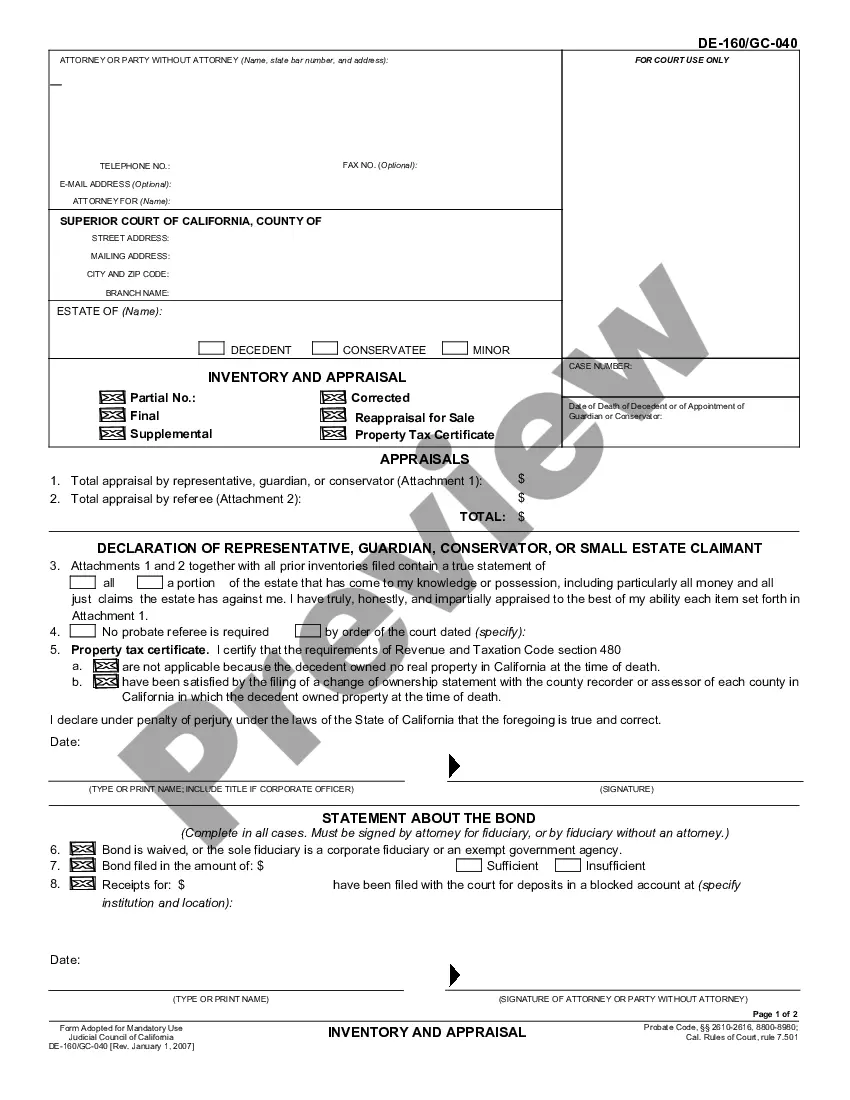

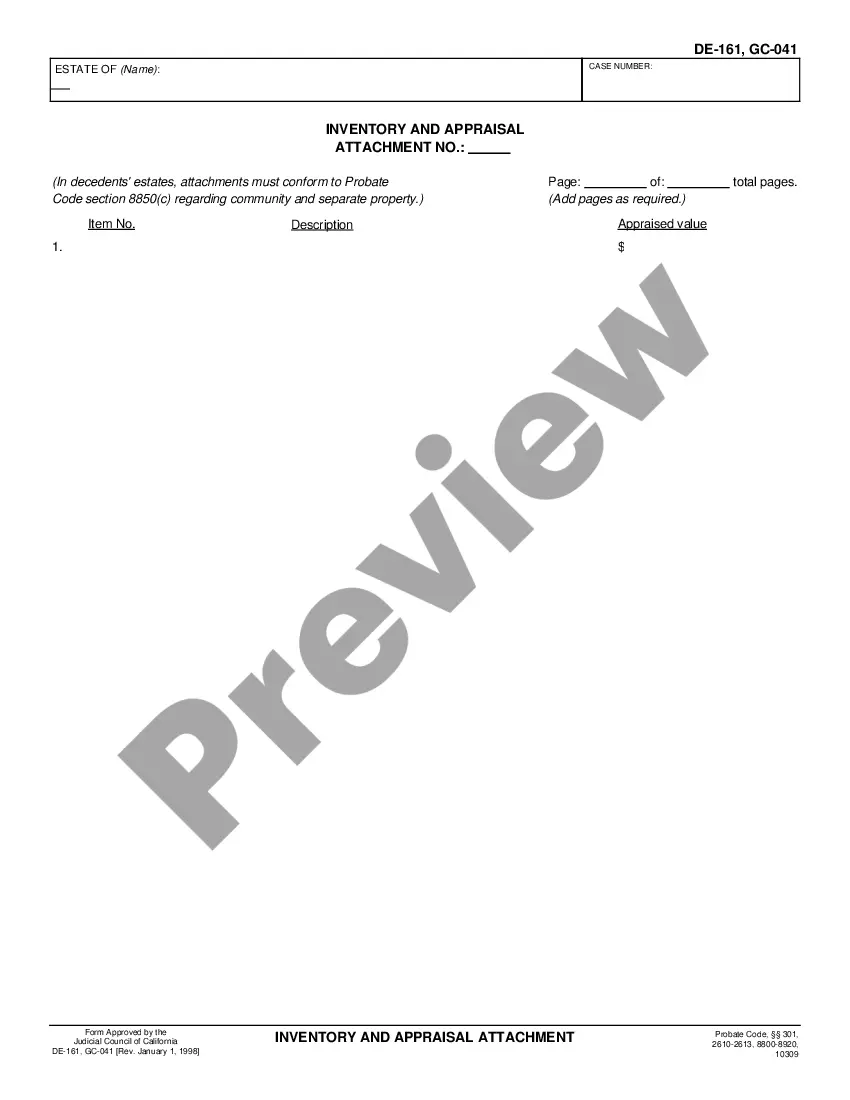

This form, Inventory and Appraisal, is an official form from the California Judicial Counsel, which complies with all applicable laws and statutes. USLF amends and updates the Judicial Counsel forms as is required by California statutes and law. This form is a declaration of the inventory and appraisal of estate property by the representative, guardian, conservator or small estate claimant and includes a statement about bond, declaration of probate referree and instructions. Enter the information as indicated on the form and file with the court as appropriate.

Rancho Cucamonga California Inventory And Appraisal

Description

How to fill out California Inventory And Appraisal?

Regardless of social or professional standing, completing legal paperwork is an unfortunate requirement in today's society.

Frequently, it’s nearly unattainable for individuals without legal education to create such documents from the ground up, primarily due to the complex terminology and legal nuances they entail.

This is where US Legal Forms comes to your aid.

Ensure the template you have discovered is appropriate for your locale, since the regulations of one state or county do not apply to another.

Examine the form and read a brief description (if provided) of scenarios the document can be utilized for.

- Our platform provides a vast array of over 85,000 ready-to-use state-specific documents suitable for nearly any legal situation.

- US Legal Forms is also a valuable asset for associates or legal advisors seeking to enhance their efficiency using our DIY forms.

- Whether you need the Rancho Cucamonga California Inventory and Appraisal or other forms that are valid in your state or county, US Legal Forms has everything readily available.

- Here’s how to quickly acquire the Rancho Cucamonga California Inventory and Appraisal using our reliable service.

- If you are already a member, feel free to Log In to your account to access the needed form.

- However, if you are new to our site, be sure to follow these instructions before obtaining the Rancho Cucamonga California Inventory and Appraisal.

Form popularity

FAQ

The inventory of a deceased estate is a complete list of all assets and property owned by the deceased at the time of their passing. This inventory includes real estate, personal items, bank accounts, and investments, serving to determine value and distribute assets to heirs appropriately. Understanding the process of Rancho Cucamonga California Inventory And Appraisal is key in preparing this document accurately. You can streamline this process by using US Legal Forms, which provides helpful templates and resources for creating an effective estate inventory.

To avoid probate in California, an estate must be valued at less than $166,250 for most types of assets. However, certain assets, like real property, may require different considerations. Knowledge of the Rancho Cucamonga California Inventory And Appraisal limits is crucial for estate planning, ensuring that you take proactive steps to manage your estate effectively. Services offered by US Legal Forms can assist you in structuring your estate to minimize probate complications.

To create an inventory list for an estate, start by gathering all assets. This includes real estate, vehicles, personal belongings, and financial accounts. Document each item with a description and approximate value, ensuring you create a thorough overview that aligns with the Rancho Cucamonga California Inventory And Appraisal process. Using a platform like US Legal Forms can simplify this by providing templates and guidance to help you organize your inventory effectively.

The purpose of an appraisal in the context of Rancho Cucamonga California Inventory And Appraisal is to establish the fair market value of an asset. This information is critical for legal purposes, insurance evaluations, and tax assessments. An accurate appraisal provides all stakeholders with reliable data, facilitating informed decisions and ensuring compliance with legal standards during property transfers.

An inventory assessment is a systematic evaluation of an estate's assets, focusing on their current value. For those in Rancho Cucamonga California Inventory And Appraisal, this assessment identifies and appraises items that comprise the estate, assisting in legal obligations and future planning. Conducting an assessment is key to understanding the total value and distribution of assets among beneficiaries.

In California, the relevant probate code for inventory and appraisal is Section 8800 through Section 8825. This legal framework outlines the procedures and requirements for compiling an inventory of estate assets and conducting their appraisal. Understanding these codes is essential for anyone involved in the probate process in Rancho Cucamonga, as proper adherence ensures the smooth handling of estates.

In the context of Rancho Cucamonga California Inventory And Appraisal, 'appraised' refers to the evaluation of items within an estate for their fair market value. This process helps determine how much each item is worth, which is essential for legal documentation and eventual distribution. A professional appraisal ensures accuracy and compliance with legal standards, providing clarity for all parties involved.

Probate Code 8901 focuses on the requirements for filing an inventory and appraisal for estates valued over a specific threshold. It mandates that detailed lists of assets be submitted to the court within a designated timeframe. For those in Rancho Cucamonga, California Inventory And Appraisal resources can guide you through these regulations, ensuring timely and accurate filings.

Section 4457 describes the process for the sale of estate assets during probate proceedings. It specifies how inventory and appraisal of assets must be completed before any sale can occur. In Rancho Cucamonga, California Inventory And Appraisal services provide vital support by ensuring compliance with this code, helping to facilitate smooth transactions.

Probate Code 15660 deals with the authority of the court in relation to the appraisal process during probate. This provision grants courts the power to appoint appraisers to assess the value of estate assets. Utilizing services dedicated to Rancho Cucamonga California Inventory And Appraisal can streamline this process, ensuring that assets are valued accurately and fairly.