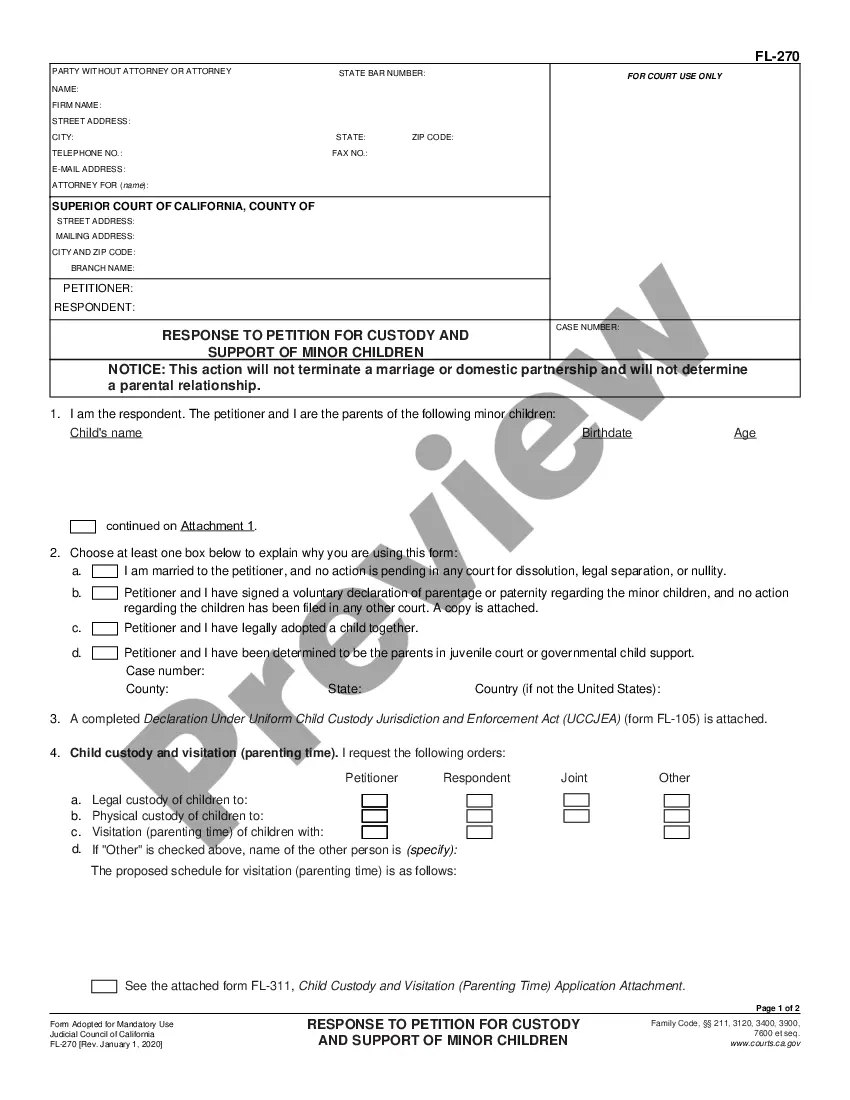

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Pomona California Schedule A, Receipts, Pensions, Annuities, and other Regular Periodic Payments-Standard Account refers to a specific financial account management system provided by the city of Pomona, California. This account is designed to assist residents in managing various types of regular periodic payments, including receipts, pensions, annuities, and similar financial disbursements. This standardized account offers a comprehensive solution for individuals seeking a streamlined approach to organizing their periodic payments. It is especially useful for retired individuals who rely on pensions and annuities as a significant part of their income. By utilizing this account, residents can simplify financial management, ensuring that they receive their payments promptly and have better control over their finances. Pomona California Schedule A, Receipts, Pensions, Annuities, and other Regular Periodic Payments-Standard Account provides the following key features: 1. Efficient Payment Processing: The account enables individuals to effortlessly manage their receipts, pensions, annuities, and other regular payments. It offers a seamless process for receiving, tracking, and organizing these payments to ensure accuracy and timeliness. 2. Personalized Payment Reports: Residents can generate detailed reports specifying incoming payments, such as receipts from business activities or regular pensions and annuities. This feature assists individuals in tracking their finances, assessing their income stream, and budgeting effectively. 3. Automated Reminders: The account system is equipped with automated reminders to ensure individuals never miss their payment deadlines. This feature helps retirees stay on top of their finances, reducing the risk of late payment penalties or missed disbursements. 4. Secure Documentation: Pomona California Schedule A, Receipts, Pensions, Annuities, and other Regular Periodic Payments-Standard Account allows users to securely store their important financial documents in one centralized location. This digital filing system ensures easy access to relevant records whenever needed. While there may not be different types of Pomona California Schedule A, Receipts, Pensions, Annuities, and other Regular Periodic Payments-Standard Account, the system caters to a wide range of regular periodic payments, making it suitable for individuals from various backgrounds and financial scenarios. In conclusion, Pomona California Schedule A, Receipts, Pensions, Annuities, and other Regular Periodic Payments-Standard Account is a comprehensive financial management tool available to Pomona residents. The account assists individuals in efficiently organizing and tracking their receipt, pension, annuity, and other regular payment streams. By leveraging this system, residents can stay on top of their finances, ensuring timely, accurate payments and improved control over their financial well-being.