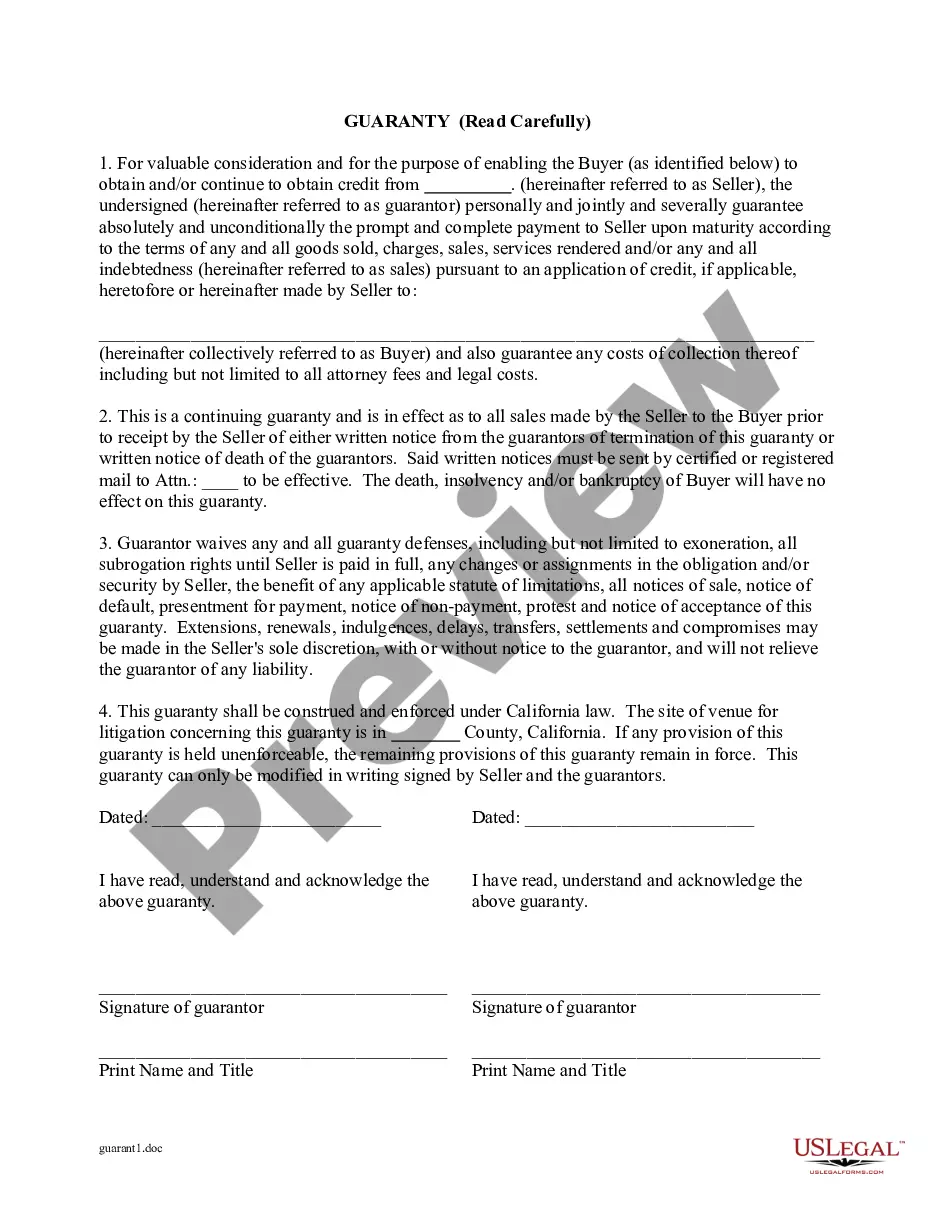

For valuable consideration and for the purpose of enabling the buyer to obtain and/or continue to obtain credit from the seller,the guarantor, personally, jointly and severally guarantee absolutely and unconditionally the prompt and complete payment to the seller upon maturity according to the terms of any and all goods sold, charges, sales, services rendered and/or any and all indebtedness pursuant to an application of credit.

A Santa Ana California Guaranty of Payment of Open Account is a legal document that provides assurance to a creditor or seller that payment for goods or services rendered will be made by the debtor or buyer. This type of guarantee is commonly used in commercial transactions where an open account is established between a seller and a buyer. The Santa Ana California Guaranty of Payment of Open Account establishes a contractual relationship between the guarantor and the creditor, ensuring that if the debtor fails to make payment for any reason, the guarantor will be responsible for fulfilling the financial obligations. This type of guarantee offers financial security to the creditor, as it ensures that they will receive payment promptly, mitigating potential financial risks. In Santa Ana, California, there are various types of Guaranty of Payment of Open Account agreements that cater to specific needs, such as: 1. Personal Guaranty of Payment: This form of guarantee involves an individual or a group of individuals accepting personal liability for the debt incurred by the debtor. The personal guarantor becomes legally obligated to repay the debt should the debtor default on payment. 2. Corporate Guaranty of Payment: This type of guarantee is utilized when a corporation guarantees payment for an open account debt. In this case, the corporation assumes the responsibility for repaying the debt in the event of the debtor's inability or failure to do so. 3. Limited Guaranty of Payment: A limited guaranty of payment specifies restrictions on the guarantor's liability. It sets limits on the guarantor's responsibility, potentially determining the maximum amount they are obligated to pay in case of default. 4. Continuing Guaranty of Payment: This form of guarantee covers a series of transactions or accounts over a specific period. It provides ongoing assurance to the creditor, ensuring payment for all future obligations during the predetermined time frame. Regardless of the specific type of Santa Ana California Guaranty of Payment of Open Account, it is essential to have the agreement in writing, signed by all relevant parties involved, to ensure its legality and enforceability. Consulting with a legal professional is advisable to draft a comprehensive and tailored guaranty agreement that aligns with the specific requirements of the transaction and applicable California laws.A Santa Ana California Guaranty of Payment of Open Account is a legal document that provides assurance to a creditor or seller that payment for goods or services rendered will be made by the debtor or buyer. This type of guarantee is commonly used in commercial transactions where an open account is established between a seller and a buyer. The Santa Ana California Guaranty of Payment of Open Account establishes a contractual relationship between the guarantor and the creditor, ensuring that if the debtor fails to make payment for any reason, the guarantor will be responsible for fulfilling the financial obligations. This type of guarantee offers financial security to the creditor, as it ensures that they will receive payment promptly, mitigating potential financial risks. In Santa Ana, California, there are various types of Guaranty of Payment of Open Account agreements that cater to specific needs, such as: 1. Personal Guaranty of Payment: This form of guarantee involves an individual or a group of individuals accepting personal liability for the debt incurred by the debtor. The personal guarantor becomes legally obligated to repay the debt should the debtor default on payment. 2. Corporate Guaranty of Payment: This type of guarantee is utilized when a corporation guarantees payment for an open account debt. In this case, the corporation assumes the responsibility for repaying the debt in the event of the debtor's inability or failure to do so. 3. Limited Guaranty of Payment: A limited guaranty of payment specifies restrictions on the guarantor's liability. It sets limits on the guarantor's responsibility, potentially determining the maximum amount they are obligated to pay in case of default. 4. Continuing Guaranty of Payment: This form of guarantee covers a series of transactions or accounts over a specific period. It provides ongoing assurance to the creditor, ensuring payment for all future obligations during the predetermined time frame. Regardless of the specific type of Santa Ana California Guaranty of Payment of Open Account, it is essential to have the agreement in writing, signed by all relevant parties involved, to ensure its legality and enforceability. Consulting with a legal professional is advisable to draft a comprehensive and tailored guaranty agreement that aligns with the specific requirements of the transaction and applicable California laws.