This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

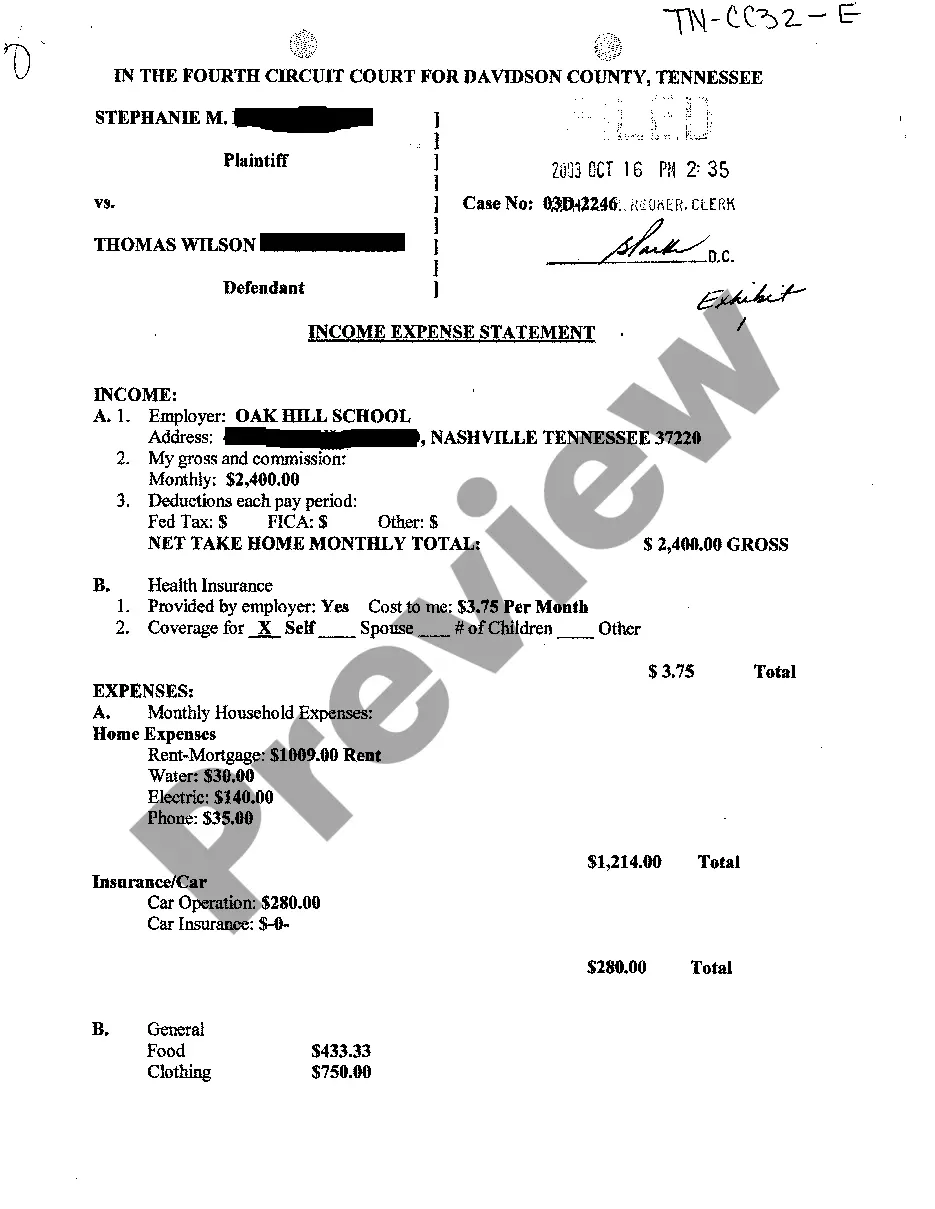

West Covina California Schedule A is a document used for reporting itemized deductions on a taxpayer's federal income tax return. This form allows individuals to claim various deductions, credits, or expenses that can help lower their taxable income, potentially resulting in a lower tax liability. Receipts play an essential role in the Schedule A process. Taxpayers must provide valid and accurate receipts as evidence of qualifying expenses. Receipts can include medical expenses, charitable contributions, mortgage interest payments, property taxes, state and local income taxes, and various other deductible items. One particular aspect of Schedule A is the Interest-Standard Account. This refers to the deduction for home mortgage interest paid on a taxpayer's primary residence. Homeowners in West Covina, California can typically claim the interest paid on loans for purchasing, building, or improving their residence within certain limits set by the Internal Revenue Service (IRS). Additionally, there are different types of West Covina California Schedule A, Receipts, Interest-Standard Account that can be classified based on the specific deductions being claimed. Some notable types include: 1. Medical Expenses: This category encompasses deductions for qualified medical and dental expenses that exceed a certain percentage of the taxpayer's adjusted gross income (AGI) as determined by the IRS. 2. Charitable Contributions: Taxpayers can claim deductions for donations made to qualified charitable organizations. It is essential to keep detailed receipts and records of all charitable contributions made during the tax year. 3. State and Local Taxes: This deduction allows taxpayers to deduct state and local income taxes or sales taxes paid throughout the year. It includes taxes paid to the state of California, local governments within West Covina, and other applicable taxes. 4. Mortgage Interest: Homeowners can claim deductions for mortgage interest paid on loans used for purchasing or refinancing their primary residence. The IRS provides specific guidelines and limits for deducting mortgage interest, which taxpayers should be aware of. 5. Property Taxes: Property owners can deduct property taxes paid on their primary residence and other real estate properties they own, subject to certain limitations. It is crucial for taxpayers to maintain accurate records and receipts for all deductions claimed on Schedule A. Careful documentation and adherence to IRS guidelines will ensure that individuals receive the maximum allowable deductions and minimize the chance of facing an audit or penalties. Always consult with a tax professional or refer to the IRS guidelines for up-to-date and accurate information on West Covina California Schedule A, Receipts, Interest-Standard Account, and its various types.