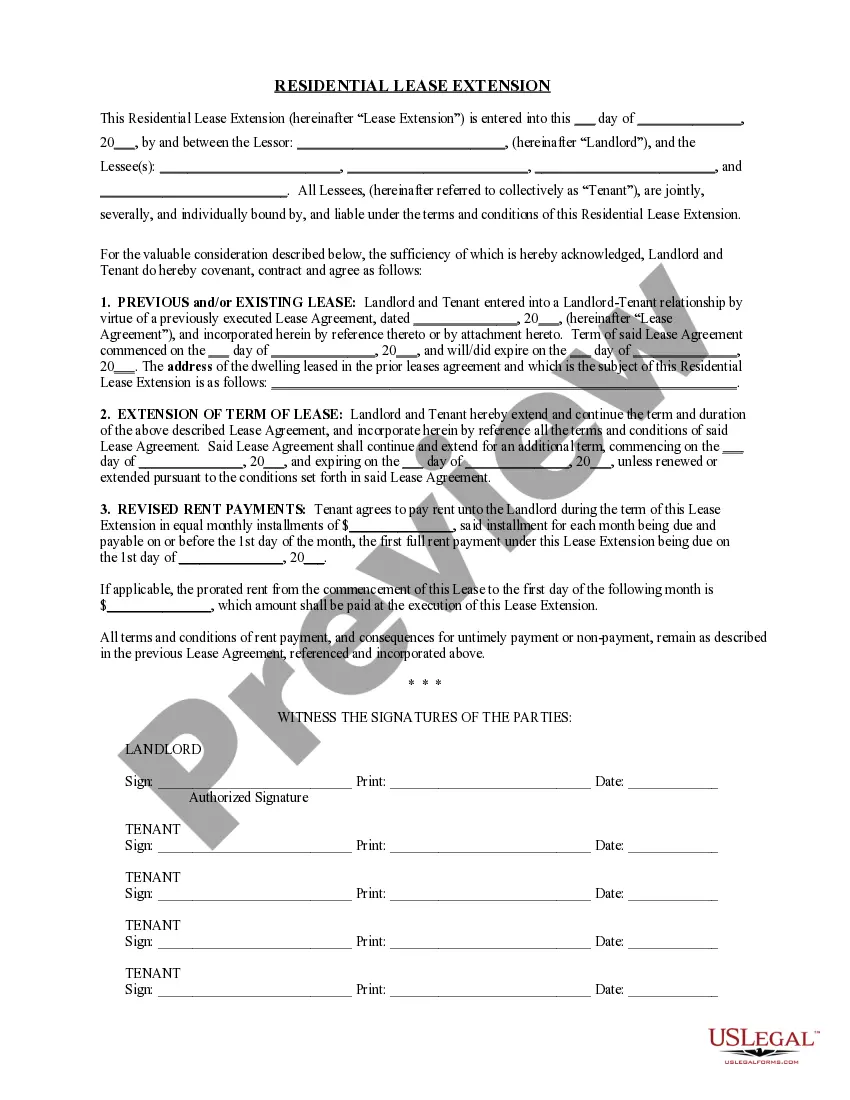

Promissory Note; Settlement Agreement: This is an Agreement and Promissory Note, stating that an individual is owed a certain sum from a corporation. The Agreement lists the payment schedule and amount to be paid by the corporation. Both the individual and a representative of the corporation must sign the contract. This form is available in both Word and Rich Text formats.

Huntington Beach California Promissory Note and Settlement Agreement

Description

How to fill out California Promissory Note And Settlement Agreement?

Do you require a trustworthy and affordable legal documents provider to obtain the Huntington Beach California Promissory Note and Settlement Agreement? US Legal Forms is your ideal solution.

Whether you need a fundamental agreement to establish rules for living together with your partner or a bundle of forms to facilitate your separation or divorce through the court, we have you covered. Our site offers over 85,000 current legal document templates for both personal and business purposes. All templates we provide are not generic and tailored according to the regulations of particular states and regions.

To download the document, you must Log In to your account, find the necessary template, and click the Download button alongside it. Please keep in mind that you can download your previously acquired form templates at any time in the My documents section.

Is it your first time visiting our site? No need to worry. You can create an account with great simplicity, but prior to that, ensure you do the following.

Now you can set up your account. Afterward, select your subscription choice and move on to payment. Once the payment is completed, download the Huntington Beach California Promissory Note and Settlement Agreement in any format provided. You can return to the website anytime and redownload the document at no additional cost.

Finding current legal forms has never been simpler. Try US Legal Forms today, and bid farewell to wasting your precious time searching for legal documents online.

- Verify that the Huntington Beach California Promissory Note and Settlement Agreement complies with the laws of your state and local jurisdiction.

- Review the form’s description (if available) to understand who and what the document is suitable for.

- Restart the search if the template does not meet your legal needs.

Form popularity

FAQ

In California, the statute of limitations on promissory estoppel claims is generally 2 years. This shorter timeframe applies to situations where you rely on another party's promise and face harm due to their failure to uphold it. If you have a related Huntington Beach California Promissory Note and Settlement Agreement, be aware of the urgency to address any claims within this period. Having the right documentation and guidance can help you navigate these complexities effectively.

The statute of limitations on a promissory note in California is generally 4 years. This means you have four years from the date of default or non-payment to take legal action related to your Huntington Beach California Promissory Note and Settlement Agreement. It's vital to keep track of this timeframe to ensure you can enforce your rights effectively. Consulting with a legal professional can provide additional clarity on your particular situation.

In California, debt can become uncollectible once the statute of limitations expires, typically ranging from 4 to 10 years, depending on the type of debt. If you have a Huntington Beach California Promissory Note and Settlement Agreement, it's crucial to be aware of the relevant time limits. Once the statute of limitations lapses, creditors lose the right to sue for collection, making it essential to act within the designated timeframe. Understanding these timeframes can help you manage your financial obligations.

Yes, promissory notes are legally binding in California when they meet specific requirements. A properly executed Huntington Beach California Promissory Note and Settlement Agreement obligates the borrower to repay the lender as agreed. To ensure that the note is enforceable, both parties must clearly understand the terms and conditions outlined within the document. Working with a reliable service can help you create a valid and binding note.

In California, the 3-year statute of limitations applies to written contracts and debt collection matters. This means that if you have a claim related to your Huntington Beach California Promissory Note and Settlement Agreement, you must initiate legal action within three years. After this period, your ability to collect the debt or enforce the agreement may be significantly limited. It's important to keep track of this timeline to protect your rights.

Conditions for a promissory note typically outline the responsibilities and obligations of both the borrower and the lender. Such conditions might cover payment deadlines, penalties for late payment, and consequences of default. When establishing your Huntington Beach California Promissory Note and Settlement Agreement, paying close attention to these conditions is crucial.

A Huntington Beach California Promissory Note and Settlement Agreement must include several key elements. These essential components are the principal amount, interest rate, payment terms, and signatures of both parties. This information will ensure clarity and security for the transaction.

Promissory conditions are the terms that specify what must occur for the note to be valid or enforceable. Common conditions include payment schedules and interest rates. For your Huntington Beach California Promissory Note and Settlement Agreement, clearly defining these conditions helps protect all parties.

Yes, promissory notes are legal and enforceable in the USA, including Huntington Beach. They serve as formal agreements between lenders and borrowers. As long as the terms comply with state laws, these documents can be used in various transactions.

To obtain your Huntington Beach California Promissory Note and Settlement Agreement, you can start by drafting the document yourself or using a trusted legal service. Platforms like uslegalforms offer templates that can simplify the creation process. Make sure to fill out the essential details accurately to ensure its effectiveness.