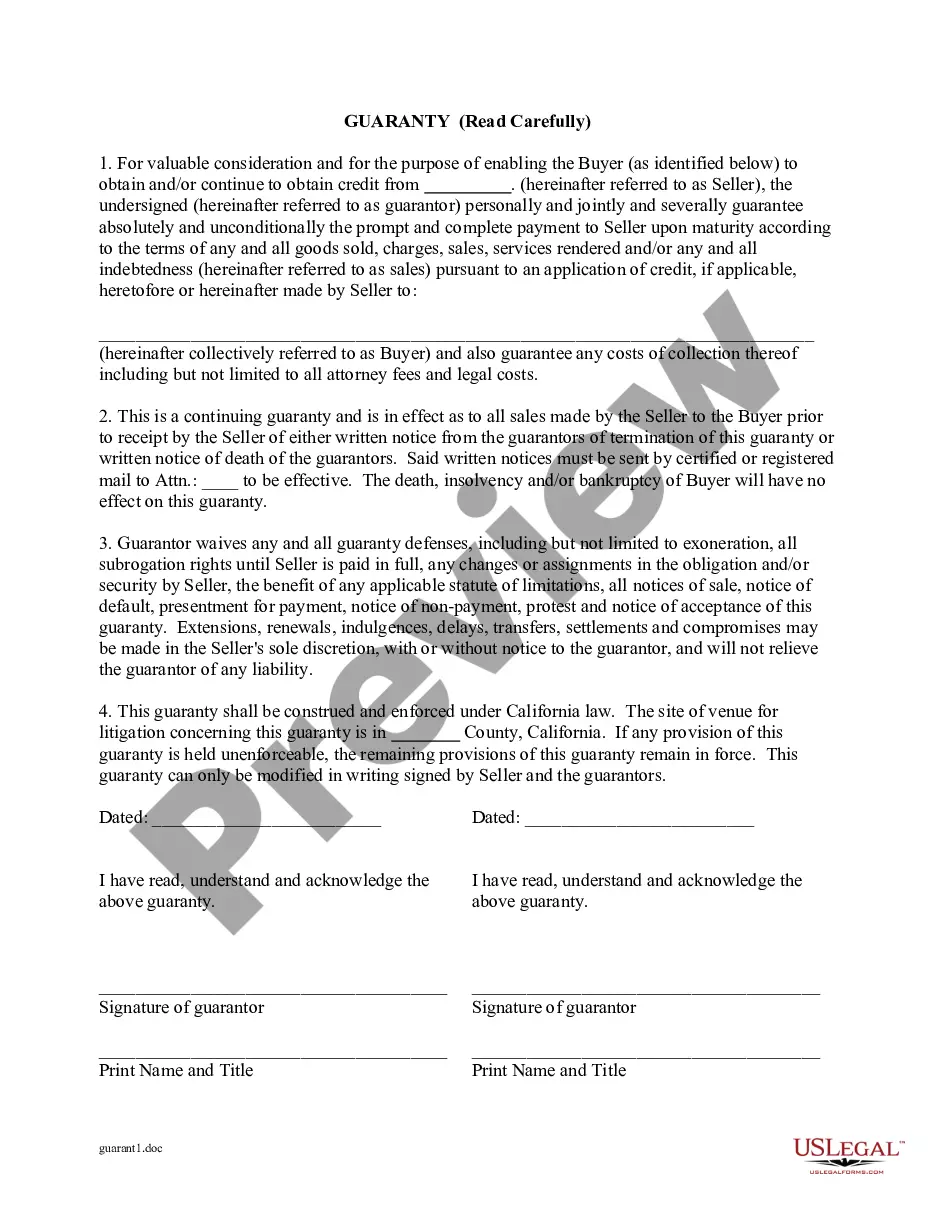

For valuable consideration and for the purpose of enabling the buyer to obtain and/or continue to obtain credit from the seller,the guarantor, personally, jointly and severally guarantee absolutely and unconditionally the prompt and complete payment to the seller upon maturity according to the terms of any and all goods sold, charges, sales, services rendered and/or any and all indebtedness pursuant to an application of credit.

The Riverside California Guaranty of Payment of Open Account, also known as the Riverside Guaranty, is a legal instrument that assures payment for open accounts in Riverside, California. This document is used when a party needs extra assurance for the fulfillment of payment obligations arising from open account transactions. By employing this guarantee, the creditor provides additional fallback options to ensure payment, offering a sense of security and trust in the business relationship. Specifically designed to encompass open account transactions, the Riverside California Guaranty of Payment ensures that payment will be made by a guarantor in the event of default by the debtor. This agreement greatly minimizes the risk of non-payment, protecting the creditor's financial interests while promoting mutually beneficial trade practices. There are different types of Riverside California Guaranty of Payment of Open Account based on the nature and scope of transactions. Some of these may include: 1. Individual Guaranty: This type involves a single person who provides a guarantee for the payment of open accounts. The guarantor assumes full responsibility for ensuring that all outstanding amounts are settled. 2. Corporate Guaranty: In this case, a business entity guarantees open account payment. This type is commonly used when one business entity is transacting with another, providing security through the financial strength of the corporation. 3. Continuing Guaranty: This type of guaranty may apply to ongoing transactions over a specific period or for an indefinite duration. It provides consistent protection for the creditor against non-payment issues that may arise from open account arrangements. 4. Limited Guaranty: Unlike a continuing guaranty, a limited guaranty only covers specific open account transactions up to a predetermined amount. This type allows the guarantor to set limitations on the extent of their responsibility for payment obligations. 5. Unilateral Guaranty: This type of guaranty involves only one party making the guarantee. It is often used when one party has more financial stability or a higher credit rating compared to the other party involved in the transaction. In summary, the Riverside California Guaranty of Payment of Open Account is a vital legal document that establishes a safety net for creditors engaging in open account transactions. It ensures that payment obligations are met, regardless of a debtor's financial situation or default. With various types available, businesses can tailor their guarantees to suit the nature of their relationships and enhance trust in their trade practices.The Riverside California Guaranty of Payment of Open Account, also known as the Riverside Guaranty, is a legal instrument that assures payment for open accounts in Riverside, California. This document is used when a party needs extra assurance for the fulfillment of payment obligations arising from open account transactions. By employing this guarantee, the creditor provides additional fallback options to ensure payment, offering a sense of security and trust in the business relationship. Specifically designed to encompass open account transactions, the Riverside California Guaranty of Payment ensures that payment will be made by a guarantor in the event of default by the debtor. This agreement greatly minimizes the risk of non-payment, protecting the creditor's financial interests while promoting mutually beneficial trade practices. There are different types of Riverside California Guaranty of Payment of Open Account based on the nature and scope of transactions. Some of these may include: 1. Individual Guaranty: This type involves a single person who provides a guarantee for the payment of open accounts. The guarantor assumes full responsibility for ensuring that all outstanding amounts are settled. 2. Corporate Guaranty: In this case, a business entity guarantees open account payment. This type is commonly used when one business entity is transacting with another, providing security through the financial strength of the corporation. 3. Continuing Guaranty: This type of guaranty may apply to ongoing transactions over a specific period or for an indefinite duration. It provides consistent protection for the creditor against non-payment issues that may arise from open account arrangements. 4. Limited Guaranty: Unlike a continuing guaranty, a limited guaranty only covers specific open account transactions up to a predetermined amount. This type allows the guarantor to set limitations on the extent of their responsibility for payment obligations. 5. Unilateral Guaranty: This type of guaranty involves only one party making the guarantee. It is often used when one party has more financial stability or a higher credit rating compared to the other party involved in the transaction. In summary, the Riverside California Guaranty of Payment of Open Account is a vital legal document that establishes a safety net for creditors engaging in open account transactions. It ensures that payment obligations are met, regardless of a debtor's financial situation or default. With various types available, businesses can tailor their guarantees to suit the nature of their relationships and enhance trust in their trade practices.