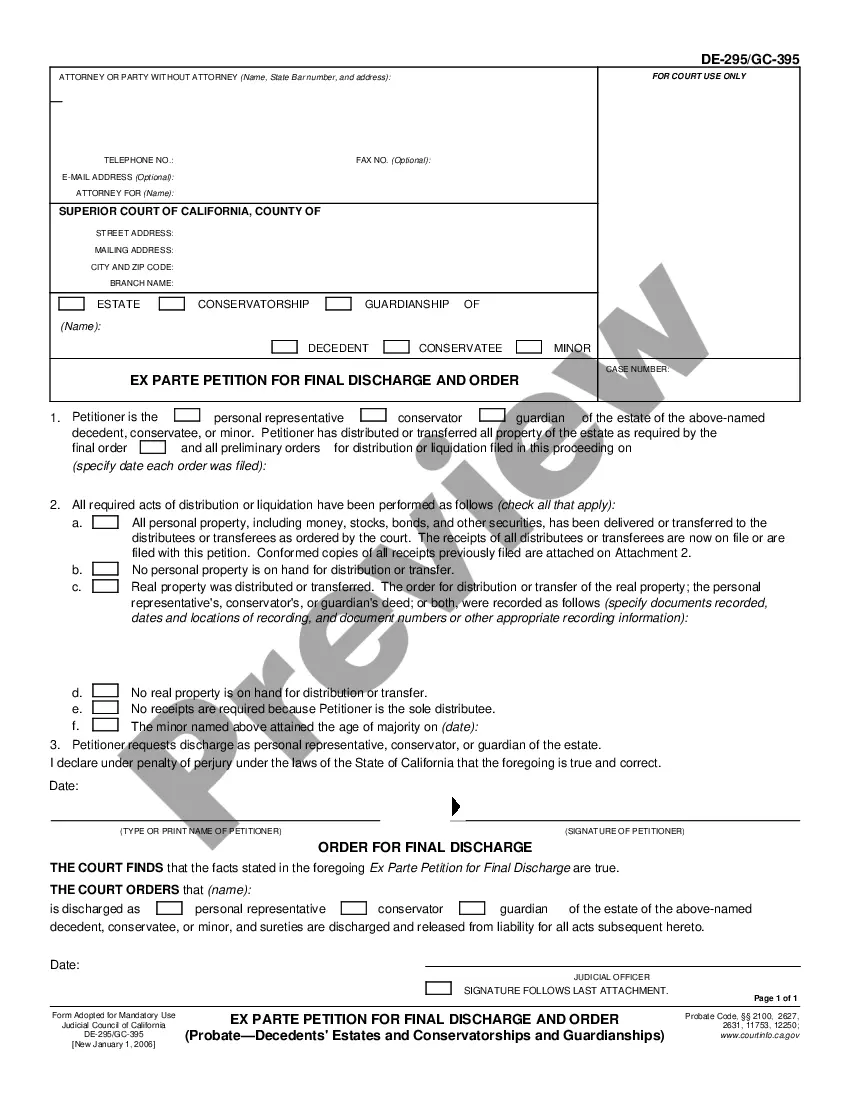

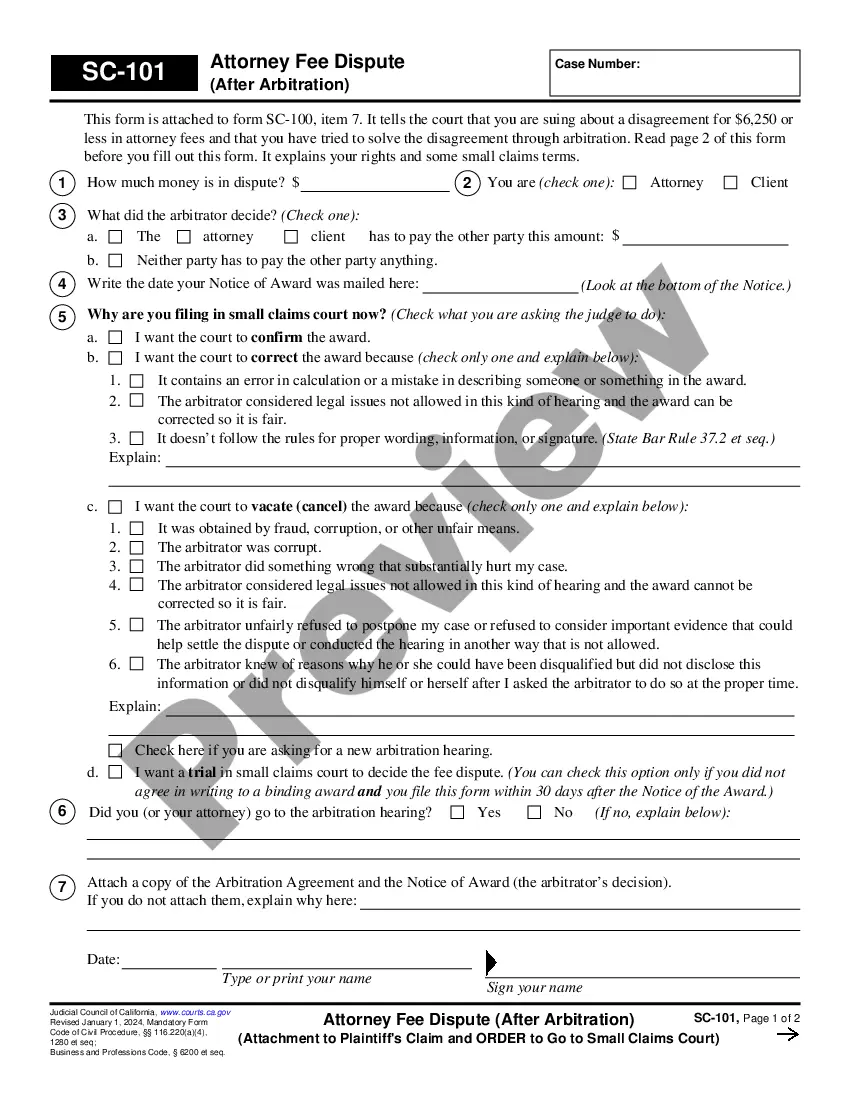

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Alameda, California Schedule A, Receipts, Interest-Standard Account refers to a specific financial document and account used in Alameda, California. It is important for individuals and businesses to understand the purpose and types of this account. Here is a detailed description of Alameda California Schedule A, Receipts, Interest-Standard Account, including its key features and types: 1. Alameda California Schedule A: Schedule A is a financial document used for reporting various types of income, deductions, and credits for tax purposes. In Alameda, California, individuals and businesses are required to file Schedule A as part of their annual tax return. This schedule provides detailed information on different sources of income, including interest earned and receipts received. 2. Receipts: Receipts refer to documentation or evidence of the funds received by an individual or business. In the context of Alameda California Schedule A, receipts can include income received from wages, self-employment, rental properties, investments, and other sources. It is essential to retain and accurately report all receipts to ensure compliance with tax regulations. 3. Interest-Standard Account: An Interest-Standard Account relates specifically to the interest earned by individuals or businesses on their savings or investment accounts. This account may be held with a bank, credit union, or other financial institutions. It tracks the interest earned over a particular period, typically for reporting and tax purposes. Types of Alameda California Schedule A, Receipts, Interest-Standard Account: 1. Individual Schedule A: This type of Schedule A is used by individual taxpayers in Alameda, California, to report their receipts and interest earned on various income sources. It includes detailed sections for reporting interest income, real estate taxes, medical expenses, charitable contributions, and other deductions. 2. Business Schedule A: Businesses operating in Alameda, California, also need to file a Schedule A if they are using the accrual method of accounting. This schedule allows businesses to report their receipts and interest earned in a structured format according to IRS guidelines. It includes sections for reporting interest income, taxable refunds, business expenses, and other deductions related to business operations. 3. Rental Property Schedule A: Landlords who own rental properties in Alameda, California, may need to file a specialized Schedule A to report their rental income, expenses, and interest earned. This schedule allows landlords to deduct various expenses related to their rental properties, such as mortgage interest, property taxes, repairs, and maintenance costs. In summary, Alameda California Schedule A, Receipts, Interest-Standard Account is a crucial financial document and account used for reporting income and interest earned in the Alameda area. Individual taxpayers, businesses, and landlords may have different types of Schedule A, tailored to their specific financial circumstances. Accurate reporting of receipts and interest income in these accounts is vital for complying with tax regulations in Alameda, California.Alameda, California Schedule A, Receipts, Interest-Standard Account refers to a specific financial document and account used in Alameda, California. It is important for individuals and businesses to understand the purpose and types of this account. Here is a detailed description of Alameda California Schedule A, Receipts, Interest-Standard Account, including its key features and types: 1. Alameda California Schedule A: Schedule A is a financial document used for reporting various types of income, deductions, and credits for tax purposes. In Alameda, California, individuals and businesses are required to file Schedule A as part of their annual tax return. This schedule provides detailed information on different sources of income, including interest earned and receipts received. 2. Receipts: Receipts refer to documentation or evidence of the funds received by an individual or business. In the context of Alameda California Schedule A, receipts can include income received from wages, self-employment, rental properties, investments, and other sources. It is essential to retain and accurately report all receipts to ensure compliance with tax regulations. 3. Interest-Standard Account: An Interest-Standard Account relates specifically to the interest earned by individuals or businesses on their savings or investment accounts. This account may be held with a bank, credit union, or other financial institutions. It tracks the interest earned over a particular period, typically for reporting and tax purposes. Types of Alameda California Schedule A, Receipts, Interest-Standard Account: 1. Individual Schedule A: This type of Schedule A is used by individual taxpayers in Alameda, California, to report their receipts and interest earned on various income sources. It includes detailed sections for reporting interest income, real estate taxes, medical expenses, charitable contributions, and other deductions. 2. Business Schedule A: Businesses operating in Alameda, California, also need to file a Schedule A if they are using the accrual method of accounting. This schedule allows businesses to report their receipts and interest earned in a structured format according to IRS guidelines. It includes sections for reporting interest income, taxable refunds, business expenses, and other deductions related to business operations. 3. Rental Property Schedule A: Landlords who own rental properties in Alameda, California, may need to file a specialized Schedule A to report their rental income, expenses, and interest earned. This schedule allows landlords to deduct various expenses related to their rental properties, such as mortgage interest, property taxes, repairs, and maintenance costs. In summary, Alameda California Schedule A, Receipts, Interest-Standard Account is a crucial financial document and account used for reporting income and interest earned in the Alameda area. Individual taxpayers, businesses, and landlords may have different types of Schedule A, tailored to their specific financial circumstances. Accurate reporting of receipts and interest income in these accounts is vital for complying with tax regulations in Alameda, California.