This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Visalia California Schedule of Fees

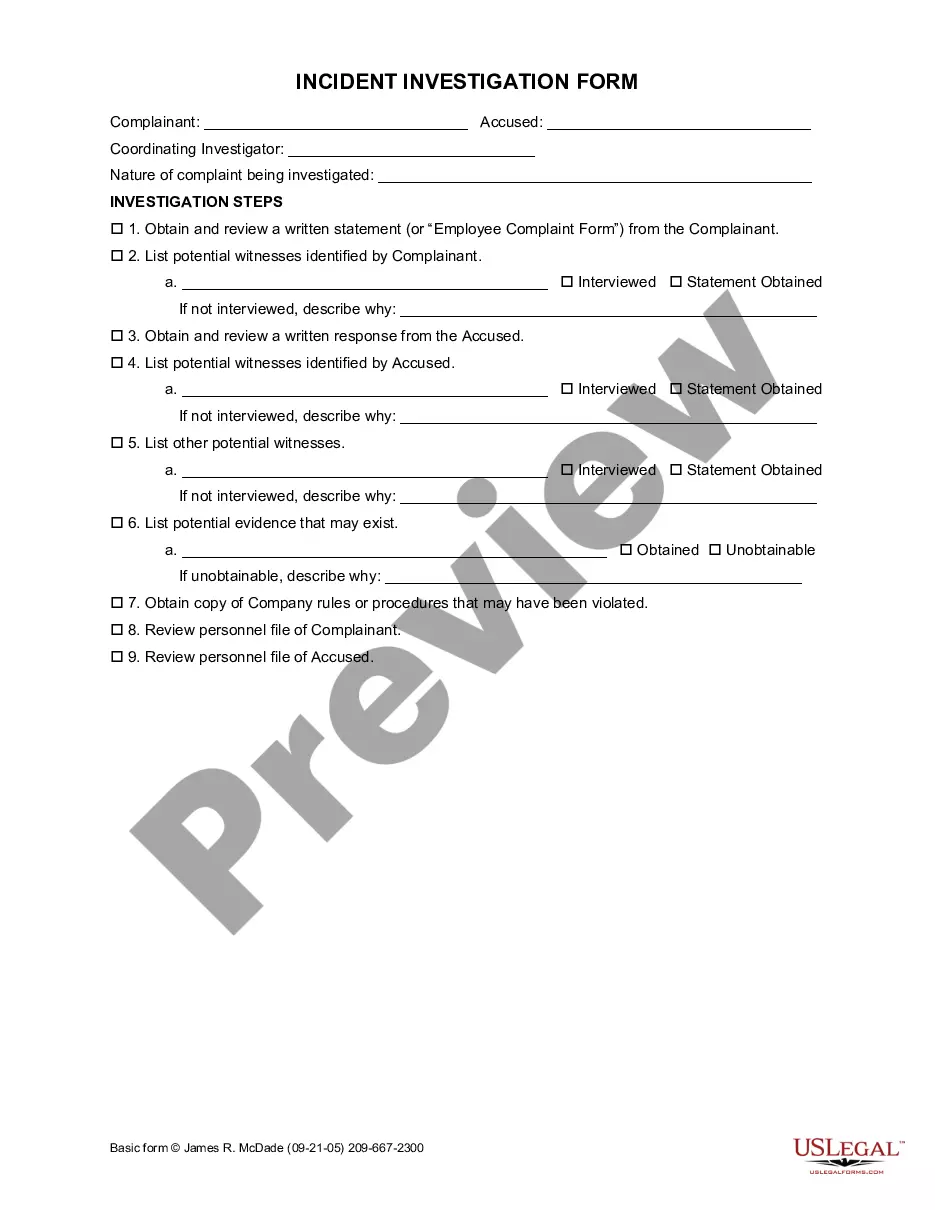

Description

How to fill out California Schedule Of Fees?

In case you are searching for a legitimate document, it’s incredibly challenging to locate a superior source than the US Legal Forms platform – one of the most extensive collections available online.

Here you can discover a vast array of document examples for both organizational and personal use categorized by types and areas or by keywords.

With our excellent search feature, locating the latest Visalia California Schedule of Fees is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finish the registration process.

Obtain the document. Specify the file format and download it to your device.

- Furthermore, the significance of each document is validated by a team of expert attorneys who routinely evaluate the templates on our site and update them according to the most recent state and county requirements.

- If you are already familiar with our service and possess an account, all you need to access the Visalia California Schedule of Fees is to sign in to your user profile and hit the Download button.

- If this is your first time using US Legal Forms, simply adhere to the guidelines outlined below.

- Ensure you have located the example you require. Review its description and utilize the Preview option to verify its content. If it does not satisfy your requirements, utilize the Search feature at the top of the page to find the suitable document.

- Validate your selection. Click the Buy now button. Afterward, choose your desired pricing plan and provide details to create an account.

Form popularity

FAQ

In Visalia, California, reasonable and customary fees are typically determined by examining local market rates and assessing the standards set by industry experts. This process often involves reviewing the Visalia California Schedule of Fees to ensure that fees align with what is common in the region. It is crucial for professionals and service providers to stay informed about these guidelines to maintain fairness and transparency. For assistance in navigating this system, you can rely on platforms like US Legal Forms, which provide valuable resources and documentation.

Tax in Visalia, California, generally includes various components that result in a total sales tax rate of 8.25%. This figure combines the state sales tax and local surcharges. Knowing the local tax rate helps inform residents and businesses and is key when reviewing the Visalia California Schedule of Fees for government-related costs.

The sales tax in Visalia, California, currently stands at 8.25%. This rate includes both the state and local taxes, which contribute to funding public services. Understanding the sales tax is essential for budgeting and financial planning, as reflected in the Visalia California Schedule of Fees document, which outlines detailed services and costs.

California's base sales tax rate is set at 7.25%. In Visalia, California, additional local taxes may apply, bringing the total tax rate to approximately 8.25%. Therefore, it is not accurate to state that California tax is a flat 10%. For precise calculations related to the Visalia California Schedule of Fees, local nuances play a critical role.

In California, you need at least one witness to sign your marriage license at the ceremony. This requirement is outlined in the state's legal framework and is detailed in the Visalia California Schedule of Fees. Ensuring your documentation is correct helps prevent any delays. If you have questions about the legalities or paperwork required, uslegalforms can provide clear assistance.

Yes, you can obtain a California birth certificate the same day, but this service is limited to specific locations. In Visalia, California, the fees and procedures align with the state's Schedule of Fees. Be prepared to provide valid identification and necessary information about the birth. Utilizing uslegalforms can help streamline the application process.

Yes, if you plan to establish a business in Tulare County, obtaining a business license is necessary. This requirement ensures that your business complies with local laws and regulations. You can find detailed information, including the Visalia California Schedule of Fees, which outline your obligations. Using resources like uslegalforms can simplify the steps to acquire the necessary license.

The city of Visalia building department typically opens its doors at 8 AM on weekdays. It’s wise to check for any specific holidays or schedule changes. Knowing the hours can save you time, especially if you need to discuss information related to the Visalia California Schedule of Fees. Visiting the city website can provide additional timely updates.

Getting a California business license can take anywhere from a few days to several weeks, depending on your specific circumstances and the required paperwork. It’s important to consult the Visalia California Schedule of Fees to understand any fees associated with your application. Additionally, having all necessary documents ready can expedite the process. Platforms like uslegalforms can help streamline your application process.