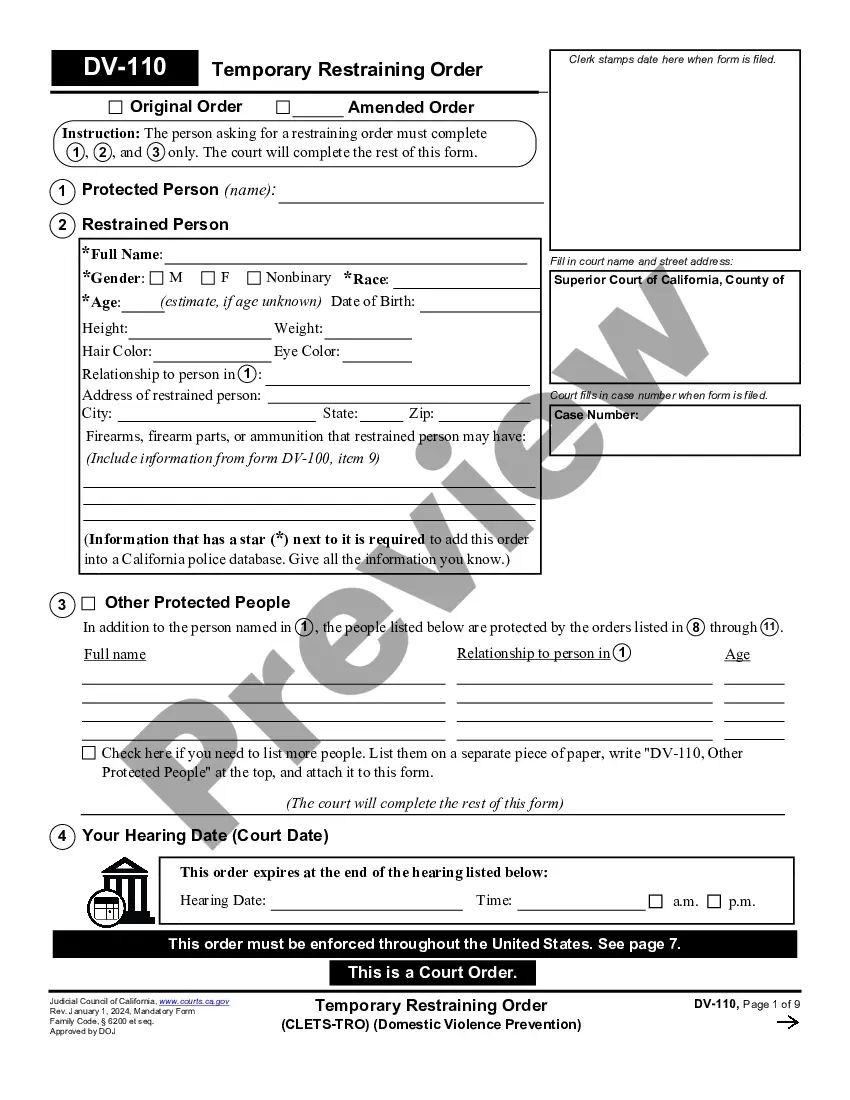

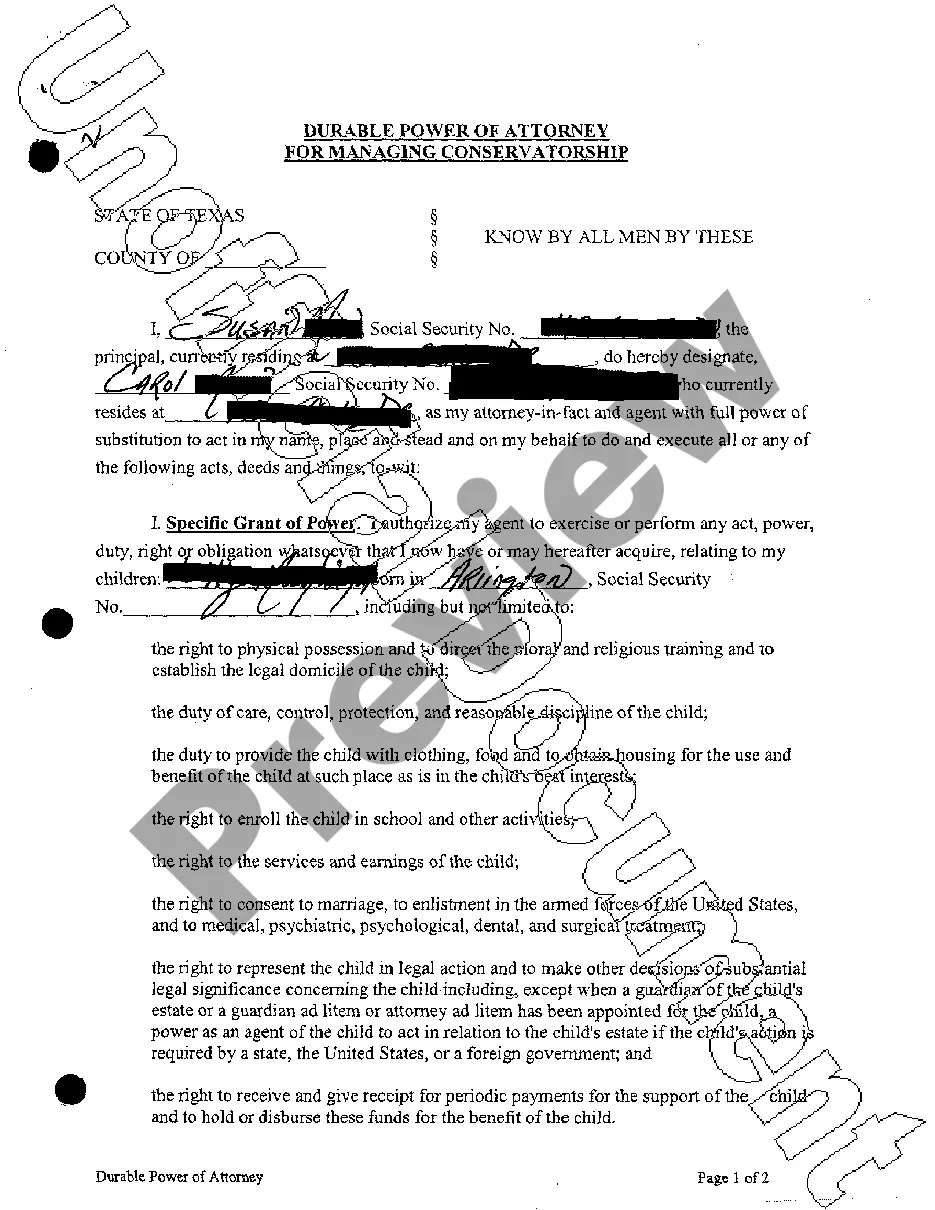

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Modesto California Schedule A, Receipts, Dividends — Standard Account is a comprehensive financial management system offered by financial institutions in Modesto, California. This account offers a range of features and benefits designed to streamline the management of personal finances and investments. Here is a detailed description of its key components and the different types available: 1. Modesto California Schedule A: This refers to the schedule or listing of various financial transactions and deductions that are itemized on your tax returns. It outlines your itemized deductions, which can include expenses such as mortgage interest, property taxes, medical expenses, and charitable contributions. The Modesto California Schedule A allows you to claim deductions on your state income tax returns, helping to minimize your overall tax liability. 2. Receipts: This feature enables account holders to keep track of their financial transactions by storing and categorizing receipts electronically. It allows individuals to easily access and organize their post-purchase receipts, making it convenient for budgeting, expense tracking, and accounting purposes. By having a digital record of receipts, account holders can save time and effort in organizing their financial information and provide necessary documentation during tax season or for auditing purposes. 3. Dividends — Standard Account: This feature involves receiving dividends on investments held within the account. Dividends are a distribution of a portion of a company's earnings to its shareholders, usually in the form of cash or additional shares. The Standard Account provides regular dividends linked to the performance of investments, helping account holders grow their wealth over time and potentially generate passive income. Different Types of Modesto California Schedule A, Receipts, Dividends — Standard Account: 1. Basic Schedule A Account: This is the entry-level option that includes the Modesto California Schedule A for tax purposes and the ability to store and categorize digital receipts. This account type is ideal for individuals who primarily want to manage their tax deductions and maintain a digital record of their expenses. 2. Advanced Schedule A Account: This upgraded version includes all the features of the Basic Account but offers enhanced tools for advanced financial planning. It may include additional features such as personalized tax optimization recommendations, investment portfolio analysis, and access to financial advisors. 3. Premium Schedule A Account: This is the top-tier account package that offers all the features of the Basic and Advanced Accounts, along with exclusive benefits. These may include priority customer support, comprehensive tax planning services, in-depth investment research, and possibly discounted or waived fees. The Modesto California Schedule A, Receipts, Dividends — Standard Account is designed to provide individuals with a comprehensive financial management system, ensuring efficient tax planning, expense tracking, and investment management. It caters to various financial needs and preferences, offering multiple tiers of accounts to suit different levels of financial expertise and requirements.