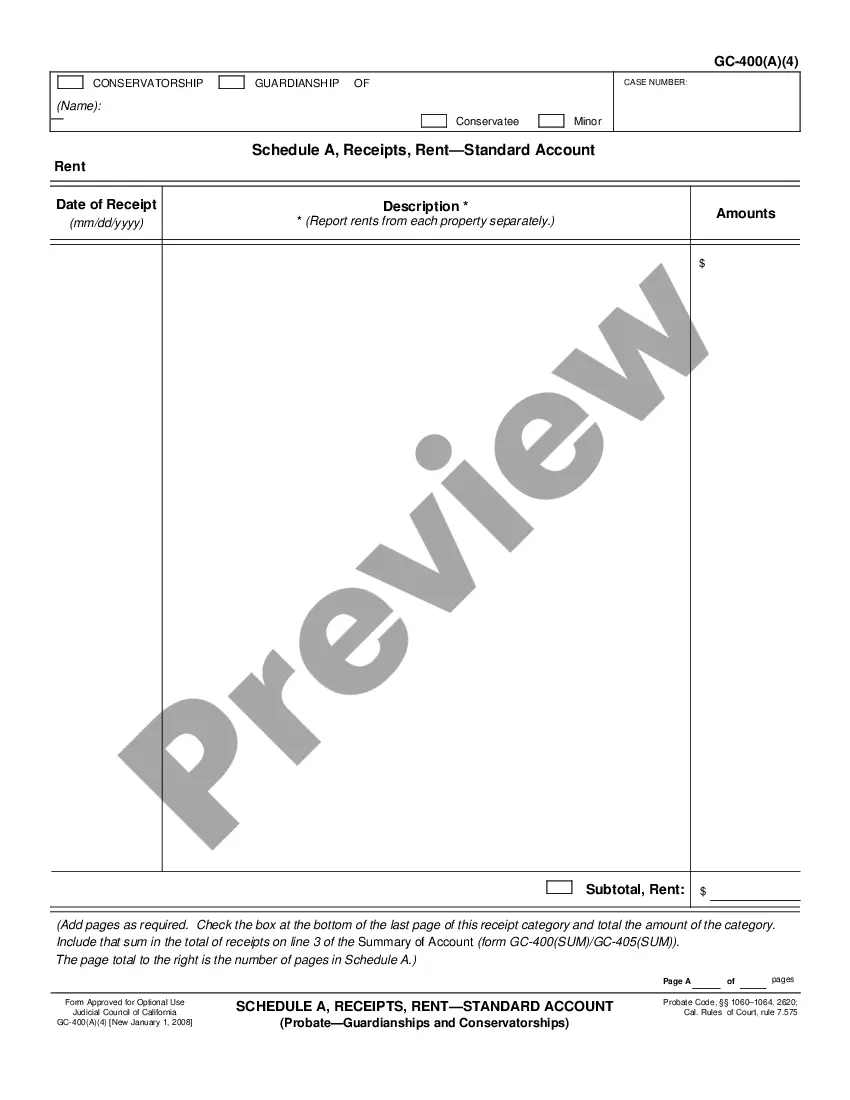

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Victorville California Schedule A, Receipts, Dividends — Standard Account is a financial document that plays a significant role in the proper management of taxes and income in Victorville, California. This detailed description will provide an understanding of what Schedule A, Receipts, Dividends — Standard Account entails, including its purpose and the different types associated with it. Victorville California Schedule A is an essential component of the tax filing process for individuals and businesses operating in Victorville, California. It serves as a supporting document to report various itemized deductions, thereby reducing the taxable income and potentially lowering the overall tax liability. Individuals and business entities can benefit from Schedule A by claiming deductions for expenses such as mortgage interest payments, state and local taxes, medical expenses, charitable contributions, and more. Receipts are an integral part of Schedule A as they act as evidence of the expenses claimed for deductions. Any qualifying expense must be supported by a valid receipt or document that itemizes the nature of the expense, the amount paid, and the date of the transaction. These receipts corroborate the accuracy of the reported expenses and help prevent tax audits or disputes in Victorville, California. Dividends, on the other hand, refer to the earnings distributed to shareholders by corporations in which they hold stock. Dividends can be received in the form of cash, additional shares, or property, depending on the company's policy. In Victorville, California, individuals who earn dividends must report them on Schedule A as part of their overall income. Dividends are subject to taxation, and accurately reporting them ensures compliance with tax regulations. The term "Standard Account" refers to a specific type of Schedule A used in Victorville, California. It involves the standard deduction option, which allows taxpayers to claim a fixed deduction amount, regardless of their actual expenses. This simplified approach is ideal for individuals who may not have substantial itemized deductions or find it more convenient to opt for the standard deduction instead of listing each expense separately. While there are no distinct subtypes of Victorville California Schedule A, Receipts, Dividends — Standard Account, it is crucial to differentiate between the standard deduction and itemized deductions. Itemized deductions offer taxpayers the opportunity to list and report their actual qualifying expenses in detail, potentially maximizing their deductions. However, the standard deduction option simplifies the process by offering a fixed amount that can be subtracted directly from the taxable income. In conclusion, Victorville California Schedule A, Receipts, Dividends — Standard Account is a crucial financial document utilized by individuals and businesses in Victorville, California, for tax purposes. It aids in reporting itemized deductions, substantiating expenses through receipts, and accurately including dividend income. By understanding the different types of deductions and the option between the standard deduction and itemized deductions, taxpayers can navigate their tax responsibilities effectively and optimize their tax savings.Victorville California Schedule A, Receipts, Dividends — Standard Account is a financial document that plays a significant role in the proper management of taxes and income in Victorville, California. This detailed description will provide an understanding of what Schedule A, Receipts, Dividends — Standard Account entails, including its purpose and the different types associated with it. Victorville California Schedule A is an essential component of the tax filing process for individuals and businesses operating in Victorville, California. It serves as a supporting document to report various itemized deductions, thereby reducing the taxable income and potentially lowering the overall tax liability. Individuals and business entities can benefit from Schedule A by claiming deductions for expenses such as mortgage interest payments, state and local taxes, medical expenses, charitable contributions, and more. Receipts are an integral part of Schedule A as they act as evidence of the expenses claimed for deductions. Any qualifying expense must be supported by a valid receipt or document that itemizes the nature of the expense, the amount paid, and the date of the transaction. These receipts corroborate the accuracy of the reported expenses and help prevent tax audits or disputes in Victorville, California. Dividends, on the other hand, refer to the earnings distributed to shareholders by corporations in which they hold stock. Dividends can be received in the form of cash, additional shares, or property, depending on the company's policy. In Victorville, California, individuals who earn dividends must report them on Schedule A as part of their overall income. Dividends are subject to taxation, and accurately reporting them ensures compliance with tax regulations. The term "Standard Account" refers to a specific type of Schedule A used in Victorville, California. It involves the standard deduction option, which allows taxpayers to claim a fixed deduction amount, regardless of their actual expenses. This simplified approach is ideal for individuals who may not have substantial itemized deductions or find it more convenient to opt for the standard deduction instead of listing each expense separately. While there are no distinct subtypes of Victorville California Schedule A, Receipts, Dividends — Standard Account, it is crucial to differentiate between the standard deduction and itemized deductions. Itemized deductions offer taxpayers the opportunity to list and report their actual qualifying expenses in detail, potentially maximizing their deductions. However, the standard deduction option simplifies the process by offering a fixed amount that can be subtracted directly from the taxable income. In conclusion, Victorville California Schedule A, Receipts, Dividends — Standard Account is a crucial financial document utilized by individuals and businesses in Victorville, California, for tax purposes. It aids in reporting itemized deductions, substantiating expenses through receipts, and accurately including dividend income. By understanding the different types of deductions and the option between the standard deduction and itemized deductions, taxpayers can navigate their tax responsibilities effectively and optimize their tax savings.