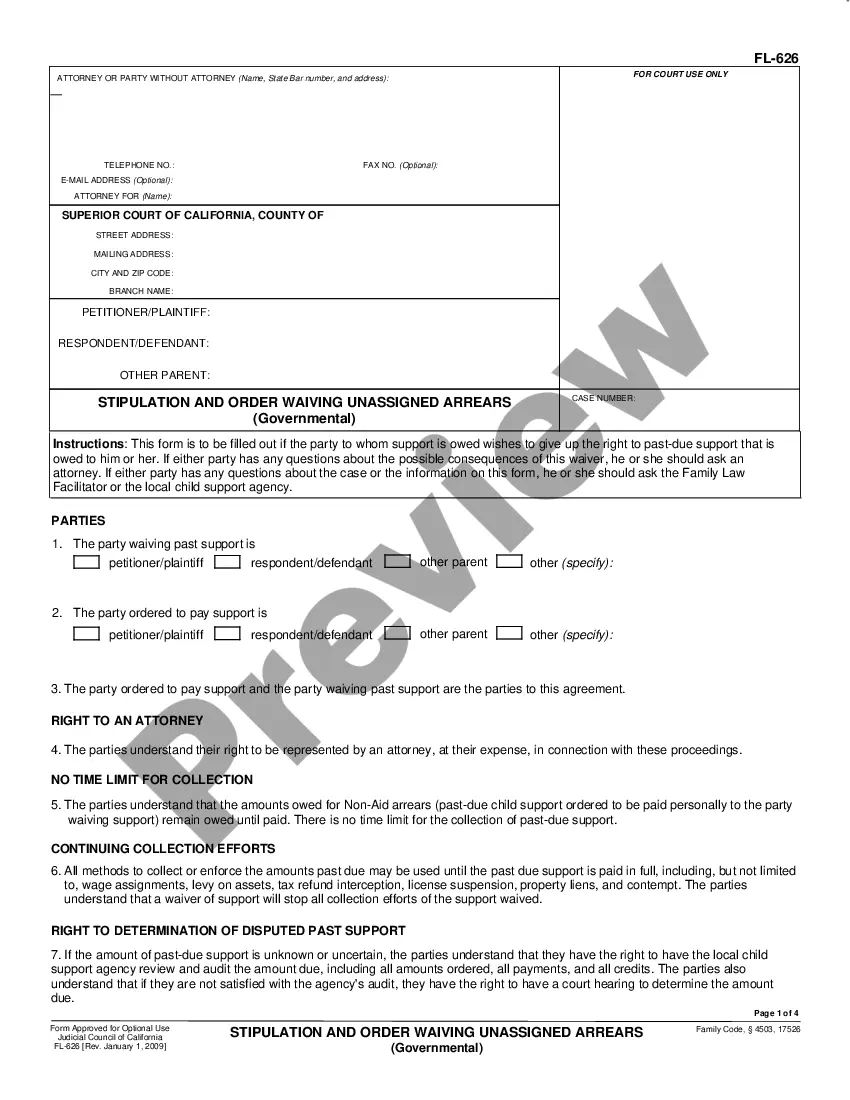

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Los Angeles California Schedule A, Receipts, Rent-Standard Account: In Los Angeles, California, Schedule A, Receipts, Rent-Standard Account refers to a specific accounting record used by landlords or property managers to document rental income and expenses. This schedule is primarily important for reporting rental activities and complying with tax regulations in California. Landlords or property owners must maintain accurate records of their rental properties, including income received and expenses incurred throughout the year. The Los Angeles Schedule A primarily includes two key components: 1. Receipts: This section entails documenting all rental income received from tenants. It includes the total rent collected, security deposits, and any additional fees or charges related to the rental property. Receipts should mention the date of payment, tenant's name, amount received, and a clear description of the transaction. 2. Rent-Standard Account: The Rent-Standard Account section outlines the expenses incurred by the landlord or property owner in maintaining and managing the rental property. This includes costs such as property taxes, insurance premiums, repairs and maintenance, utilities, advertising expenses, property management fees, and any other relevant expenses. Each expense should be accompanied by supporting documentation, such as receipts, invoices, or bills. Different types or variations of Los Angeles California Schedule A, Receipts, Rent-Standard Account may exist based on the specific requirements of individual landlords or property management companies. Some landlords might prefer to track expenses separately for each property they own, while others may combine them into one consolidated schedule. Additionally, some landlords may categorize expenses by specific deductions and rental activity types (e.g., short-term rentals versus long-term leases). Overall, maintaining an organized and accurate Schedule A, Receipts, Rent-Standard Account is essential for landlords and property owners in Los Angeles, as it not only simplifies tax reporting but also provides an accurate snapshot of the financial health of their rental business. It is crucial to consult a qualified tax professional or accountant to ensure compliance with local regulations and optimize tax advantages available to rental property owners in Los Angeles, California.Los Angeles California Schedule A, Receipts, Rent-Standard Account: In Los Angeles, California, Schedule A, Receipts, Rent-Standard Account refers to a specific accounting record used by landlords or property managers to document rental income and expenses. This schedule is primarily important for reporting rental activities and complying with tax regulations in California. Landlords or property owners must maintain accurate records of their rental properties, including income received and expenses incurred throughout the year. The Los Angeles Schedule A primarily includes two key components: 1. Receipts: This section entails documenting all rental income received from tenants. It includes the total rent collected, security deposits, and any additional fees or charges related to the rental property. Receipts should mention the date of payment, tenant's name, amount received, and a clear description of the transaction. 2. Rent-Standard Account: The Rent-Standard Account section outlines the expenses incurred by the landlord or property owner in maintaining and managing the rental property. This includes costs such as property taxes, insurance premiums, repairs and maintenance, utilities, advertising expenses, property management fees, and any other relevant expenses. Each expense should be accompanied by supporting documentation, such as receipts, invoices, or bills. Different types or variations of Los Angeles California Schedule A, Receipts, Rent-Standard Account may exist based on the specific requirements of individual landlords or property management companies. Some landlords might prefer to track expenses separately for each property they own, while others may combine them into one consolidated schedule. Additionally, some landlords may categorize expenses by specific deductions and rental activity types (e.g., short-term rentals versus long-term leases). Overall, maintaining an organized and accurate Schedule A, Receipts, Rent-Standard Account is essential for landlords and property owners in Los Angeles, as it not only simplifies tax reporting but also provides an accurate snapshot of the financial health of their rental business. It is crucial to consult a qualified tax professional or accountant to ensure compliance with local regulations and optimize tax advantages available to rental property owners in Los Angeles, California.