This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

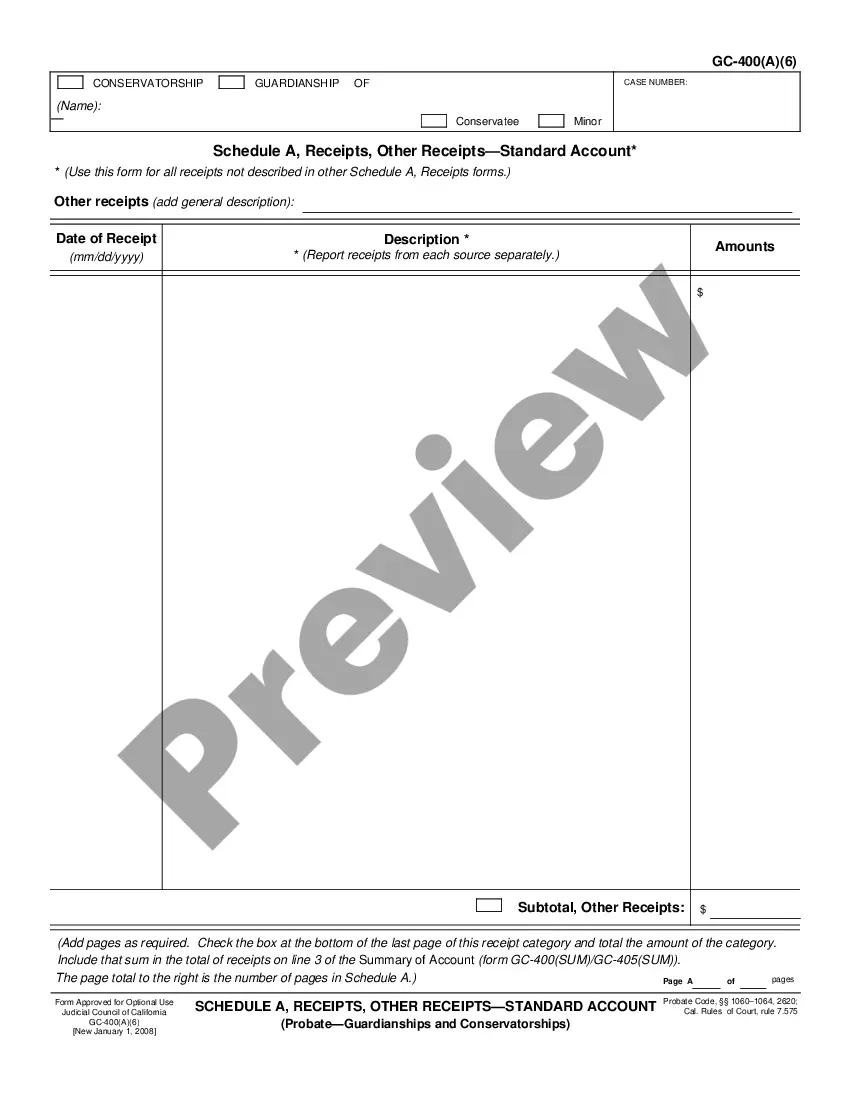

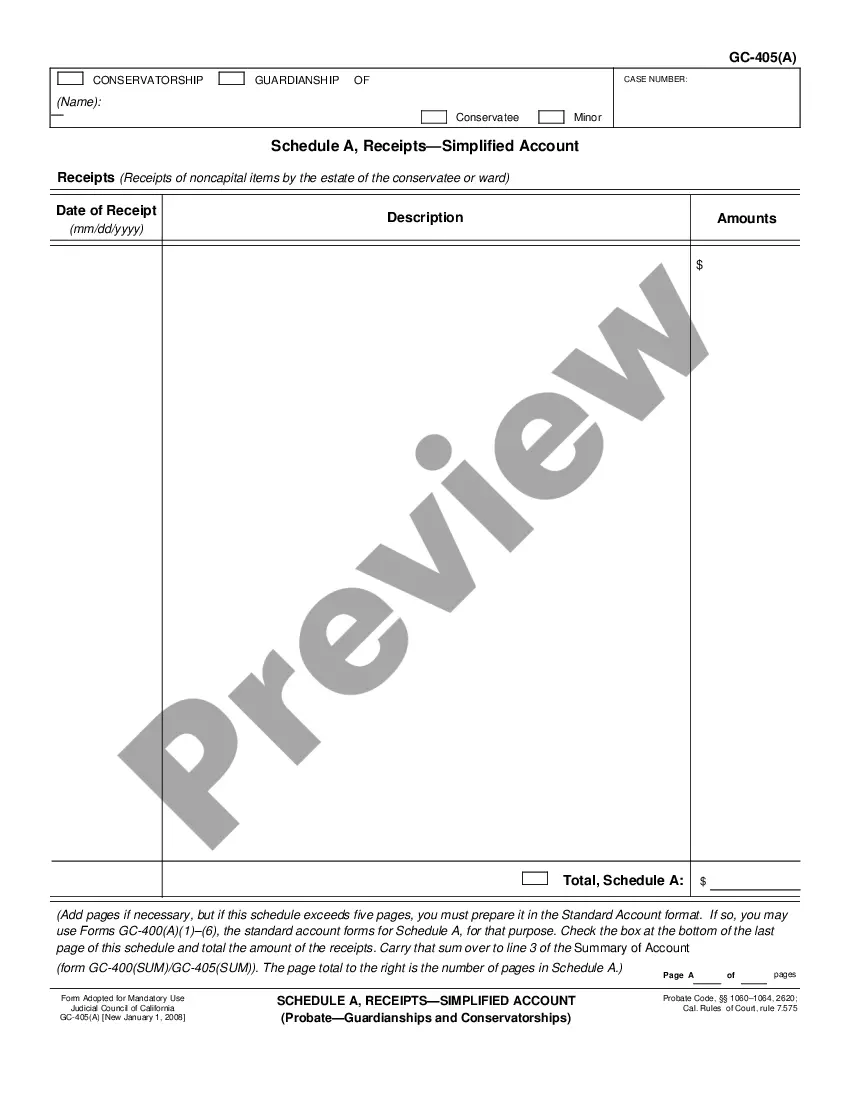

Sunnyvale California Schedule A, Receipts, Dividends - Standard Account

Description

How to fill out California Schedule A, Receipts, Dividends - Standard Account?

We consistently aim to minimize or evade legal repercussions when navigating intricate legal or financial matters. To achieve this, we seek legal alternatives that are typically quite expensive. Nevertheless, not every legal problem is of the same complexity. Most can be managed independently.

US Legal Forms is an online repository of current DIY legal documents concerning a range of topics from wills and power of attorney to incorporation articles and dissolution petitions. Our collection empowers you to handle your affairs without relying on legal advice. We provide access to legal document templates that aren’t always publicly accessible. Our templates are tailored to specific states and areas, which greatly simplifies the search process.

Utilize US Legal Forms whenever you require to obtain and download the Sunnyvale California Schedule A, Receipts, Dividends - Standard Account or any other document conveniently and securely. Simply Log In to your account and click the Get button next to it. If you misplace the document, you can always retrieve it again in the My documents tab.

The procedure is just as simple even if you are not familiar with the website! You can establish your account in a matter of minutes.

- Ensure that the Sunnyvale California Schedule A, Receipts, Dividends - Standard Account aligns with the laws and regulations of your state and locality.

- It’s essential to review the form’s outline (if available), and if you find any inconsistencies with what you were initially looking for, consider searching for an alternate template.

- Once you have confirmed that the Sunnyvale California Schedule A, Receipts, Dividends - Standard Account is appropriate for your situation, you can choose a subscription plan and proceed to payment.

- Then you can download the document in any preferred file format.

- With over 24 years of experience in the market, we’ve assisted millions by providing customizable and up-to-date legal forms. Take advantage of US Legal Forms now to conserve effort and resources!

Form popularity

FAQ

Calculating your adjusted gross income (AGI) is one of the first steps in determining your taxable income for the year....To calculate your AGI: Calculate your total taxable income. Sum totals of taxable income from all sources. Subtract allowable deductions and expenses from the sum.

Adjusted Gross Income (AGI) is defined as gross income minus adjustments to income. Gross income includes your wages, dividends, capital gains, business income, retirement distributions as well as other income.

If you live in a state that requires you to file annual income tax returns, your AGI can also impact your state taxable income. This is because many states use your federal AGI as the starting point for calculating your state taxable income.

The following is a comparison of key features of federal income tax laws that have been enacted as of August 16, 2022, and California personal income tax laws. California adjusted gross income is based on federal adjusted gross income.

Your total itemized deductions are more than your standard deduction. You do not qualify to claim the standard deduction....Common itemized deductions. DeductionCA allowable amountFederal allowable amountJob Expenses and Certain Miscellaneous Itemized DeductionsExpenses that exceed 2% of your federal AGINone4 more rows ?

Unlike the standard deduction, the dollar amount of itemized deductions varies by the taxpayer, depending on the expenses that they deduct on Schedule A of Form 1040. The total amount is subtracted from the taxpayer's taxable income, and the remainder is your actual taxable income.

For both federal tax as well as California state and local taxes, you can only deduct expenses that exceed 7.5 percent of your Adjusted Gross Income (AGI). For example, if you earned $50,000 in 2021, you could only deduct expenses above $3,750 (7.5 percent of $50,000).

That's because you can only deduct costs that exceed 7.5% of your adjusted gross income (AGI) in 2021. For example, if your AGI (line 8b of Form 1040) is $50,000 and you have $5,000 of medical expenses, you could only deduct $1,250 of expenses. The first $3,750 of your out-of-pocket costs aren't deductible.

Purpose. Use Schedule CA (540), California Adjustments ? Residents, to make adjustments to your federal adjusted gross income and to your federal itemized deductions using California law.

In the case of an individual, the miscellaneous itemized deductions for any taxable year shall be allowed only to the extent that the aggregate of such deductions exceeds 2 percent of adjusted gross income.