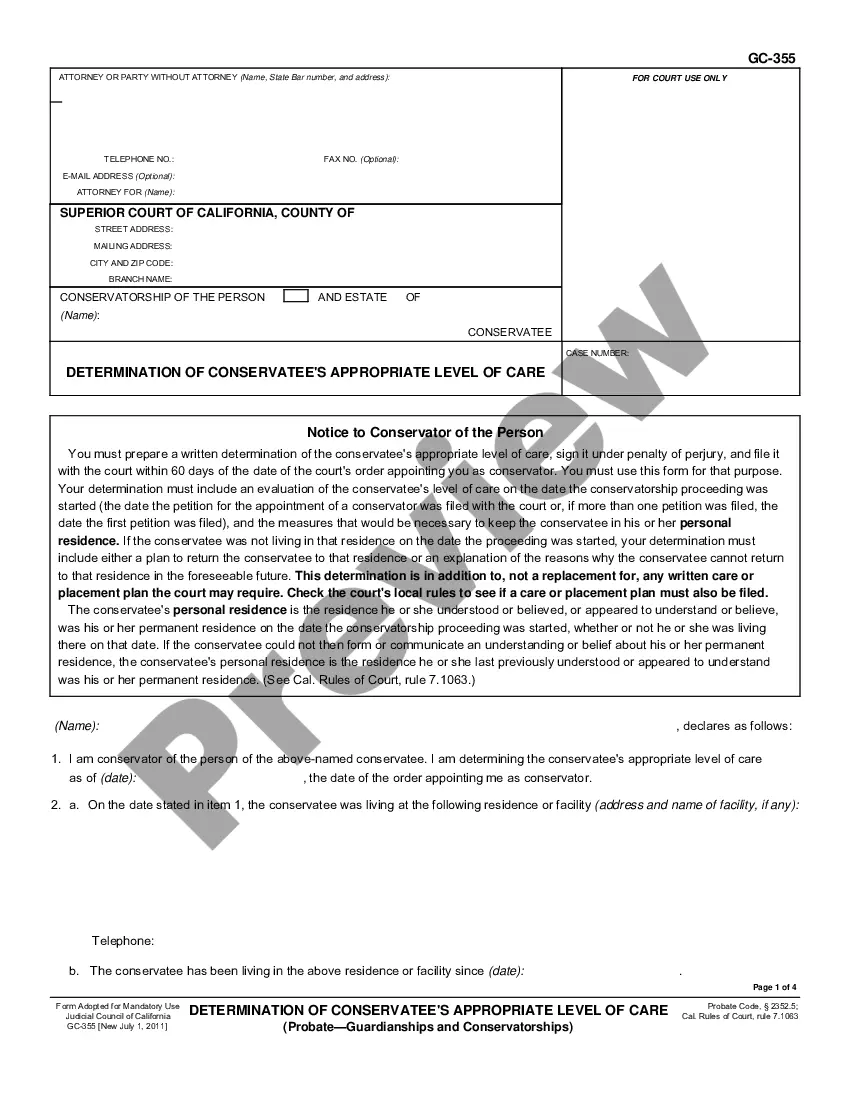

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Oxnard California Schedule A, Receipts, Interest-Standard Account is a financial document used by individuals and businesses in Oxnard, California to report their income and interest earned on standard accounts. It is an essential part of the tax filing process and provides a detailed breakdown of income sources and interest earned. The Schedule A form helps taxpayers in Oxnard to accurately report their income and calculate any tax deductions or credits they may be eligible for. It consists of various sections, including receipts and interest earned, allowing individuals to report their income from different sources and provide supporting documentation. Receipts on the Schedule A form refer to the income received by an individual or business, such as wages, salaries, dividends, and rental income. It is important to accurately report all receipts to ensure compliance with tax regulations and avoid any penalties or audits. Interest-Standard Account on the Schedule A form refers to the interest earned on standard bank accounts, such as savings accounts or certificates of deposit. Many individuals in Oxnard have standard accounts where they deposit their funds and earn interest over time. It is important to report this interest income on the Schedule A form to comply with tax laws and accurately calculate one's tax liability. Different types of Oxnard California Schedule A, Receipts, Interest-Standard Account may include: 1. Schedule A-1: This version of the form is for individuals who have multiple or complex income sources and need additional space to report their receipts and interest earned on standard accounts. 2. Schedule A-2: This variation of the form is specific to businesses operating in Oxnard, California. It allows businesses to report their income and interest earned, including any deductions or credits that may apply to their industry or activities. In summary, Oxnard California Schedule A, Receipts, Interest-Standard Account is a crucial financial document that helps individuals and businesses in Oxnard accurately report their income sources and interest earned on standard accounts. Properly completing this form ensures compliance with tax regulations and allows individuals to take advantage of any deductions or credits they may be eligible for.