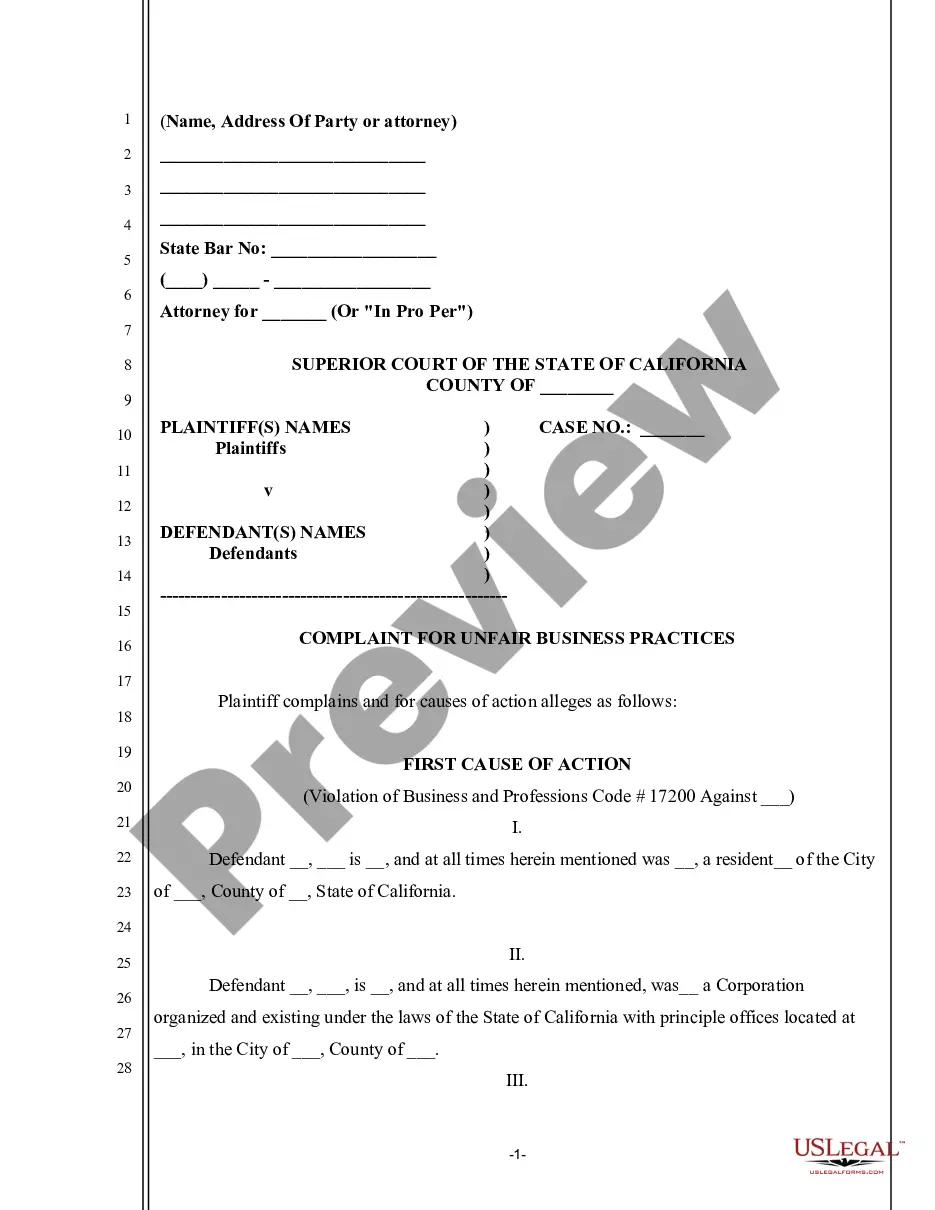

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Riverside California Schedule A is a comprehensive document that outlines the various types of receipts, pensions, annuities, and other regular periodic payments in the state of Riverside, California. This schedule serves as a blueprint for individuals and organizations to understand their financial obligations and rights related to these payments. Here, we will explore the different types of Riverside California Schedule A, Receipts, Pensions, Annuities, and other Regular Periodic Payments-Standard Account. 1. Receipts: The schedule provides a breakdown of different types of receipts, including income from employment, business profits, rental income, dividends, interests, and royalties. It details how these receipts should be reported and included in the standard account. 2. Pensions: Riverside California Schedule A covers various pension types, such as employee pensions, military pensions, and government pensions. It outlines the specific requirements for reporting and calculating income from these pensions. 3. Annuities: Annuities refer to regular payments made by an insurance company to an individual. The schedule provides guidelines on how to report annuity income and distinguish it from other types of payments. 4. Regular Periodic Payments: This category includes regular payments received by individuals that are not classified as pensions or annuities. It encompasses payments from sources like disability benefits, social security payments, alimony, child support, trust income, and more. The schedule clarifies how each of these payments should be reported. 5. Standard Account: The Standard Account is a common format used by individuals and organizations to present their financial information accurately. The schedule provides instructions on how to organize and report all the receipts, pensions, annuities, and regular periodic payments to ensure compliance with Riverside, California regulations. By referring to Riverside California Schedule A, individuals and entities can ensure that their financial information is reported accurately and in accordance with the specific requirements of the state. The schedule helps to promote transparency, accountability, and fair practices in managing and reporting various types of income sources.