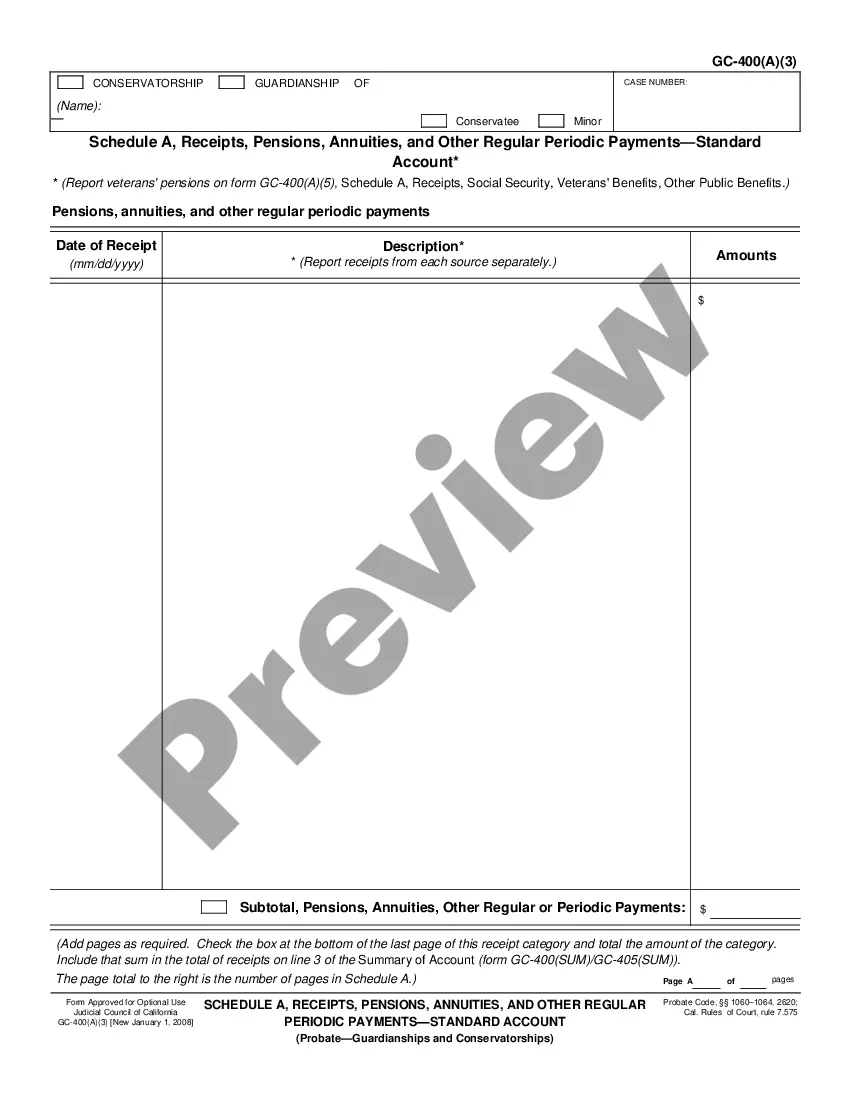

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Hayward California Schedule A is a tax document used by residents of Hayward, California, to report itemized deductions on their state income tax returns. It is also known as the California Schedule A — Itemized Deductions. Receipts are documents that serve as proof of payment or transaction. In the context of Hayward California Schedule A, receipts are necessary to support the claimed deductions. For example, if an individual claims a deduction for medical expenses, they would need to include receipts from medical providers as evidence. Dividends, on the other hand, refer to the portion of profits distributed by a corporation to its shareholders. The Schedule A may also include a section for reporting dividend income received during the tax year. This is important for taxpayers who have investments in stocks, mutual funds, or other dividend-paying financial instruments. The term "Standard Account" is not directly related to Hayward California Schedule A, Receipts, Dividends. However, it can be inferred that it refers to the standard or basic version of the account used for reporting taxes and deductions, as opposed to specialized or enhanced versions. It is worth mentioning that the Hayward California Schedule A may vary for different tax years or be subject to changes in tax laws. Taxpayers are advised to consult the official California Franchise Tax Board website or seek professional guidance to ensure accurate completion of the form and compliance with the latest regulations.Hayward California Schedule A is a tax document used by residents of Hayward, California, to report itemized deductions on their state income tax returns. It is also known as the California Schedule A — Itemized Deductions. Receipts are documents that serve as proof of payment or transaction. In the context of Hayward California Schedule A, receipts are necessary to support the claimed deductions. For example, if an individual claims a deduction for medical expenses, they would need to include receipts from medical providers as evidence. Dividends, on the other hand, refer to the portion of profits distributed by a corporation to its shareholders. The Schedule A may also include a section for reporting dividend income received during the tax year. This is important for taxpayers who have investments in stocks, mutual funds, or other dividend-paying financial instruments. The term "Standard Account" is not directly related to Hayward California Schedule A, Receipts, Dividends. However, it can be inferred that it refers to the standard or basic version of the account used for reporting taxes and deductions, as opposed to specialized or enhanced versions. It is worth mentioning that the Hayward California Schedule A may vary for different tax years or be subject to changes in tax laws. Taxpayers are advised to consult the official California Franchise Tax Board website or seek professional guidance to ensure accurate completion of the form and compliance with the latest regulations.