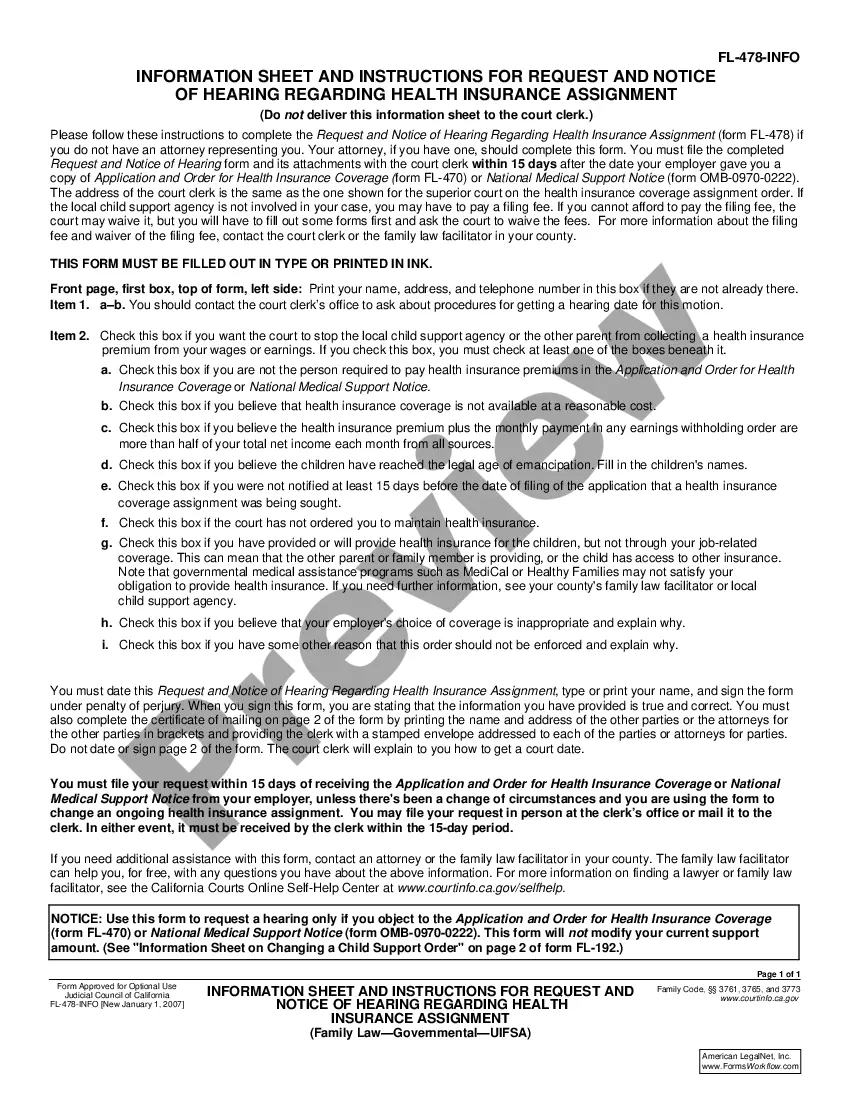

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Rialto California Schedule A, Receipts, Interest-Standard Account is a financial document provided by the city of Rialto, California, to taxpayers who have an interest-bearing standard account with the city. This detailed document outlines the various types of receipts, interest earned, and schedules related to this specific account type. The Schedule A document includes information about the taxpayer's account statements, interest accrued, and other financial transactions related to their interest-standard account. It is crucial for taxpayers to review this document to ensure accuracy and verify that all receipts and interest calculations align with their records. There are several types of Rialto California Schedule A, Receipts, Interest-Standard Account, including: 1. Schedule A — Receipts: This section provides a detailed breakdown of all receipts received by the taxpayer related to their interest-standard account. It lists the source of the receipts, such as payments made by the taxpayer or deposits from other financial institutions, along with corresponding dates and amounts. This section ensures transparency and allows taxpayers to track their income accurately. 2. Schedule A — Interest Earned: This particular section outlines the interest earned by the taxpayer on their interest-standard account. It specifies the interest rate, compounding frequency, and the calculation method employed by the city of Rialto. This information is crucial for taxpayers to understand the overall performance of their account and the increase in their funds due to interest earnings. 3. Schedule A — Standard Account Transactions: This section highlights all the pertinent transactions conducted by the taxpayer in their interest-standard account. It provides a chronological record of deposits, withdrawals, transfers, and any other significant activities related to the account. This detailed account history helps individuals keep track of their financial activities and reconcile their own records with those of the city. 4. Schedule A — Account Balances: This section displays the current balance of the taxpayer's interest-standard account. It includes the beginning balance, additions (receipts and interest earned), subtractions (withdrawals and fees), and the remaining balance as of the document's date. This ensures that taxpayers are aware of their account's financial status and can plan their future transactions accordingly. Overall, the Rialto California Schedule A, Receipts, Interest-Standard Account provides taxpayers with a comprehensive overview of their interest-bearing standard account activities. It allows individuals to monitor their cash flow, track interest earnings accurately, and reconcile their records with those of the city. This document is vital for taxpayers to ensure financial transparency and proper management of their accounts.