This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Elk Grove California Notice of Filing of Inventory and Appraisal and How to Object to the Inventory or the Appraised Value of Property

Description

How to fill out California Notice Of Filing Of Inventory And Appraisal And How To Object To The Inventory Or The Appraised Value Of Property?

No matter one’s social or professional standing, filling out law-related documents is an unfortunate requirement in today’s professional landscape.

Frequently, it’s nearly unfeasible for someone with no legal education to draft these types of papers from scratch, primarily due to the complex language and legal nuances they involve.

This is where US Legal Forms proves to be useful.

Confirm that the template you found is suitable for your area since the rules of one state or county do not apply to another.

Inspect the form and read a brief summary (if present) of the situations the document can be utilized for.

- Our service provides an extensive catalog with over 85,000 ready-to-use state-specific forms that cater to nearly any legal situation.

- US Legal Forms also acts as an invaluable resource for associates or legal advisors seeking to save time using our DIY documents.

- Whether you need the Elk Grove California Notice of Filing of Inventory and Appraisal and How to Object to the Inventory or the Appraised Value of Property, or any other documents that will be recognized in your state or county, with US Legal Forms, everything is readily available.

- Here’s how to obtain the Elk Grove California Notice of Filing of Inventory and Appraisal and How to Object to the Inventory or the Appraised Value of Property within minutes using our reliable service.

- If you are already a member, simply Log In to your account to download the relevant form.

- However, if you’re new to our platform, be sure to follow these steps before acquiring the Elk Grove California Notice of Filing of Inventory and Appraisal and How to Object to the Inventory or the Appraised Value of Property.

Form popularity

FAQ

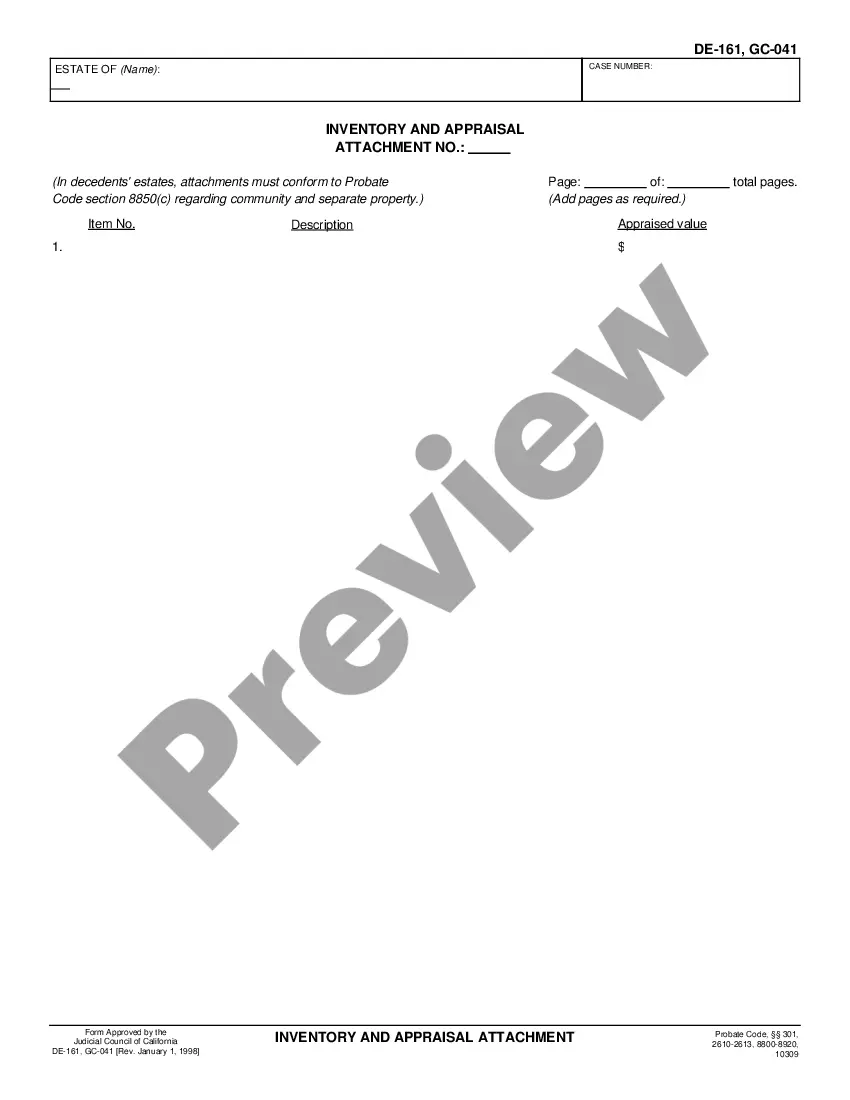

When a property is labeled as 'appraised in the inventory,' it indicates that the item has been evaluated and assigned a value during the probate process. This assessment is part of the larger Elk Grove California Notice of Filing of Inventory and Appraisal and How to Object to the Inventory or the Appraised Value of Property. Such appraisals are crucial for establishing an accurate view of the estate's total value and for guiding the distribution process.

The probate code regarding inventory and appraisal is outlined in California Probate Code Sections 8800 to 8900. This code provides the legal framework for the Elk Grove California Notice of Filing of Inventory and Appraisal and How to Object to the Inventory or the Appraised Value of Property. Understanding these legal codes can help you navigate the probate process more effectively, ensuring compliance with California's requirements.

An inventory assessment evaluates the various assets within an estate to determine their fair market value. It is an integral part of the Elk Grove California Notice of Filing of Inventory and Appraisal and How to Object to the Inventory or the Appraised Value of Property process, ensuring an accurate presentation of the estate's worth. This assessment can influence decisions made by heirs and beneficiaries, guiding them on how to approach the estate division.

An inventory appraisal assesses the value of all assets held by an estate. This type of appraisal is essential for filing the Elk Grove California Notice of Filing of Inventory and Appraisal and How to Object to the Inventory or the Appraised Value of Property. It provides a detailed account of what the estate comprises, which is crucial for settling debts and distributing the remaining assets according to the deceased's wishes.

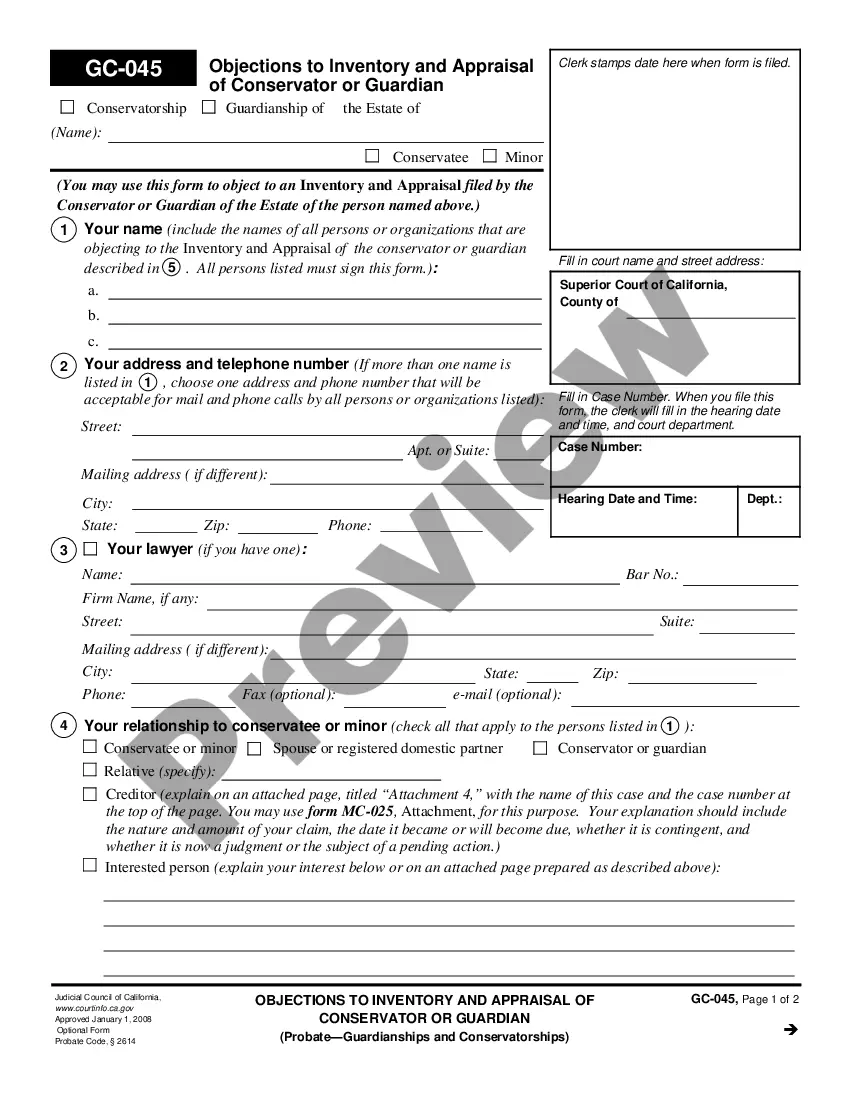

The purpose of an appraisal is to provide an unbiased estimate of a property's value. In the context of Elk Grove California Notice of Filing of Inventory and Appraisal and How to Object to the Inventory or the Appraised Value of Property, appraisals help to ensure that the assets are fairly valued for estate distribution. This process can serve as a critical step in probate proceedings, helping to resolve any potential disputes over property value.

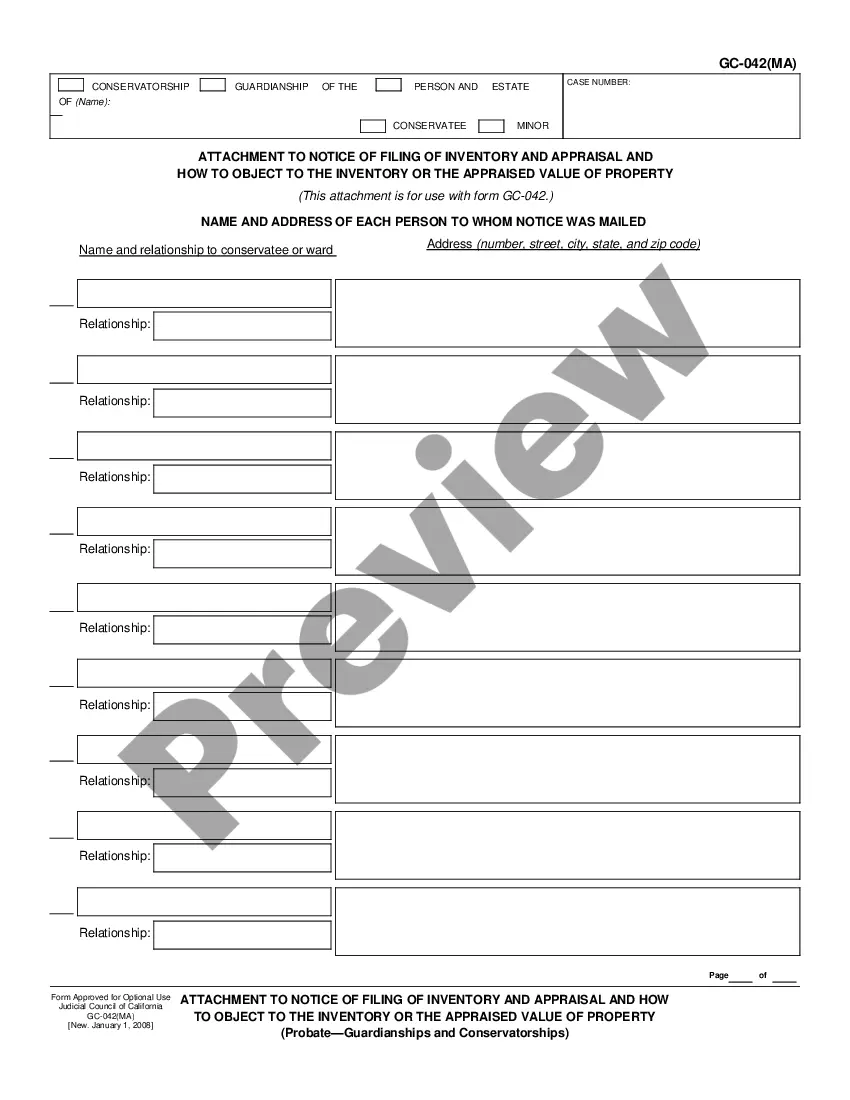

Yes, in California, the inventory and appraisal must be served to interested parties after it is completed. This ensures that all heirs and beneficiaries are aware of the estate’s assets and valuations. It is crucial to follow the procedures outlined in the Elk Grove California Notice of Filing of Inventory and Appraisal to avoid potential disputes or objections.

Typically, a licensed appraiser or real estate professional conducts the appraisal of a house included in the inventory and appraisal form. Their role is to provide an unbiased valuation based on market conditions. When you receive the Elk Grove California Notice of Filing of Inventory and Appraisal, it should outline the appraisal process and your rights to dispute the valuation if you disagree.

An inventory and appraisal consist of two steps: compiling a list of the deceased's assets and determining their fair market value. This process plays a vital role in estate management, particularly when addressing disputes among heirs. Understanding the Elk Grove California Notice of Filing of Inventory and Appraisal can help you navigate these intricacies and object if necessary.

The inventory of a deceased estate is a complete list of all assets owned by the deceased at the time of their passing. This includes real property, financial accounts, and personal belongings. The Elk Grove California Notice of Filing of Inventory and Appraisal requires that an accurate inventory is filed, which becomes essential for understanding the estate's overall value.

In California, the timeline to settle an estate can vary but typically takes about 9 to 12 months. Factors like the complexity of the estate and any disputes among heirs can affect this duration. Staying informed about the Elk Grove California Notice of Filing of Inventory and Appraisal can help you understand your obligations and the timeline for resolving any objections.