This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

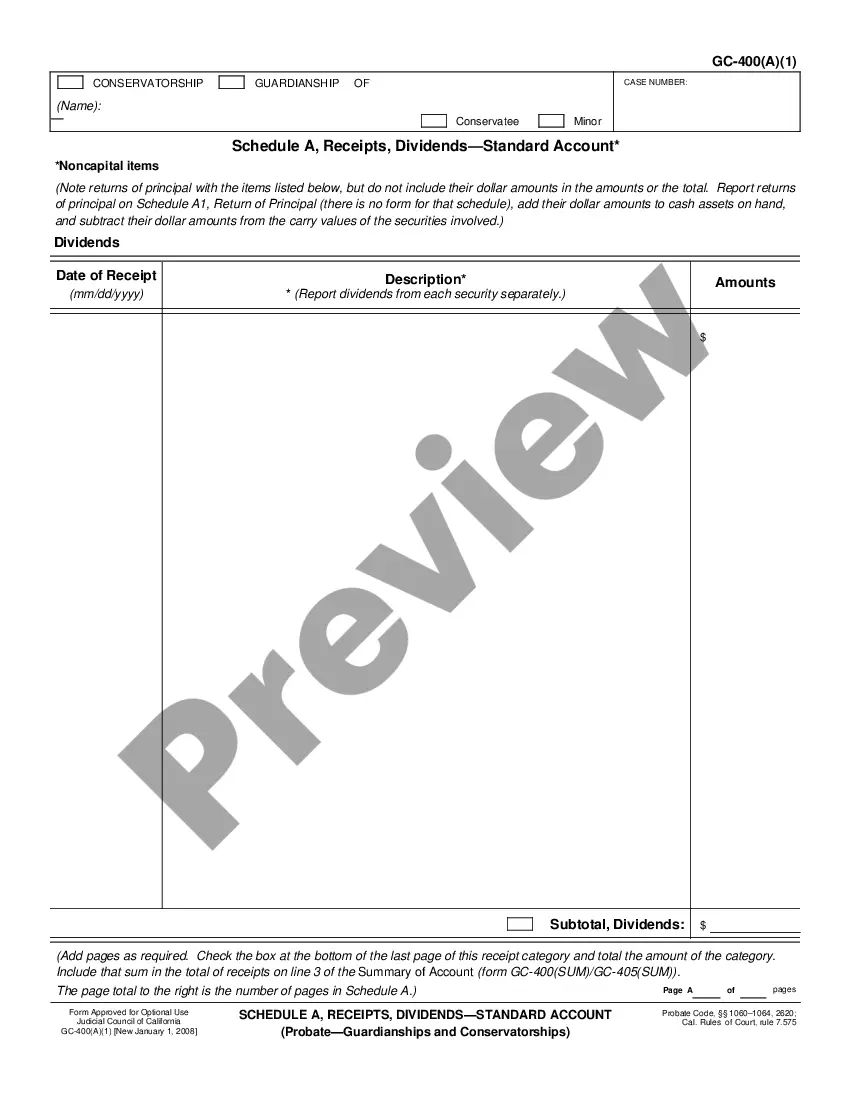

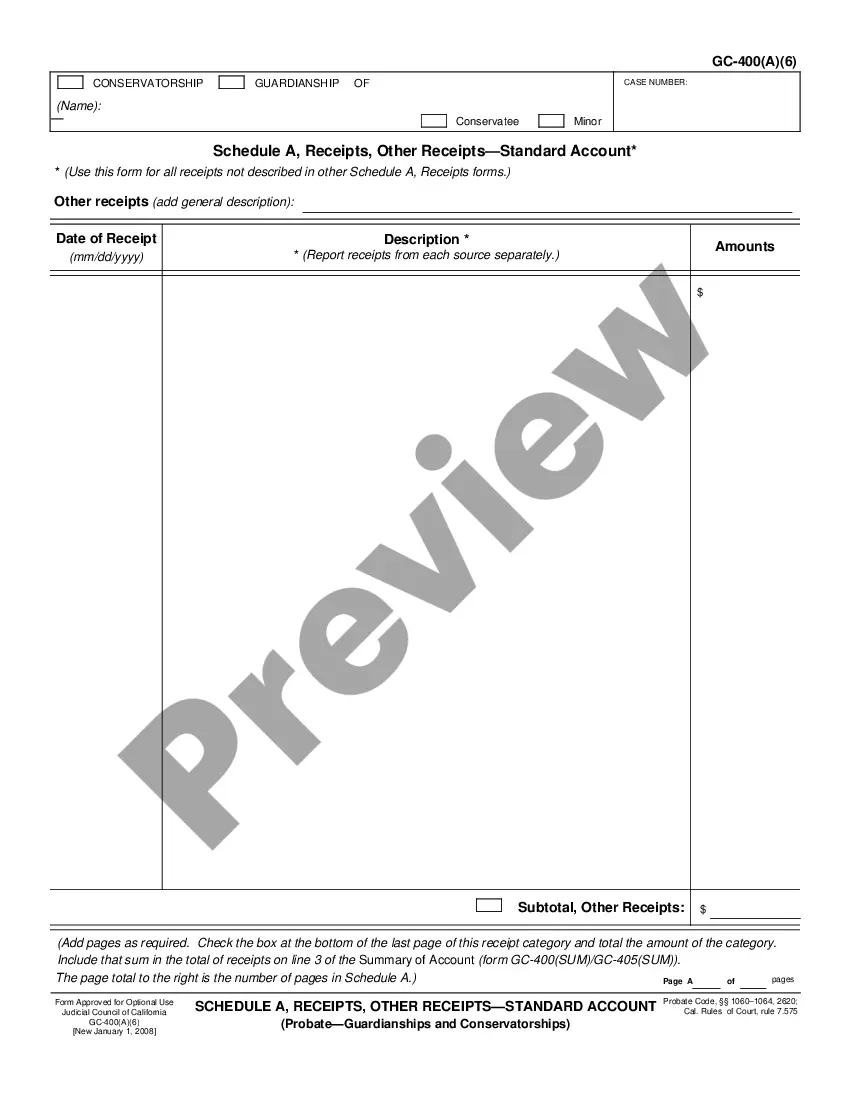

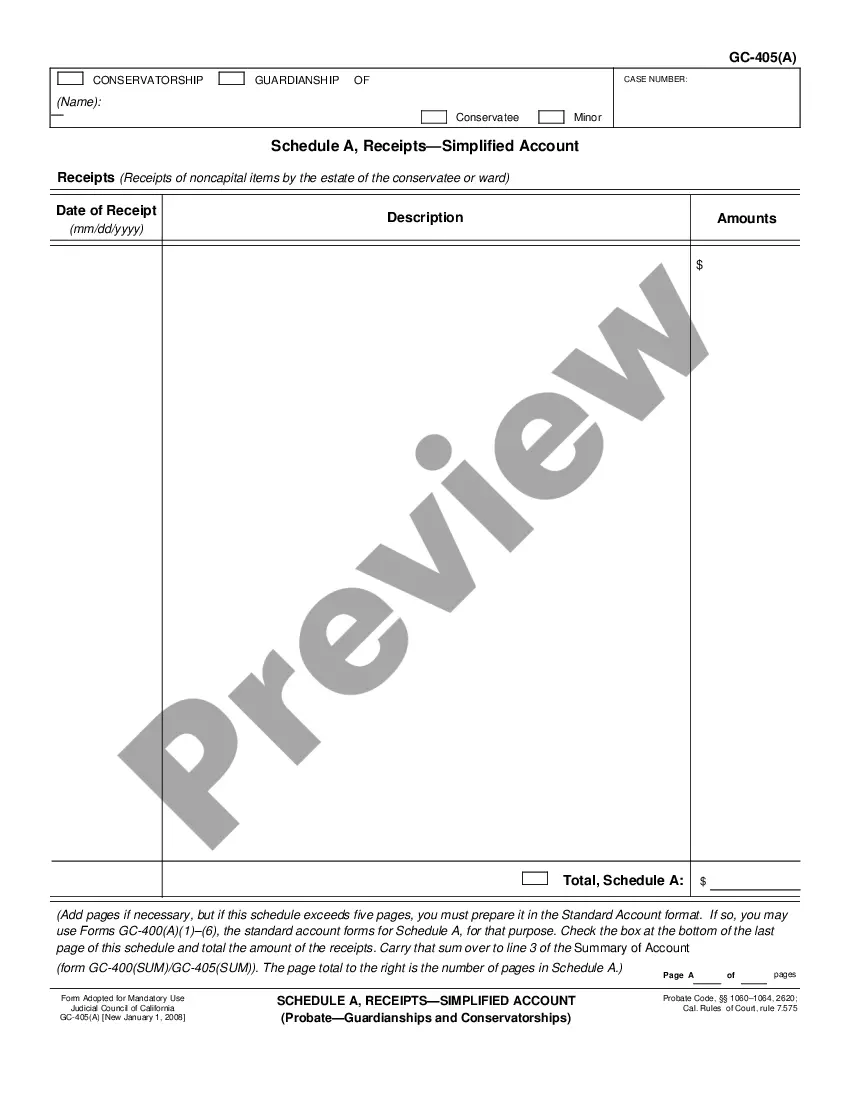

Riverside California Schedule A, Receipts, Rent-Standard Account

Description

How to fill out California Schedule A, Receipts, Rent-Standard Account?

We consistently aim to minimize or evade legal complications when managing intricate legal or financial matters.

To achieve this, we enroll in attorney services that are typically very costly.

Nevertheless, not every legal issue is as merely complicated.

The majority can be handled by ourselves.

Take advantage of US Legal Forms whenever you need to quickly and securely acquire and download the Riverside California Schedule A, Receipts, Rent-Standard Account, or any other form. Simply Log In to your account and click the Get button beside it. If you misplace the form, you can always retrieve it again from the My documents section. The process is equally straightforward if you're unfamiliar with the site! You can establish your account in just a few minutes. Ensure to verify if the Riverside California Schedule A, Receipts, Rent-Standard Account complies with the laws and regulations of your state and region. Additionally, it’s essential to review the form’s outline (if available), and if you detect any inconsistencies with what you initially sought, look for an alternative template. Once you’ve confirmed that the Riverside California Schedule A, Receipts, Rent-Standard Account would be suitable for your needs, you can select a subscription plan and move forward to payment. Afterwards, you can download the form in any appropriate format. For more than 24 years in the market, we’ve assisted millions by providing ready-to-customize and current legal documents. Maximize the benefits of US Legal Forms now to conserve time and resources!

- US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and power of attorney to articles of incorporation and dissolution petitions.

- Our platform enables you to take control of your affairs without the necessity of consulting a lawyer.

- We offer access to legal document templates that are not always readily available.

- Our templates are specific to state and region, which significantly simplifies the search process.

Form popularity

FAQ

To fill out a rent receipt, begin by recording the date of payment, followed by the tenant's name and the property’s address. Include the total rent amount received and specify the rental period it covers. Using UsLegalForms can help you draft a compliant rent receipt that aligns with Riverside California Schedule A, Receipts, Rent-Standard Account expectations.

To write a receipt for proof of payment, start with the transaction date and a clear description of the payment, including the amount. Next, mention the reason for the payment and include both parties' names or entities involved. Remember, using clear, concise language not only aids in understanding but also ensures compliance with Riverside California Schedule A, Receipts, Rent-Standard Account standards.

Filling out a rental verification form involves listing detailed information about the tenant, including their current address, rental history, and payment method. Be sure to provide accurate information regarding the rental property's specifics and confirm the tenant's compliance with terms. Using a proper template, like those found on UsLegalForms, can streamline this process, ensuring you meet Riverside California Schedule A, Receipts, Rent-Standard Account guidelines.

To fill out a receipt properly, begin by including the date of the transaction. Clearly state the amount received, along with a concise description of the goods or services provided. Additionally, ensure that both the payer's and payee's details are included. This practice not only promotes clear documentation but also aligns with the requirements of the Riverside California Schedule A, Receipts, Rent-Standard Account.

Yes, registering a mobile home in California is a legal requirement. This process provides you with a title, allowing for secure ownership and protection under state law. If you are in Riverside California, the Riverside California Schedule A, Receipts, Rent-Standard Account plays a crucial role in this process, ensuring that you are compliant. For further assistance, platforms like uslegalforms can guide you through the registration steps.

Getting a mobile home title in California typically takes about two to four weeks after you submit your application. However, processing times can vary due to factors like application volume and required documentation. To expedite your title processing in Riverside California, ensure all forms are accurate and complete, including Riverside California Schedule A, Receipts, Rent-Standard Account. Resources from uslegalforms can help you manage these documents effectively.

The Superior Court of California, County of Riverside, also known as the Riverside County Superior Court, is the branch of the California superior courts with jurisdiction over Riverside County.... Riverside County Superior CourtCurrentlyHon. Judith C. ClarkSinceCourt Executive OfficerCurrentlySam Hamrick12 more rows

Superior Court of California, County of Riverside.

ESubmit is Citi's ability to process client requests based on scanned images of completed account opening and maintenance documents. The information within the documents will be securely delivered using an enterprise wide process to secure email between the Citi and the client.

The jurisdiction for Riverside is Riverside County Superior Court.